🌐Meta rejects Bitcoin, Poland elects a pro-crypto president, Musk launches XChat, Strategy accumulates

Welcome to the Tuesday June 3, 2025 Daily Tribune ☕️

Hello Cointribe! 🚀

Today is Tuesday, June 3, 2025 and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you should not have missed!

But first…

✍️ Cartoon of the day:

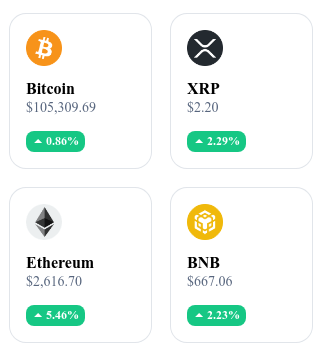

A quick look at the market…

🌡️ Temperature:

☀️ Sunny

24h crypto recap! ⏱

🏦 Meta rejects Bitcoin in its treasury

99.92% of Meta shareholders voted against integrating Bitcoin into the company treasury. The proposal, submitted by Ethan Peck, was countered by Mark Zuckerberg, who holds 61% of the voting rights.

🇵🇱 A pro-Bitcoin president elected in Poland

Karol Nawrocki becomes president of Poland after a runoff marked by crypto-friendly positions. His rival, Sławomir Mentzen, proposed a strategic reserve of bitcoins and tax benefits for investors.

🔐 Elon Musk launches XChat with Bitcoin-inspired security

Elon Musk unveiled XChat, an encrypted feature integrated into the X platform. The tool allows ephemeral messages, file transfers, and calls without a phone number.

📈 Strategy buys 705 bitcoins for 75 million dollars

The company Strategy acquired 705 bitcoins for an amount of 75.1 million dollars. Its holdings now exceed 580,000 BTC.

Crypto of the day: Conflux (CFX)

🧠 Technology and innovation

Conflux is a layer 1 blockchain designed to offer exceptional scalability, efficiency, and interoperability. It uses a unique architecture based on adaptive sharding and a consensus mechanism called Secure Proof of Stake (SPoS), enabling processing of up to 15,000 transactions per second with minimal fees.

This infrastructure is ideal for decentralized applications (dApps), decentralized financial services (DeFi), NFTs, and the metaverse. Conflux aims to create a complete digital ecosystem, facilitating the mass adoption of blockchain across various sectors.

💰 CFX Token – Utility and distribution

The CFX is the native token of Conflux. It is used for:

Staking: securing the network and participating in block validation.

Transaction fee payment: users pay fees in CFX to perform transactions on the network.

Governance: holders can vote on protocol evolution proposals.

📊 Market data (as of June 3, 2025)

Current price: $0.07938

24-hour change: +$0.0049 (+6.6%)

Market capitalization: approximately 402 million dollars

Rank on CoinMarketCap: #135

Circulating supply: 5.08 billion CFX

24-hour trading volume: approximately 20 million dollars

Ethereum aims for a 10x performance leap

Ethereum co-founder Vitalik Buterin recently detailed an ambitious plan: to multiply the Layer 1 capacity by ten within 12 to 18 months. Presented at ETHGlobal in Prague, this project marks a major milestone in Ethereum’s technical roadmap.

Beyond simple scalability gains, this initiative redefines what a high-performance Layer 1 blockchain could be, while maintaining the network's fundamental pillars: decentralization, accessibility, and resilience to censorship.

Precise technical levers for controlled scaling

Three main evolution axes are highlighted by Vitalik Buterin to achieve this capacity increase:

Gradual increase of the gas limit: recently raised from 30 to 36 million, this parameter could still be extended to allow a higher volume of transactions per block — without compromising stability.

Adoption of stateless clients: these new types of clients would enable block validation without requiring full storage of the network state, significantly reducing infrastructure requirements.

Targeted EVM optimizations: by making the execution environment more efficient (notably via new opcodes and structural simplifications), Ethereum could reduce computational costs without changing its security logic.

These enhancements aim for "native" scalability of Layer 1, which would directly strengthen the base network’s execution capacity, without relying solely on Layer 2.

Decentralization and governance: deliberate trade-offs

Buterin remains firm on one principle: decentralization will not be sacrificed for performance. That is why scaling will be gradual and controlled. Unlike other blockchains that prioritize rapid scalability even if it favors centralized actors, Ethereum bets on balance: technical growth without excluding modest validators.

The development philosophy thus aligns with a long-term vision: preserving accessibility to validation, encouraging client diversity, and resisting potential censorship pressures.

This strategic positioning, halfway between conservatism and innovation, strengthens Ethereum’s legitimacy as a global blockchain infrastructure.

If the goals of this "L1 revolution" are met, Ethereum could reposition itself as the sector’s essential reference, capable of absorbing global adoption without compromise on security or decentralization.