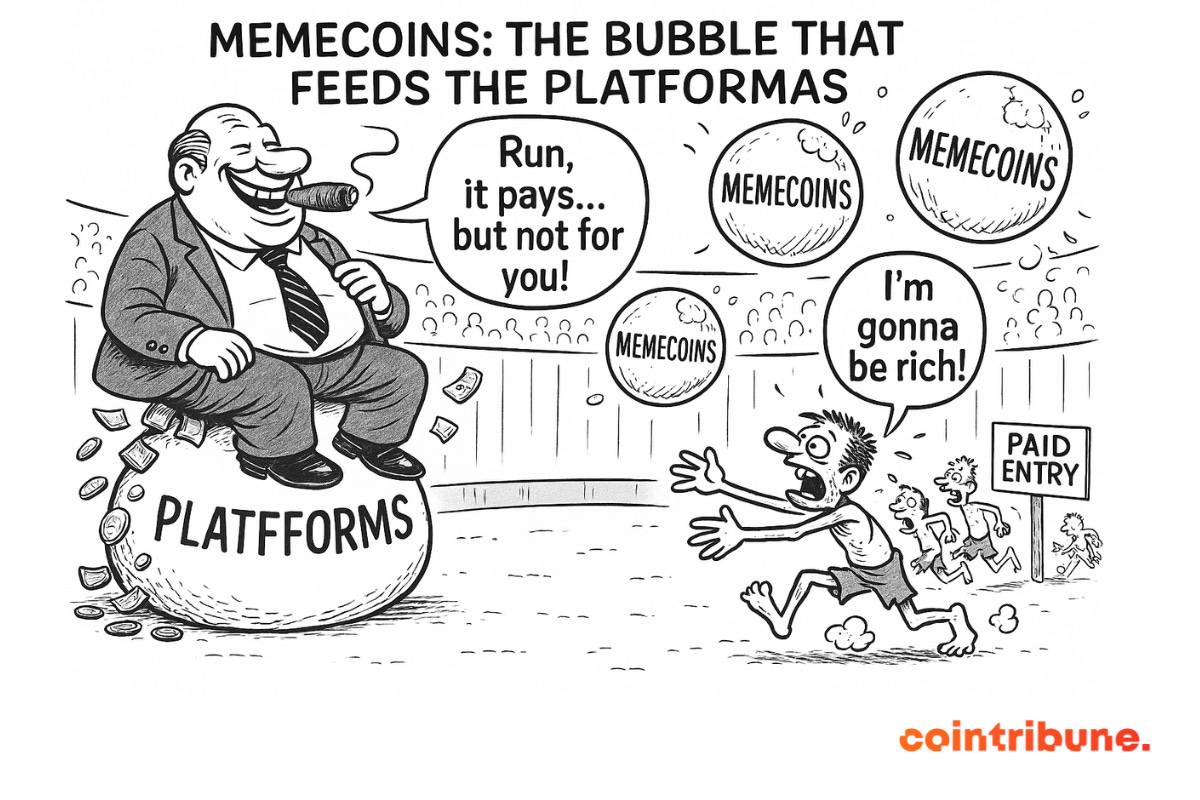

🎈 Memecoins: A lucrative bubble for platforms, not for users

Welcome to the Daily for Thursday, October 2, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, October 2, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the past 24 hours’ news you shouldn’t miss!

But first…

✍️ Cartoon of the day:

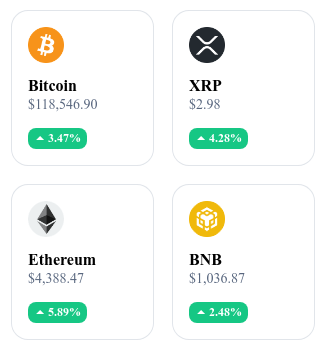

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

📈 Bitcoin surges, fueled by hopes of rate cuts

Bitcoin has surpassed $119,000, its highest level since mid-August. This rally is driven by expectations of Fed monetary easing following the release of weak private employment data.

👉 Read the full article

🔐 BNB Chain restores its X account after phishing attack

On October 1, 2025, the official BNB Chain X account was restored after being compromised by phishing. The incident comes amid a global surge in scams targeting crypto social media.

