🚀 Matrixport predicts a Bitcoin price of $160,000 in 2025 !

Welcome to the Daily Tribune of Saturday, December 14, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, December 14, 2024, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you should not miss !

But first…

✍️ Cartoon of the day:

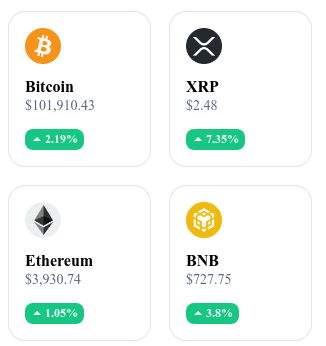

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🚀 Matrixport sees Bitcoin at $160,000 in 2025

Matrixport anticipates a spectacular rise in Bitcoin to $160,000 by 2025, driven by the growth of Bitcoin ETFs, symbolizing massive institutional adoption. Its latest analysis highlights a growing demand for these financial products, supported by a favorable macroeconomic environment, including the global expansion of liquidity and increased recognition of Bitcoin as a strategic asset.

The firm recommends a cautious approach to capture opportunities while limiting risks. The current environment, marked by inflation and geopolitical instability, fuels this trend. If these predictions come true, Bitcoin could redefine the relationships between traditional finance and cryptos, while sparking new debates on regulation and innovation.

🔗 Ethereum, the pillar of a revolutionary repo signed by Société Générale and Banque de France

Société Générale, through its subsidiary SG-Forge, and the Banque de France have executed an unprecedented transaction using the Ethereum blockchain for a repurchase agreement (repo). This pioneering operation allowed the deposit of tokenized bonds on Ethereum as collateral to obtain a central bank digital currency (CBDC) issued on the Banque de France's private blockchain. This hybrid model combines the transparency and interoperability of a public blockchain with the security and compliance of a private infrastructure.

This repo validates the feasibility of interbank financial transactions directly executed on the blockchain, reducing costs and improving liquidity. It marks a turning point in the integration of blockchain technologies within traditional finance and could inspire other European central banks to accelerate their CBDC projects.

🚨 Cryptos: Unlikely allies that led HTS to victory in Syria

Hay’at Tahrir al-Sham (HTS), a Syrian rebel group, used cryptocurrencies to fund a decisive offensive against the regime of Bashar al-Assad. According to an investigation by Chainalysis, anonymous donations in cryptos allowed HTS to raise significant funds between October and November 2024. These resources funded major military operations, thanks to the speed and discretion of blockchain transactions.

HTS implemented advanced money laundering techniques, making their transactions difficult to trace. This practice, already observed with other groups such as the Islamic State, illustrates the growing role of cryptos in conflict zones. A dynamic that poses significant regulatory challenges and requires international cooperation to limit abuses and preserve the opportunities offered by decentralized finance.

🚀 Solana surpasses Ethereum in the talent war

In 2024, Solana attracted 7,625 new developers, surpassing Ethereum for the first time, which saw a 17% drop in its monthly active developers. Solana distinguished itself by its low fees and transaction speed, increasing its new recruits by 83%. Meanwhile, Ethereum, although still the leader in total developers, mainly relies on Layer 2 solutions such as Optimism and Arbitrum, representing 56% of its ecosystem.

Furthermore, Asia, with India leading, is now the main hub for blockchain talent, far surpassing North America.

Crypto of the day: Fantom (FTM)

Fantom is a Layer 1 blockchain, EVM compatible, known for its Lachesis consensus mechanism. This unique technology allows for near-instantaneous transactions through fast and decentralized validation, providing a highly scalable alternative for dApps and peer-to-peer payment projects. Fantom stands out for its speed and low costs, making it an ideal solution for various use cases in decentralized finance (DeFi) and beyond.

The native crypto of Fantom, FTM, is essential to its ecosystem. It is used to secure the network through staking, pay transaction fees, and allow holders to participate in governance by voting on proposals. Distributed through presale and mining mechanisms, FTM offers attractive rewards for stakers while playing a key role in managing operations on the blockchain. It can also be traded on major platforms like Binance and Bybit.

Recent Performances

Current price: €1.20

24h Change: +6%

Market Capitalization: €3.58 billion

CoinMarketCap Rank: 52

🏦 BlackRock recommends 1 to 2% in Bitcoin: A measured and strategic allocation

BlackRock, the largest asset manager in the world, recommends an allocation of 1 to 2% in Bitcoin to diversify portfolios while minimizing risks.

This strategy, deemed "reasonable", is based on data analysis showing that this proportion optimizes diversification without compromising the overall stability of investments. Integrated into a standard portfolio composed of 60% stocks and 40% bonds, this allocation maintains an overall risk comparable to that of shares in large tech companies like Amazon or Microsoft. However, BlackRock warns that excessive exposure could increase volatility due to the still young and unstable nature of Bitcoin.

Bitcoin is valued by BlackRock as a distinctive tool for diversification due to its low correlation with traditional financial assets over the long term. Meanwhile, the development of Bitcoin ETFs, such as the iShares Bitcoin Trust, which currently manages $54 billion, facilitates institutional access to this asset, generating massive capital flows. These products could intensify demand and lead to an increase in Bitcoin’s value.

BlackRock views this approach as a key step towards integrating Bitcoin into traditional investment strategies, while paving the way for increased institutional adoption, likely to transform the crypto market in the coming years.