🛡️Hoskinson points out Bitcoin's flaws, 🚨 Security compromised at Binance

Welcome to the Daily Tribune on Tuesday, February 6, 2024 ☕️

Hello Cointribe! 🚀

Today is Tuesday, February 6, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

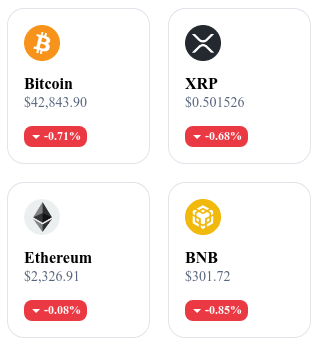

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24-hour crypto summary ! ⏱️

🚀 Bitcoin L2 under criticism: Hoskinson from Cardano gives his opinion!

Charles Hoskinson, the founder of Cardano, recently highlighted the limitations of Bitcoin's layer 2, raising questions about the future of this technology. According to him, blockchains like Ethereum and Cardano, thanks to their more dynamic and scalable nature, present a stark contrast with the rigidity of Bitcoin L2. Hoskinson has observed a repetitive pattern over more than ten years, postulating that Bitcoin L2 companies face major obstacles due to Bitcoin's inability to quickly adapt to the requirements of a vibrant L2 environment.

He emphasized that, while Bitcoin can serve as a store of value, its adaptation to dynamic L2 solutions remains a challenge. Citing concrete examples, Hoskinson highlighted the limitations of a rigid infrastructure, contrasting with Ethereum's successful L2 solutions and Cardano's successful integration of advanced features. These observations suggest that to support a robust L2 ecosystem, a dynamic and programmable approach, like the one adopted by Ethereum and Cardano, is essential.

Charles Hoskinson highlights a major challenge for Bitcoin: its ability to evolve and adapt to the changing needs of the cryptocurrency market. Bitcoin's inability to support a dynamic L2 environment, unlike more flexible blockchains like Ethereum and Cardano, could limit its utility as a platform for decentralized applications and innovative financial services.

🚨 Security alert: Binance user data for sale on the dark web

Binance, one of the largest cryptocurrency exchange platforms, faces a major controversy following the discovery of a leak of sensitive customer data, now for sale on the dark web. This alarming situation was revealed after part of Binance's source code was found on Github, exposing critical information such as password management and two-factor authentication (2FA) for users. Although Binance claimed that the code in question was not used by the platform, the prolonged presence of this code on Github raises concerns about the company's security practices.

Shortly after, researchers reported that Binance customer data, including millions of email addresses, passwords, and phone numbers, were available for purchase on the dark web. Binance denied any link between this leak and the Github code incident, but the correlation seems evident to many experts. Binance users are now deeply concerned about the security of their accounts and assets, with some even reporting suspicious login attempts. This series of events represents a disaster for Binance, shaking the confidence of its users.

The data leak at Binance and the sale of this information on the dark web are a serious blow to the security reputation of one of the largest cryptocurrency exchanges. This situation could encourage users to prefer platforms perceived as safer and accelerate the adoption of more advanced security technologies by cryptocurrency exchanges.

📈 Bitcoin ETF: Remarkable breakthrough among financial giants

In January, two Bitcoin ETFs made a notable entry among the top ten ETFs in terms of investment flows, according to Nate Geraci. These financial products, offered by BlackRock and Fidelity, have disrupted the rankings, signaling increasing interest in cryptocurrency investments within traditional financial markets. BlackRock's iShares Bitcoin Trust ETF (IBIT) and Fidelity's Wise Origin Bitcoin ETF (FBTC) had net assets of $2.6 billion and $2.2 billion respectively, ranking eighth and tenth.

This outstanding performance, in a context of Bitcoin price decline, illustrates a notable shift in investment trends and suggests a gradual integration of cryptocurrencies into the traditional financial ecosystem. The approval of these ETFs by the SEC marked a turning point, strengthening optimism about the future of cryptocurrency investments and paving the way for a new era in this sector.

