Hello Cointribe! 🚀

Today is Wednesday, May 28, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

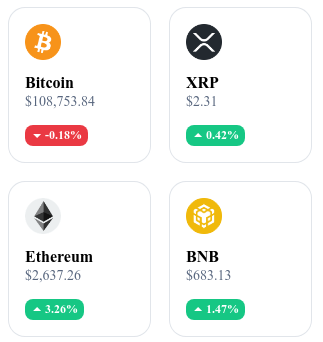

A quick look at the market…

🌡️ Temperature:

🌤️ Partly sunny

24h crypto recap! ⏱

🇫🇷 France: Blockchain Group to Acquire an Additional 590 Bitcoins Thanks to a Fundraising

Blockchain Group has raised $72 million to acquire approximately 590 additional bitcoins. The company aims to hold 1% of the total bitcoin supply by 2032. Since the beginning of the year, its stock has surged more than 765%, supported by this accumulation strategy.

📺 Live Trading Arrives on Binance Square

Binance has launched a live trading feature on its social platform Binance Square. This innovation allows users to trade in real-time during live broadcasts, combining learning, interaction, and cryptocurrency investing on a single interface.

📉 Bitcoin Rally Slowed by Unexpected Profit-Taking

The recent Bitcoin rally was slowed by unexpected profit-taking, mainly by new whales who realized 82% of recent gains. In contrast, the historical whales remain confident, limiting their sales and betting on a future increase. This divergence creates downward pressure and a generational split influencing BTC’s future.

💸 Elon Musk Confirms an Unprecedented Disruption with the Imminent Launch of X Money

Elon Musk confirmed the imminent launch of "X Money," a feature aiming to transform finance through an all-in-one app. The service will start in beta with very limited access, Musk emphasizing the need for extreme caution when users’ savings are at stake.

Crypto of the Day: Kaspa (KAS)

🧠 Technology and Innovation

Kaspa is a layer 1 blockchain that stands out due to its ability to process blocks in parallel, thanks to its unique GHOSTDAG protocol. Unlike traditional blockchains that reject competing blocks, Kaspa organizes them into a directed acyclic graph (DAG), enabling fast transaction confirmation and enhanced security.

This innovative architecture allows Kaspa to achieve high transaction speeds, with blocks generated every second, while maintaining decentralization and security comparable to Bitcoin. Additionally, Kaspa uses a proof-of-work (PoW) consensus mechanism, ensuring fair distribution and resistance to attacks.

💰 KAS Token – Utility and Distribution

The KAS is the native token of the Kaspa network. It is primarily used for:

Transaction fees: users pay fees in KAS to make transactions on the network.

Mining rewards: miners receive KAS rewards for validating blocks and securing the network.

Exchange and store of value: KAS can be exchanged on various platforms and used as a store of value.

KAS distribution is fully decentralized, with no pre-mining or initial allocation to investors or the founding team, thus fostering fair and community-based adoption.

📊 Market Data (as of May 28, 2025)

Current price: $0.042 USD

24-hour change: +$0.001 (+2.44%)

Market capitalization: around $950 million

Rank on CoinMarketCap: #89

Circulating supply: 22.6 billion KAS

24-hour trading volume: around $15 million

Is It Too Late to Buy Bitcoin?

While Bitcoin has recently crossed the symbolic $110,000 mark, the question of investment timing is back on everyone’s lips: is it still wise to enter the market now, or is it already too late?

Between bullish euphoria, massive institutional adoption, and technical signals in overheat zones, opinions are divided. This analysis aims to untangle emotional arguments from strategic analysis to objectively enlighten buying perspectives at this valuation level.

An Adoption That Changes the Game: Fundamentals Remain Strong

Support structures for Bitcoin have never been stronger.

On the institutional side, massive inflows into spot Bitcoin ETFs, coupled with growing adoption by major banks (JPMorgan, Fidelity, BlackRock), are redefining the asset's profile. Bitcoin is no longer a marginal speculative bet: it has become a strategic component in long-term asset allocation.

Adding to this are constructive regulatory signals. In the United States, the creation of a strategic Bitcoin reserve by public entities marks an ideological turning point: BTC is considered a safe asset, like gold.

On the visionary side, Michael Saylor and Robert Kiyosaki do not temper their optimism: they mention targets between $250,000 and $350,000 by the end of 2025, betting on increasing scarcity and a gradual loss of interest in dollar-denominated assets.

An Expanding Market… but Not Without Risks

Facing these prospects, several voices call for caution. B2 Ventures founder Arthur Azizov reminds that historical analysis is limited: at these price levels, technical benchmarks are fragile. In case of an exogenous shock (macro-economic, geopolitical, or regulatory), a return to the $60,000 to $50,000 zone is not excluded.

Furthermore, several leading indicators point to a short-term overheating state:

Weekly RSI in the 75-80 zone,

High funding rates on derivatives markets,

Dense speculative positioning on options.

This does not call into question the underlying bullish trend, but encourages favoring a gradual approach (DCA, inter-asset arbitrage) rather than a high-leverage single entry point.

No, it is not too late to buy Bitcoin. But it is too risky to do so without a strategy.

At this stage of the cycle, investing in BTC requires fine management: defining a long investment horizon, integrating into a diversified allocation, and accepting high volatility.

Bitcoin remains a high-potential asset, but it is no longer managed like in 2017: it is now considered a wealth position, not short speculation.