📆 January could be a difficult month for Bitcoin

Welcome to the Daily of Saturday, December 06, 2025 ☕️

Hello Cointribe! 🚀

Today is Saturday, December 06, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

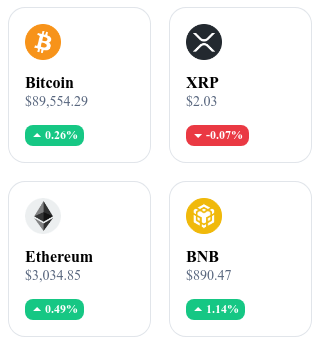

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

⚖️ U.S. prosecutors seek up to 12 years in prison for Do Kwon

In the case of the Terra-Luna ecosystem collapse, U.S. authorities are requesting a maximum 12-year prison sentence for Do Kwon. 👉 Read full article

🛡️ Strategy does not plan to sell its Bitcoins according to Bitwise

Despite current pressure on crypto markets and Bitcoin volatility, Bitwise states that Strategy does not intend to liquidate its BTC holdings, affirming sufficient financial margin to meet its obligations. 👉 Read full article

📉 Meta confirms a historic cut to its metaverse budget

Meta announces a ~30% reduction in its metaverse development budget, reflecting a strategic shift and a refocus on other technological priorities. 👉 Read full article

Crypto of the Day: Pendle (PENDLE)

🧠 Innovation and added value

Pendle is a protocol that enables the separation of future yield from an underlying asset. This creates a structured market around interest rates, a mechanism rarely exploited in DeFi.

Each yield-bearing asset is split into two parts: one token represents the asset’s value, and another represents its future yield. This allows users to access precise rate strategies, similar to traditional fixed-income markets.

Pendle attracts investors who want to buy yield at a fixed price, hedge a position, or sell future yield to unlock liquidity. The protocol improves transparency and increases market depth on rate-based products.

💰 The token

The PENDLE token plays a role in governance and incentives. Holders influence the protocol’s key parameters, including liquidity allocation and pool adjustments.

Token locking, through a voting mechanism, directs rewards toward the pools most supported by the community. This dynamic creates competition between projects to attract user voting. The use of PENDLE is directly tied to activity in rate markets, a growing sector in DeFi.

📊 Real-time performance (CMC)

💵 Current price: $2.40

📈 24h change: +0.44 %

💰 Market cap: $395.82 M

🏅 CoinMarketCap rank: #109

🪙 Circulating supply: 164.27 M PENDLE

📊 24h volume: $25.31 M

Why January could be a difficult month for Bitcoin according to 21Shares

Bitcoin is starting 2026 under the worried eyes of analysts. After crossing the symbolic threshold of $109,000 a year earlier, the cryptocurrency is struggling to maintain momentum in an increasingly unstable macroeconomic environment. This is the warning expressed by Ophelia Snyder, co-founder of 21Shares, who mentions a January that is unlikely to favor a price surge. A statement that draws attention, as many investors were hoping for a quick market restart.

21Shares’ pessimism: volatility, liquidations, and caution

Bitcoin’s recent trajectory shows strong volatility: within a few weeks, the asset experienced a drop of around 10%, accompanied by $19 billion in liquidations across crypto markets. For 21Shares, these elements weaken hopes for a rally as early as January. According to Snyder, “January will probably not look like last year’s,” referencing the sharp rise seen at the beginning of 2025.

She focuses on a global context dominated by investor risk aversion. Traditional markets as well as cryptocurrencies are affected by a climate of caution, driven by uncertainties over monetary policy, geopolitical tensions, and global economic outlooks. This dynamic appears to outweigh internal factors within the crypto ecosystem.

Despite a correction already well underway, Bitcoin’s upside potential is constrained by widespread caution. The $109,000 threshold seems out of reach in the short term, which could dampen expectations for some market participants.

A broader horizon: institutional adoption and long-term hope

Despite these negative signals for early in the year, Snyder does not paint an entirely bleak picture. She emphasizes that current movements reflect classic market mechanisms rather than structural weaknesses in the crypto sector. In the medium and long term, she sees opportunities instead.

Among the drivers of this potential bullish dynamic is the development of crypto ETFs, which provide a regulated gateway into digital assets. Growing interest from institutional investors and governments in blockchain also forms a solid basis for a sustainable recovery.

In other words, the caution expressed by 21Shares does not contradict a positive long-term outlook. The key idea remains that the crypto market is entering a phase of maturation, where short-term fluctuations do not call fundamentals into question.