📈 Investors flock to Ethereum ETFs despite crypto market turmoil

Welcome to the Daily Tribune Thursday, August 8, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, August 8, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

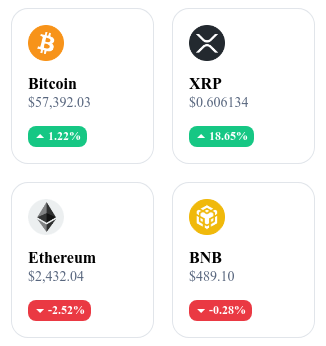

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24h crypto recap! ⏱

Ethereum ETFs captivate investors amidst the crypto market turmoil 🤑

Amidst the turmoil in the crypto market, Ethereum ETFs are attracting significant investments. Despite a massive $500 billion drop in the market over the weekend, and a 20% decrease in the price of Ether on August 5, investors have injected around $49 million into Ethereum ETFs, marking their second-best day since their launch on July 23. The biggest beneficiaries of these flows include BlackRock's ETHA with $47.1 million, followed by VanEck's ETHV and Fidelity's FETH. Even smaller ETFs like Grayscale, Bitwise, and Franklin Templeton have recorded positive inflows. This momentum highlights the unwavering confidence of institutional investors in the fundamental value of Ether, despite short-term volatility. Despite the panic, the price of ETH has shown remarkable resilience, bouncing back from $2,100 to $2,500, a 19% increase. Analysts remain optimistic about a possible new bullish momentum. 🔗 Read the full article here.

Iranian retaliation could disrupt the crypto market 🌍

Geopolitical tensions, especially the potential retaliation by Iran against Israel, are raising speculations about possible repercussions on the cryptocurrency market. Such escalation could destabilize traditional markets and cause unexpected movements in the digital asset sector. Investors, in search of safety, could lead to increased volatility and sudden price fluctuations. Trading volumes on cryptocurrency exchanges would tend to increase as investors seek to reposition themselves quickly. In case of cyberattacks or other forms of destabilization, this volatility could be exacerbated. Bitcoin could see an increase in demand as a safe haven, but this perception will depend on investors' confidence in the resilience of the crypto infrastructure. In the long run, an Iranian retaliation could accelerate the development of more robust security solutions and strengthen the crypto ecosystem despite increased regulatory pressure. 🔗 Read the full article here.

Crypto significantly influences US elections! 🇺🇸

The crypto industry, often perceived as antagonistic to the Biden administration, is intensifying its efforts to influence US politics by financially supporting Democratic candidates. Several pro-crypto super PACs, such as Protect Progress, Fairshake, and Defend American Jobs, have raised and spent millions of dollars to support cryptocurrency-friendly candidates during the Congressional primaries. Protect Progress has spent over $13 million, with major contributions from industry giants like Andreessen Horowitz, Coinbase Global Inc., and the Winklevoss twins of Gemini. Overall, these super PACs have raised $170 million for the 2024 election cycle. Their actions aim to promote increased regulatory clarity in response to the strict regulation imposed by the SEC, which has been criticized by industry players. 🔗 Read the full article here.

BRICS: Google and Amazon make big bets on India's digital currency project 💰

Google and Amazon are showing a strong interest in India's digital currency project by partnering with the Reserve Bank of India to integrate the e-rupee, a digital version of the Indian rupee, into their payment platforms. This initiative is part of the BRICS' efforts to reduce dependence on the US dollar and strengthen their global economic influence. Launched in December 2022, India's Central Bank Digital Currency (CBDC) project is now expanding to payment companies after initially being limited to banking institutions. GooglePay, PhonePe (backed by Walmart), and AmazonPay plan to integrate the e-rupee into their systems within three to four months, which could revitalize the adoption of this digital currency. The support of these tech giants could stimulate innovation and the acceptance of digital currencies within the BRICS. 🔗 Read the full article here.

Crypto of the day: XRP (XRP)

XRP, developed by Ripple, is an innovative solution that revolutionizes cross-border payments using distributed ledger technology. The main innovation of the XRP blockchain lies in its ability to perform almost instant and low-cost transactions, eliminating inefficiencies in traditional payment systems. This technology provides added value by enabling fast and reliable fund transfers on a global scale, which is particularly beneficial for financial institutions and businesses seeking to reduce transaction costs and improve the flow of international payments.

XRP primarily serves as a bridge to facilitate currency exchanges on the RippleNet network. Its main utility is to provide liquidity on-demand for international payments, enabling fast and efficient transactions between different fiat currencies. XRP was initially distributed by Ripple Labs through various methods, including private sales and distributions to investors. Benefits for XRP holders include fast transactions, minimal transaction costs, and the ability to use it for cross-border payments. Additionally, XRP can be used as a store of value and a payment instrument on various platforms and applications.

Recent Performance:

Current Price: €0.60

Percentage Increase/Decrease: 17.70% (1-day increase)

Market Capitalization: €33,923,341,358

CoinMarketCap Rank: 7

Analysis on August 8, 2024: Crypto market downturn, but Solana surges

The cryptocurrency market has experienced a widespread downturn, impacting Solana (SOL), which has plummeted by 45% in one week, dropping from $190 to $110. This decline was primarily fueled by poor global economic results and significant geopolitical tensions. However, despite this selling pressure, Solana has quickly rebounded, currently reaching a price around $155. This rebound is largely due to marked buying interest at the $110 level, a noteworthy support point. The medium and long-term trend for Solana remains bullish, with the price holding its 50 and 200-day moving averages, indicating stability and potential for future growth.

In terms of outlook, if Solana manages to maintain above the critical threshold of $120, a bullish continuation towards $170 or even $190 could be considered, with potential resistance between $205 and $210. Conversely, an inability to maintain this threshold could lead to further decline towards $110, or even lower to $100 or $86. Despite recent fluctuations, the signs of Solana's resilience are encouraging, and persistent buyer interest contributes to a renewed sense of optimism about its future. However, it will be crucial to closely monitor price reactions at different key levels to confirm or refute current assumptions. 🔗 Read the full analysis here.

🔗 Read the full analysis here.