🏦JPMorgan finally allows its clients to buy Bitcoin

Welcome to the Daily Tribune for Wednesday, May 21, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, May 21, 2025, and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

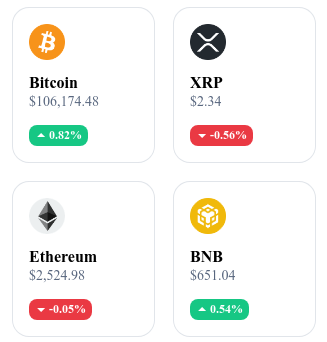

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24h crypto recap! ⏱

📊 The SEC suspends the review of Solana ETFs from Bitwise and 21Shares

The Securities and Exchange Commission (SEC) has suspended the review of the proposed Solana ETFs submitted by Bitwise and 21Shares. The regulatory authority cited concerns regarding potential market manipulation and investor protection, in accordance with the requirements of the Securities Exchange Act.

⚖️ Investors sue Strategy for lack of transparency

Investors have filed a class action lawsuit against Strategy (formerly MicroStrategy) and its co-founder Michael Saylor. They accuse them of having concealed essential information regarding the financial viability of their policy of massive bitcoin accumulation.

🚨 Cardano under investigation after embezzlement suspicions

The Cardano network is under investigation following allegations of embezzlement of $600 million in ADA during the Allegra hard fork. Charles Hoskinson, founder of the project, denied these accusations and announced the implementation of a full audit to clarify the situation.

🏦 JPMorgan allows its clients to buy bitcoin

JPMorgan announced it will allow its clients to buy bitcoin, although it will not provide custody. CEO Jamie Dimon maintains his personal unfavorable stance towards bitcoin, calling it an asset "without intrinsic value". Despite this, the bank’s analysts predict bitcoin will outperform gold in the second half of 2025.

The crypto of the day: Artificial Superintelligence Alliance (ASI)

The Artificial Superintelligence Alliance (ASI) is the result of the merger of three major projects in the field of decentralized artificial intelligence: Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN). This alliance aims to create a unified infrastructure for the development of general artificial intelligence (AGI) and ultimately artificial superintelligence (ASI), with a focus on decentralization, ethics, and transparency.

The ASI token serves as access to the artificial intelligence services offered by the alliance, such as AI models, autonomous agents, and decentralized data services. Holders can also monetize their contributions by publishing agents, data sets, or models, receiving rewards in ASI.

Recent performance:

Current price: $0.7816 USD

24-hour change: +6.5%

Market capitalization: approximately $2.03 billion

Rank on CoinGecko: #64

Bitcoin: confirmed uptrend, but fragile momentum

Bitcoin continues its upward trajectory. Despite a positive change over seven days (+1.7%), the market shows mixed signals: the trend remains supported by moving averages, but decreasing volumes and slowing technical momentum call for a cautious reading. BTC is in a transition zone where confirmation of a breakout or the risk of a technical pullback are both on the table.

Positive technical structure, but under tension

The three key moving averages (SMA 20, 50, and 200 days) remain upward oriented, confirming a favorable market structure for the medium term. The price stays well anchored above the critical thresholds of $100,000 and $96,000.

However, momentum is retreating—as evidenced by a decline in RSI and a 4.6% drop in volumes this week ($31.3 billion). This divergence between price direction and internal dynamics indicates a weakening of the buying pressure.

The short-term levels to watch are clear:

Bullish bias confirmed above $105,700,

Key resistances at $107,000 then $109,354,

Major supports at $100,000, then critical zone at $93,426.

A bullish breakout with volume would open the way to $110,000 and beyond, while a return below $100,000 could trigger a 10 to 20% correction.

Market sentiment still constructive but nervous

The derivatives market remains favorable to the bullish scenario: open interest is increasing, the funding rate remains positive, and flows are balanced between buyers and sellers. This reflects a positioning still oriented upwards, but without excessive euphoria.

Enthusiasm around spot Bitcoin ETFs continues to play a psychological and structural support role. Nonetheless, in the absence of immediate macro catalysts, BTC will have to rely on its own technical fundamentals to maintain momentum. In this respect, the next sessions will be decisive to assess the market’s ability to absorb profit-taking and relaunch a real breakout.

Bitcoin evolves in a clear upward trend, but the internal market dynamic shows signs of fatigue. Technical indicators remain favorable, but declining volume and momentum call for tactical vigilance.

At this stage, investors must closely monitor the levels of $105,700 and $107,000 to validate the continued uptrend or anticipate a potential return to deeper support zones.