📊 Is Bitcoin ready to rebound or fall further?

Welcome to the Daily for Saturday, 22 November 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, 22 November 2025, and as every day from Tuesday to Saturday, we bring you a summary of the key news from the last 24 hours that you shouldn’t have missed!

But first…

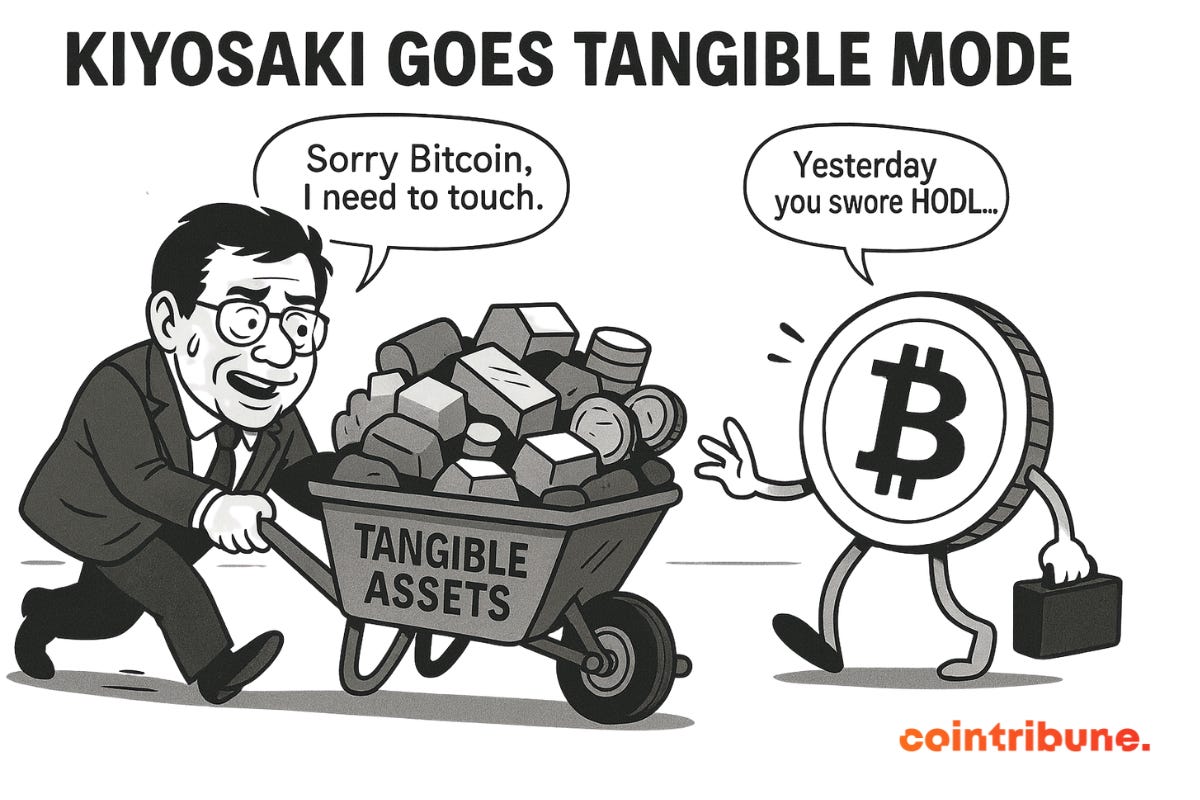

✍️ Cartoon of the day:

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

🧨 Memecoin market collapses to its lowest level of the year 📉

The memecoin segment has fallen to a market capitalization of 39.4 billion dollars, marking a 66.2% drop from the 116.7 billion dollars recorded on 5 January 2025.

👉 Read the full article

📌 Solana and XRP ETFs hold strong while Bitcoin faces record withdrawals

ETFs linked to Solana and XRP have recorded 500 million dollars and 410 million dollars in net inflows respectively since their launch, while Bitcoin saw 3.79 billion dollars in net outflows on its ETFs in November 2025.

👉 Read the full article

🔄 Ethereum staking: BitMine’s ultimate plan to survive the market

After significant losses on its ETH holdings, BitMine has announced the launch of its “MAVAN” project in 2026 to revive its revenues through Ethereum staking.