👉 Read the full article

🔗 Chainlink enables tokenized asset transactions via SWIFT

Chainlink announced an integration with the SWIFT network enabling the tokenization and settlement of financial assets. Chainlink’s CCIP protocol is being used to connect multiple blockchains to banking infrastructures.

👉 Read the full article

📱 Republicans investigate Gary Gensler’s deleted text messages

Republican lawmakers have launched an investigation into the deletion of text messages by SEC Chairman Gary Gensler. Lawmakers are demanding the recovery of exchanges related to regulatory discussions on cryptocurrencies.

👉 Read the full article

📌 Crypto of the Day: Avantis (AVNT)

Innovation and Added Value 🧠

Avantis is a DEX specialized in derivatives, built on the Base blockchain (the Coinbase ecosystem). Its innovation lies in offering perpetuals with leverage up to 500×, not only on cryptocurrencies but also on forex, commodities, and certain real-world assets (RWA).

Avantis also introduces a unique fee model: only profitable trades pay fees, improving the user experience. Liquidity is provided by USDC vaults, and the protocol relies on a dual oracle infrastructure to ensure price reliability. With these features, Avantis positions itself as a comprehensive DeFi platform, aiming to bridge traditional finance and decentralized trading.

The Token 💰

The AVNT token is at the center of the ecosystem. It is used for governance: holders can vote on proposals related to the protocol’s evolution. Staking AVNT allows participants to support network security while receiving rewards.

The economic model also incorporates a deflationary mechanism: part of the collected fees is burned, reducing the circulating supply over time. Finally, AVNT serves as an incentive for liquidity providers who place their funds in USDC vaults, in exchange for yields and rewards.

Real-Time Performance 📊

💵 Current Price: 0.54 USD

📉 24h Change: −5.41%

💰 Market Cap: 147,000,000 USD

🏅 Rank on CoinMarketCap: #169

🪙 Circulating Supply: 272,500,000 AVNT

📊 Trading Volume (24h): 18,900,000 USD

Memecoins: The gold rush that mostly enriches platforms

They promised sudden fortunes and improbable returns. Driven by absurd names and enthusiastic communities, memecoins have flooded blockchain networks, particularly Solana. But behind the crypto folklore, a cold mechanism emerges: it is the launch platforms and trading bots that pocket most of the gains, leaving traditional users behind. A Galaxy Research report delivers a damning assessment of this new digital gold rush.

Memecoins, a playground for machines

The report published by Galaxy Research highlights a clear phenomenon: speculation on memecoins brings little benefit to individual investors. In reality, this market has become the preferred playground for trading bots, programmed to capture the slightest price variation in just seconds. This technological dominance is illustrated by a striking figure: on Solana, the median holding time for a memecoin has dropped to around 100 seconds, compared to 300 a year ago. Further proof that cycles are now so fast they escape any human investment logic.

Bots operate on platforms optimized for their use, with scripts capable of “sniping” tokens at launch, extracting a margin, and exiting—all in under two minutes. Ordinary users, often lured by hype or viral promises, generally arrive too late. This algorithmic imbalance widens the gap between community promise and financial reality.

When platforms become the real winners

In this ecosystem dominated by speed and technology, it is mainly the memecoin creation platforms that come out stronger. Two names stand out: Pump.fun and Axiom. These players provide tools for users to launch their own tokens, but their business model relies mostly on creation fees, transaction commissions, and advanced services aimed at savvy users.

Pump.fun is emblematic. When it launched its own token, PUMP, the platform raised $500 million in less than 12 minutes. Since then, it has generated several million dollars per week through activities linked to newly issued tokens. This monetization is made possible by an infrastructure designed to capture a constant flow of projects, regardless of their quality or viability.

Thus, while users speculate on goofy names and baseless promises, platforms take their cut at every stage: creation, exchange, promotion. In this game, they become the true beneficiaries of the memecoin bubble.

An imbalanced market with an uncertain future

The spectacular growth of memecoins reveals both the strengths of crypto innovation and its systemic flaws. Between sniping algorithms, built-in fees, and ultra-fast cycles, the majority of users are relegated to the sidelines. While the model remains profitable for infrastructures, it could eventually erode retail confidence, already undermined by frequent losses and a frustrating user experience.

In the longer term, the question remains: can this economic model survive without a solid base of real participants? Or does it risk collapsing as soon as the influx of new entrants slows down? As it stands, memecoins look less like a financial revolution and more like an algorithmic casino, with rules written by and for those who control the technology.