⚡ Larry Fink strongly supports Bitcoin, Trump chooses a pro-crypto as running mate!

Welcome to the Daily Tribune on Wednesday, July 17th, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, July 17th, 2024 and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

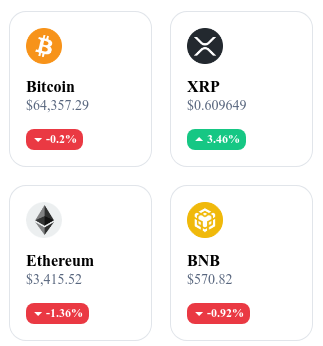

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

Imminent launch of Ethereum ETFs 🚀

Analyst Nate Geraci recently expressed strong optimism about the imminent approval of Ethereum ETFs. President of The ETF Store, Geraci stated that there is no valid reason to further delay this launch, scheduled for this week. The crypto community is closely following this development, which could have a significant impact on the market. The SEC has already granted preliminary approval to three asset managers, including BlackRock, Franklin Templeton, and VanEck. Analysts point out that recent minor changes to the ETF filings are a positive sign, suggesting that the approval process is well underway. The anticipation of this launch has pushed the price of ETH up by 3.24% in the last 24 hours, reaching $3,347. Experts predict that the introduction of Ethereum ETFs could attract massive institutional investments, thereby increasing the demand and value of Ethereum. 🔗 Read the full article here.

Bitcoin: A bright future for miners 🌟

Analysts at Bernstein describe a promising future for Bitcoin miners, referred to as a "Goldilocks scenario," where conditions are perfectly balanced to promote the growth and stability of the Bitcoin mining industry. Several factors contribute to this optimism: increasingly favorable Bitcoin policies, particularly thanks to the growing influence of Donald Trump, who has recently expressed support for the crypto industry. The latest generations of mining chips, more efficient and powerful, reinforce this trend. Furthermore, miners benefit from a technological advantage in terms of energy connectivity, opening up collaboration opportunities with artificial intelligence (AI) data centers. Lastly, the recent stabilization of the Bitcoin price after a period of volatility provides a more predictable environment for long-term mining investments. 🔗 Read the full article here.

JD Vance: Trump's pro-Bitcoin choice for vice president 🤝

Donald Trump has chosen JD Vance, a Republican senator from Ohio, as his running mate for the 2024 presidential election. Known for his strong support for Bitcoin, Vance owns a personal portfolio of $100,000 to $250,000 in Bitcoin. He is also a key player in promoting a legislative framework favorable to cryptocurrencies and has drafted a bill inspired by the Financial Innovation and Technology Act for the 21st Century (FIT21) to clarify the SEC and CFTC's jurisdiction. Vance's nomination is undoubtedly aimed at attracting the crypto-enthusiastic electorate. Trump's campaign team now accepts cryptocurrency donations, and the Republican Party has pledged to end the "illegal crackdown" on the sector. 🔗 Read the full article here.

BlackRock CEO admits mistake and radically changes tone 🏦

Larry Fink, CEO of BlackRock, recently stated that Bitcoin is a "legitimate financial instrument," marking a radical change from his past criticisms. In 2017, Fink referred to Bitcoin as a "money laundering index," and in 2018, he claimed that BlackRock clients were not interested in cryptocurrencies. However, BlackRock is now a key promoter of Bitcoin ETFs, offering institutional investors secure access to this asset class. Fink acknowledged that his previous analysis was incorrect and admitted that Bitcoin offers uncorrelated returns and increased financial control potential, attractive characteristics in an uncertain economic environment. The impressive performance of BlackRock's iShares Bitcoin Trust (IBIT) fund, which has accumulated over $18 billion in assets since its launch in January, illustrates this growing interest. Larry Fink's stance could accelerate institutional acceptance of Bitcoin!

Coin of the day: Gala (GALA)

Gala is powered by GalaChain, a level 1 blockchain designed to fuel the Gala entertainment ecosystem, which includes Gala Games, Gala Music, and Gala Film. Recently, GalaChain has opened up to external developers from various industries, offering open-source resources to streamline development. This blockchain allows for the creation of custom tokens, smart contracts, and node networks, while facilitating interoperability with other blockchains such as Ethereum and Binance Smart Chain.

The GALA token is primarily used to reward node operators and for transactions within the Gala ecosystem. Initially distributed through rewards to founding nodes, it offers benefits such as participation in governance and daily rewards. Holders can use GALA to purchase games, music, and films within the ecosystem and participate in exclusive events.

Recent performance:

Current price: €0.02604

Percentage increase/decrease: +11.70% (in 1 day)

Market capitalization: €856,369,774

Rank on CoinMarketCap: #84

Analysis of July 16th, 2024: Bitcoin up by 20%

Bitcoin recently rebounded by 20% after hitting a low of $53,500, sparking renewed buyer interest. After consolidating in the form of an ascending triangle below $59,000, the BTC price surpassed the previous peak at $63,800, signaling a possible end to the short-term downtrend. Currently, Bitcoin is trading around $63,000, with a return above its 200-day moving average, although still below the 50-day moving average. This recovery has allowed Bitcoin to regain some stability, supported by positive oscillators and renewed buyer interest, providing an optimistic context for medium and long-term investors.

Open interest for Bitcoin perpetual contracts has increased by over 28%, reaching $2.5 billion, despite a recent slight decline. This increase, combined with a positive funding rate and moderate liquidations, shows that the majority of speculators anticipate further Bitcoin price increases. Significant liquidation zones are above $67,500 and between $72,000 and $73,000, while key support zones are just below $58,000. If Bitcoin maintains its price above $61,000, a breakout of $64,000 - $65,000 is anticipated, with potential resistance at $67,500. Conversely, a drop below $61,000 could bring Bitcoin back to support levels around $58,000 and $54,000.

🔗 Read the full analysis here.