👉 Read the full article

💼 Robert Kiyosaki sells his Bitcoins and invests in physical assets

Robert Kiyosaki sold Bitcoins purchased at 6,000 dollars for a total of 2.25 million dollars, then reinvested the gains into two surgery centres and a billboard business targeting 27,500 dollars in monthly tax-free income.

👉 Read the full article

Crypto of the day: JasmyCoin (JASMY)

🧠 Innovation and added value

JasmyCoin is a Japanese project specialising in the decentralised management of personal data, often described as “Web3 for the Internet of Things (IoT)”.

The protocol’s goal is to give users full control over their data: storage, access, sharing and monetisation.

Information (from IoT devices, applications, sensors, etc.) is protected through advanced encryption technologies, then processed on a blockchain infrastructure that guarantees transparency and traceability.

Jasmy relies on two technological components:

Personal Data Locker (PDL): a digital vault where users themselves retain their data;

Secure Knowledge Communicator (SKC): a secure exchange protocol allowing companies to access data only with the user’s consent.

Thanks to its privacy-centric approach, Jasmy fits into a Web3 vision where personal data becomes an asset controlled by its owner, rather than a product exploited by centralised platforms.

💰 The token

JASMY is the utility token of the ecosystem. It is used to:

pay for transactions and interactions with Jasmy services;

reward users who choose to share or monetise certain data;

enable companies to participate in controlled access to data via the SKC protocol;

support IoT services such as authentication, secure access and technological governance.

The economic model is based on the idea that personal data has real economic value, and that JASMY can become the native intermediary for this exchange within an ecosystem compliant with Japan’s strict security and privacy standards.

📊 Real-time performance (CMC)

💵 Current price: $0.007295

📈 24h change: +2.65%

💰 Market cap: $360.73M

🏅 CoinMarketCap rank: #117

🪙 Circulating supply: 49.44B JASMY

📊 Trading volume (24h): $55.3M

Bitcoin on alert: fear dominates, rebound ahead?

The crypto market thermometer is heating up: Bitcoin’s fear and greed index has dropped below 5 points, revealing a climate of anxiety rarely seen. While the most seasoned investors see an opportunity, macroeconomic tensions continue to apply pressure. Which technical levels should be monitored to anticipate the next major move?

Bitcoin at its lowest morale, extreme fear sets in

The Fear & Greed Index is a composite indicator used to assess the dominant sentiment in the Bitcoin market. It fluctuates between 0 (extreme fear) and 100 (extreme greed). Currently, this index has fallen to a historically low level, below 5 points, with a 21-day moving average at 10%, according to data from 10x Research. Such thresholds indicate investor capitulation—a phase where many sell in panic, often close to a bottom.

The index is calculated from several factors: volatility, momentum, Bitcoin dominance and social trends. A level this low may signal that the market is oversold and that a technical rebound could be considered. This was observed in 2022, when the index dropped to a similar level, followed by a rebound of more than 50% within a few months.

However, it is essential to keep in mind that this type of signal, although historically relevant, is not a guarantee of recovery. It offers useful contextual information but must be complemented by broader technical and fundamental analysis.

Critical levels not to breach to avoid chaos

On a technical level, two thresholds are particularly monitored by analysts. A sustainable rebound would require a return and close above 85,000 dollars. This threshold is both psychological and technical, marking a renewed confidence among buyers. Such a configuration could open the way towards 90,000 dollars and then 95,000 dollars, according to optimistic scenarios.

Conversely, a clear break below 80,000 dollars—especially accompanied by high volume—could drive the market towards new supports at 78,000 dollars and then 75,000 dollars. These levels are considered critical, as massive liquidations have already been observed there, triggering sharper declines.

It is also necessary to integrate macroeconomic parameters into this analysis. Geopolitical instability or tighter monetary policy from central banks may hinder any rebound attempt, even in a context of extreme fear.

The current climate therefore demands caution and method: emotional signals must be counterbalanced by a rigorous approach.

The Bitcoin market is navigating between extreme fear and hopes of a technical recovery. While history offers some reassurance, the coming sessions will be decisive to confirm a bullish return or validate a prolonged downturn. One thing is certain: caution is essential in this phase where each level can shift the trend.