BlackRock and Fidelity's Bitcoin ETFs entering the top 10 ETFs in terms of investment flows signal increasing acceptance of cryptocurrencies by institutional and traditional investors. This marks a turning point for cryptocurrency investment, indicating deeper integration into the traditional financial system and recognition of their potential as a legitimate asset class.

💡 Wall Street and Crypto: A future rebound thanks to bullish sentiment?

The optimism displayed by Wall Street in 2024, despite uncertainties surrounding Fed interest rate decisions, could signal a promising future for crypto markets. The cautious approach of the Fed, coupled with positive economic data, has generated a more positive sentiment regarding stock market prospects, which could have a positive impact on crypto assets. Investors see in this change in attitude an opportunity for a rebound in cryptocurrencies, especially Bitcoin, whose rise could lead other digital currencies.

Although challenges remain, the renewed optimism on Wall Street and favorable conditions for crypto assets point to a recovery after difficult months. Investors remain optimistic about the prospects of the crypto sector for 2024, expecting a significant rebound in the prices of major cryptocurrencies in the near future.

If this optimism translates into increased investment in cryptocurrencies, it could not only stimulate short-term prices but also strengthen the legitimacy of cryptocurrencies as a long-term investment.

Crypto of the day: Ethereum Name Service (ENS)

Ethereum Name Service (ENS) represents a major innovation in the blockchain ecosystem, offering a decentralized naming solution that transforms complex Ethereum addresses into readable and memorable domain names. This innovation brings significant added value by improving the user experience within the Ethereum ecosystem, facilitating interaction with blockchain addresses, smart contracts, and decentralized services. ENS not only enhances the accessibility and user-friendliness of cryptocurrencies but also serves as the foundation for a layer of digital identity in Web3, allowing users to manage their online presence securely and in a decentralized manner.

The native cryptocurrency of ENS, also named ENS, plays a central role in the governance of the protocol, allowing holders to participate in decisions regarding updates and changes to the system. The initial distribution of ENS was done through an airdrop to service users, rewarding the community and early adopters. Benefits for holders include the right to vote on governance proposals and potential involvement in the network's evolution. ENS can be used to purchase domains within the ecosystem, offering practical use in addition to its role in governance.

Recent Performance

Current Price: $21.94 USD (approximately in €, based on the current exchange rate)

Percentage Increase/Decrease: 21.12% increase over 1 day

Market Cap: $674,766,353.22 USD (approximately in €, based on the current exchange rate)

Rank on CoinMarketCap: 92

Crypto Analysis of the day: Bitcoin (BTC)

After flirting with $43,000, Bitcoin seems to be pausing. This level, already identified as crucial in our previous analyses, proves to be a major consolidation point, coinciding with the 50-day moving average. This is not insignificant: this price range, oscillating between $42,000 and $44,000, represents a significant value zone for Bitcoin, highlighting the levels where trading activity has been most intense. However, oscillators, these indicators that give us the market pulse, show signs of stabilization around a median threshold, signaling that Bitcoin's bullish momentum could be fading. More worrisome, the presence of a bearish divergence between these oscillators and the price of Bitcoin warns us of a potential downside risk.

In terms of derivatives, open interest for BTCUSDT has seen a notable increase, a sign of increased trader engagement in these products. However, this excitement has not translated into an increase in the underlying price, leaving Bitcoin in a position that could be described as \"heavy\". In other words, despite growing interest, there seems to be some hesitancy preventing the price from breaking through the resistance barrier. And this is where things get interesting: the liquidation heat map reveals that the area around $44,000 has become a stronghold of resistance, making any breakthrough beyond this level even more significant.

So, what does the future hold? If Bitcoin manages to hold above $42,000, we could witness a new rise towards $45,000, or even beyond. But beware, if the support at $42,000 were to give way, a return to $40,000, and perhaps even $38,000, cannot be ruled out. As always, the cryptocurrency market is a complex universe, where each technical signal must be interpreted with caution and taking into account the many factors that can influence prices.