📊 Investors Are Abandoning Bitcoin for Safer Assets

Welcome to the Daily for Wednesday, November 12, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, November 12, 2025, and as every day from Tuesday to Saturday, we bring you the key news from the past 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

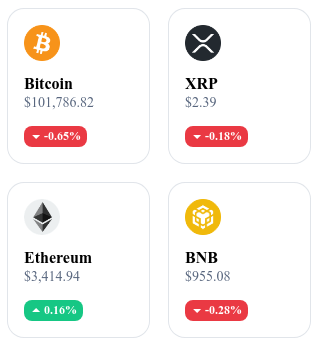

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🎨 NFTs and Memecoins Rebound After a Month of Calm

The NFT and memecoin markets are seeing a strong rebound, with trading volumes up 26% over the past seven days. The recovery is driven mainly by major Ethereum collections and large-cap tokens like DOGE and PEPE.

👉 Read the full article

🐕 Shiba Inu Team Denies Project Shutdown Rumors

Posts circulating on X claimed Shiba Inu was ending, causing a temporary drop in SHIB’s price. The team quickly denied the rumors, confirming continued development around Shibarium and its DeFi ecosystem.

👉 Read the full article

⚡ Lightning Network: Data Shows a Concerning Drop in Activity

The Lightning Network has seen a 14% decline in active channels and a similar drop in total Bitcoin capacity. Analysts point to slowing commercial use and waning interest from node operators.

👉 Read the full article

💳 Visa Tests Automated Stablecoin Payments Backed by Fiat Funds

The payments giant launched a pilot program allowing companies to automatically distribute rewards in stablecoins backed by bank deposits. The initiative aims to link Visa’s infrastructure with public blockchains to streamline global payments.

Crypto of the Day: Cosmos (ATOM)

🧠 Innovation and Added Value

Cosmos is an ecosystem designed to solve one of Web3’s biggest challenges: interoperability between blockchains. Nicknamed “the Internet of Blockchains,” it allows independent chains to exchange data and assets without intermediaries.

Its architecture is based on Tendermint Core, a fast, energy-efficient Proof of Stake (PoS) consensus engine, and the Cosmos SDK, an open-source toolkit that simplifies the creation of custom blockchains.

The key innovation of Cosmos lies in the IBC (Inter-Blockchain Communication) protocol, which enables asset transfers between networks such as Osmosis, Akash, Secret Network, and Kava.

Cosmos embodies a modular vision of Web3, where each blockchain retains its sovereignty while participating in a global, interconnected ecosystem.

💰 The Token

ATOM is the native token of the Cosmos Hub, the ecosystem’s main chain. It serves three main functions:

– Securing the network through staking, where holders delegate their tokens to validators and earn rewards.

– Paying transaction fees across the Cosmos network.

– Participating in governance to influence updates, economic parameters, and ecosystem evolution.

ATOM’s economic model features variable inflation to maintain optimal staking participation and supports cross-chain governance, a core element of the interoperable Web3 future.

📊 Real-Time Performance

💵 Current Price: 2.92 USD

📉 24h Change: –1.29 %

💰 Market Cap: 1.39 B USD

🏅 Rank on CoinMarketCap: #59

🪙 Circulating Supply: 477.48 M ATOM

📊 24h Trading Volume: 90.64 M USD

Bitcoin Falls to $101,000 as Gold and Wall Street Surge

The cryptocurrency market is facing another shock as Bitcoin (BTC) slid to $101,000, marking a 3.4% drop. This correction comes while U.S. stock markets and precious metals soar, fueled by optimism over an imminent end to the U.S. government shutdown. The divergence reflects a rotation of capital toward traditional assets, viewed as more stable in the short term.

Investors Flock to Safe Havens Ahead of U.S. Budget Vote

As Congress prepares to vote on legislation to avoid a government shutdown, investors are moving toward equities and precious metals.

The Dow Jones climbed 423 points (+0.9%), supported by Goldman Sachs, JPMorgan Chase, and American Express, while the S&P 500 edged up (+0.1%).

Meanwhile, gold surged to $4,180 and silver surpassed $53, both buoyed by safe-haven demand amid political uncertainty.

Bitcoin, on the other hand, declined as capital was reallocated. Caution dominates as markets await new economic data and clarity on fiscal policy. Investors appear to favor assets more directly tied to U.S. government and Federal Reserve actions.

Bitcoin ETFs Still Send a Positive Signal

Despite the price dip, institutional interest in Bitcoin remains intact.

Spot Bitcoin ETFs recorded $524 million in net inflows on Tuesday — their best performance since October 7. These substantial entries highlight persistent professional investor demand, even in a market pullback.

This renewed appetite could signal preparation for a rebound once markets stabilize. Some analysts suggest that a dovish tone from the Fed in its next meeting could reignite risk appetite for digital assets. Conversely, a stricter stance might extend Bitcoin’s consolidation phase.

Volatility Could Turn Back in Bitcoin’s Favor

Bitcoin’s decline appears driven more by macroeconomic caution than by lasting investor retreat. Should the budget impasse resolve and monetary policy ease, the cryptocurrency could regain its appeal as a portfolio diversification tool.

Volatility, long unfavorable, could soon benefit Bitcoin — especially if capital flows resume into ETFs and regulated platforms. The crypto market thus remains in a holding pattern, balanced between political uncertainty and monetary optimism — a fragile yet potentially fertile setup for the next rebound.