🚨 MiCA pushes Tether towards the exit, Lagarde closes the door on Bitcoin, and Pump.fun in the sights of investors!

Welcome to the Daily Tribune on Saturday, February 1, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Saturday, February 1, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

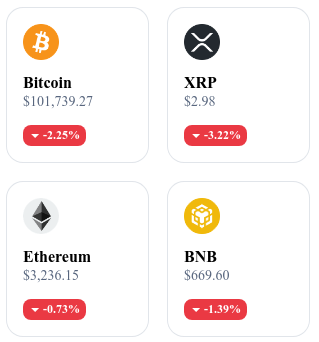

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

🎭 SBF's parents bet on Trump for a presidential pardon!

Convicted to 25 years in prison for fraud in the FTX case, could Sam Bankman-Fried benefit from a presidential pardon? His parents are actively exploring this option by consulting lawyers and associates of Donald Trump. Their hope relies on the leniency that the former president has already granted to controversial figures like Ross Ulbricht (Silk Road). However, SBF's situation is much more delicate: he is accused of having embezzled billions of dollars of investors' funds, making him a symbol of the brutal fall of the crypto industry in 2022. If Trump were to decide to grant him a pardon, it could divide the crypto community and reignite debates on the impunity of economic elites. 🔗 Read the full article

💸 Tether under pressure: USDT withdrawn en masse in Europe!

European regulations are pushing Crypto.com and Coinbase to withdraw USDT from their platforms to comply with the MiCA framework. This move, deemed hasty by Tether, could disrupt the European market and create a chaotic situation for investors. Tether reminds that the market for USD stablecoins is little used in Europe, unlike emerging markets where USDT plays a key role. Meanwhile, Tether is working on Hadron, a project aimed at making USDT compliant with European requirements. ESMA (European Securities and Markets Authority) has given platforms until March 2025 to withdraw non-compliant stablecoins, hinting at further turbulence to come. 🔗 Read the full article

❌ Lagarde closes the door on Bitcoin in central bank reserves

Christine Lagarde, president of the ECB, reaffirmed her categorical opposition to the inclusion of Bitcoin in central bank reserves. According to her, BTC does not meet any of the liquidity, security, and stability criteria required for a reliable monetary reserve. This position contrasts with that of the Czech National Bank, which is exploring new asset classes, potentially including Bitcoin. This rejection illustrates the rift between a conservative approach to the financial system and a more open vision to monetary transformations. While institutions like MicroStrategy accumulate BTC, the ECB remains rigidly opposed, rejecting any rapprochement between crypto and European monetary policy. 🔗 Read the full article

⚖️ Pump.fun in the crosshairs of justice for fraud!

A class action has been filed against Pump.fun, a platform specialized in creating memecoins on the Solana blockchain. The complaint, initiated by Diego Aguilar, accuses Pump.fun of having sold unregistered securities and having set up pump-and-dump schemes, generating nearly $500 million in fees. According to the plaintiffs, the platform used aggressive marketing techniques to entice investors to buy volatile tokens, often with no real utility. In December 2024, the UK FCA had already banned Pump.fun, warning of fraud and market manipulation risks. This case highlights how memecoins remain a slippery slope for investors and could soon be subject to stricter regulations. 🔗 Read the full article

The crypto of the day: Neo (NEO)

Neo is an open-source blockchain founded in 2014 and often referred to as "Chinese Ethereum". Its main objective is to digitize assets via the blockchain and integrate a digital identity into its transactions to ensure their legality. Neo stands out with its approach to Smart Economy, combining:

Digital assets (conversion of physical assets into digital assets on the blockchain).

Digital identity (multi-level authentication including facial, voice recognition, and fingerprints).

Smart Contracts (automatic execution of agreements without intermediaries).

Neo relies on a consensus mechanism called Delegated Byzantine Fault Tolerance (dBFT), ensuring speed and security of transactions.

The NEO is the native cryptocurrency of the network. It cannot be divided and mainly serves as a governance token used to validate transactions and network decisions.

Neo also has GAS, another token that serves to pay transaction fees and execute smart contracts on the blockchain. The initial distribution took place via two fundraising rounds:

2015: 17.5 million NEO sold for $550,000.

2016: 22.5 million NEO sold for $4.5 million.

Benefits for holders of this cryptocurrency and uses

Network governance: Participation in decisions via staking.

GAS generation: NEO holders automatically receive GAS tokens as a reward.

Development of decentralized applications (dApps) on the Neo ecosystem.

Interoperability with other blockchains via the NeoX protocol.

Recent performances

Current price: €14.67

24h change: +6.65%

Market capitalization: €1.03 billion

Ranking on CoinMarketCap: #85

Bitcoin as national reserve: Czech Republic faces a strategic choice

The Czech Republic is questioning the integration of Bitcoin into its national reserves, a decision that sparks heated debates within the country's economic institutions.

The governor of the Czech National Bank, Aleš Michl, has expressed interest in this cryptocurrency, considering its potential as a diversification asset. However, the Ministry of Finance, concerned about the volatility of Bitcoin, strongly opposes this idea. At the last council on January 30, the central bank ultimately opted for a cautious approach, preferring to explore other asset classes without explicitly mentioning Bitcoin. Despite this temporary rejection, Michl remains convinced of the relevance of such an initiative, arguing that increasing gold reserves (from 0% to 5%) and the goal of 30% in equities could justify a thorough study of Bitcoin.

Historically, the Czech Republic has a close link with Bitcoin. The country hosted the first mining pool, was behind the first hardware wallet, and organizes one of the largest Bitcoin conferences in the world. The local crypto industry views this initiative as a logical continuation of its technological engagement. However, beyond the technical and economic aspects, this reflection fits into a strategy of financial diversification. The Czech Republic, although a member of the European Union, still refuses to adopt the euro and maintains its own currency, the Czech crown. In the face of high inflation (17.5% in 2022) and a desire to reduce its exposure to traditional assets, the country seeks alternatives to secure its financial wealth while asserting its monetary independence.

If no immediate decision has been made, Bitcoin remains an option considered for the future. Michl emphasizes its lack of correlation with government bonds, making it a potentially interesting element for diversifying national reserves. In a context where several countries are exploring the possibility of adopting Bitcoin as a strategic reserve, the Czech Republic could be one of the first European states to take the plunge. However, the lack of consensus among local financial institutions and the inherent risks of this asset class make this transition uncertain. Caution remains prudent, but the idea of a national treasury in Bitcoin continues to gain traction in Czech economic circles.