Is the crypto industry ready to turn the page on Bitcoin? 🌟

Welcome to the Daily Tribune on Saturday, May 25, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, May 25, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

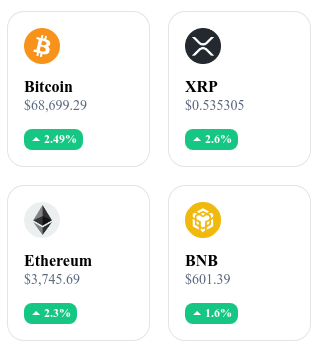

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

Can the crypto industry truly move beyond Bitcoin? 💡

Charles Hoskinson, founder of Cardano, suggests that the cryptocurrency industry needs to evolve beyond Bitcoin to remain relevant. He criticizes the technological limitations of Bitcoin, specifically its proof-of-work consensus mechanism, calling it outdated and energy-consuming. Hoskinson highlights the innovations of platforms like Cardano, which use more ecological and scalable methods like proof-of-stake. This perspective could lead to a reconsideration of Bitcoin's central role in the crypto ecosystem. Read the full article

Pepe: The skyrocketing rise of the memecoin 🐸🚀

The memecoin Pepe has seen its value increase by over 100% in one month, reaching a price of $0.00001419 and a market capitalization of $5.97 billion. This spectacular rise has allowed 97% of PEPE holders to realize profits. However, several indicators show signs of a possible trend reversal. Whales are withdrawing large amounts of PEPE from exchanges, while other investors are starting to sell their holdings, which could lead to a price correction. Read the full article

Nvidia at its peak, AI cryptocurrencies ignite 🎮💥

Nvidia has announced record quarterly results with a revenue of $26.04 billion and a net income increase of 628% to $14.88 billion. The company forecasts a revenue of $28 billion for the next quarter and has decided to split its shares to make them more accessible. Although this announcement initially caused a decline in AI-related tokens like Render (RNDR), Fetch.ai (FET), The Graph (GRT), and SingularityNet (AGIX), experts anticipate a potential rebound and increasing adoption of AI. Read the full article

Bitcoin and Ethereum: ETFs ignite the crypto market 📈🔥

The SEC has recently approved Ethereum spot ETFs, increasing the visibility and value of cryptocurrencies. This decision follows the approval of Bitcoin ETFs four months ago and has led to a significant increase in inflows, notably for BlackRock's ETF with $89 million in one day. Despite a recent 2.61% decline in the price of Bitcoin, analysts remain optimistic, anticipating a potential increase of up to $95,000 in the coming months. Read the full article

Crypto of the day: Compound (COMP)

Compound is a decentralized finance (DeFi) platform that allows users to lend and borrow cryptocurrencies seamlessly through smart contracts on the Ethereum blockchain. The innovation lies in its liquidity pool model that automatically adjusts interest rates based on supply and demand. This approach provides added value by increasing market efficiency and liquidity.

The COMP token is used for governance, allowing holders to vote on important proposals affecting the protocol. Initially distributed to platform users as a reward for their participation, COMP offers benefits such as reduced fees and direct influence on the evolution of the platform. It can be used to enhance the profitability of crypto investments.

Recent performances 📊

Current price: €59.77

Percentage increase/decrease: +9.56% (1-day increase)

Market capitalization: €496.23 million

Rank on CoinMarketCap: #131

Why Bitcoin will never replace the dollar according to Morgan Stanley 💵

Morgan Stanley recently emphasized that despite the growing appeal of cryptocurrencies, Bitcoin cannot yet compete with the US dollar. The main reason cited is its excessive volatility, which makes it unsuitable as a stable medium of exchange. Morgan Stanley's David Adams explains that investors prefer to hold onto their cryptocurrencies rather than use them for daily transactions due to the significant fluctuations in their value. Furthermore, the recognition and acceptance of a new currency as legitimate take several decades, and Bitcoin has not yet achieved this stability status.

The dollar still reigns supreme!

Despite current economic challenges such as inflation and growing debt, the dollar maintains a dominant position thanks to its long history of stability and trust. Morgan Stanley also highlights the importance of central bank digital currencies (CBDCs), which could offer a more stable alternative to current cryptocurrencies while integrating the advantages of blockchain technology. However, experts believe that the dollar will continue to dominate international transactions and foreign exchange reserves due to its central role and the trust it inspires. Cryptocurrencies still have significant obstacles to overcome before they can claim to replace the dollar on the global stage.