Michael Saylor does not stop: MicroStrategy adds 18,300 BTC to its reserves

Welcome to the Daily Tribune Saturday, September 14, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, September 14, 2024, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

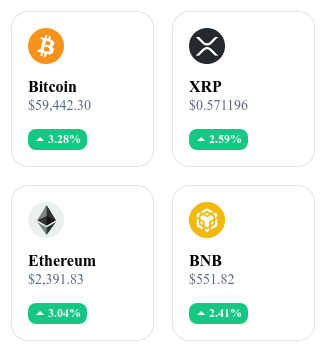

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

MicroStrategy continues its Bitcoin buying frenzy 🪙

MicroStrategy, led by Michael Saylor, has just acquired an additional 18,300 bitcoins for a total of $1.11 billion, at an average price of $60,408 per BTC. This new acquisition brings the company's total holdings to 244,800 BTC, valued at approximately $14 billion. Since 2020, MicroStrategy has been pursuing an aggressive strategy of accumulating Bitcoin, which it views as a superior store of value compared to traditional assets and a hedge against inflation. This announcement had a positive impact on the market, with a slight increase in the price of BTC. MicroStrategy, the largest institutional holder of Bitcoin in the world, continues to strengthen its influence in the crypto market and inspire other companies to adopt similar strategies. 🔗 Read the full article here.

SWIFT opens up to RWA cryptos for instant transfers 🌐

SWIFT, the global banking messaging network, now integrates RWA (Real-World Assets) cryptos to facilitate the transfer of tokenized assets around the world. These RWA cryptos, backed by tangible assets like real estate or commodities, offer increased liquidity and enhanced accessibility, especially for institutional investors. SWIFT aims to connect its network to public and private blockchains as well as CBDCs, eliminating digital silos and reducing transaction costs. This initiative could transform global finance into a hybrid model combining traditional and digital systems, while addressing the growing demand for tokenized assets, estimated at $30 trillion by 2034. SWIFT thus positions itself as a leader in interoperability, unifying the worlds of fiat currencies and cryptos for instant transfers. 🔗 Read the full article here.

18% of French people own cryptos: growing adoption 🇫🇷

According to a Gemini study published on September 10, 2024, 18% of French people now own cryptocurrencies, a significant increase compared to the 12% observed at the beginning of the year. This represents over 12 million French investors in crypto assets, a record figure for the country. Furthermore, 30% of French people have previously owned cryptos at some point. The majority of Bitcoin holders are optimistic about the future, with 70% expecting an increase in its value over the next five years, and 63% predicting greater adoption of cryptos as a means of payment by 2034. This adoption rate places France on par with the United Kingdom, but below the United States (21%) and far behind Singapore (26% after a recent decline). 🔗 Read the full article here.

Trump enters the scene with World Liberty Financial 🚀

Donald Trump will launch his own crypto platform, World Liberty Financial, on September 16, 2024, aiming to revolutionize the financial sector by integrating decentralized finance (DeFi) and stablecoins. The project offers decentralized credit accounts via the Aave platform on the Ethereum blockchain, enabling users to borrow and lend money without going through traditional banks. Trump also plans to launch stablecoins pegged to the US dollar to maintain the dollar's influence in the crypto world. The timing of this launch, 50 days before the US presidential elections, has sparked criticism, with some seeing it as an electoral maneuver. Despite the controversies, World Liberty Financial could mark a turning point in the large-scale adoption of DeFi, provided it overcomes challenges of privacy and regulation. 🔗 Read the full article here.

Crypto of the day: Bittensor (TAO)

Bittensor is a blockchain focused on artificial intelligence and distributed data, aiming to transform the way neural networks are created, shared, and monetized. The key innovation of Bittensor lies in its ability to encourage user contributions by rewarding AI models that provide useful knowledge.

The native crypto of the platform, TAO, serves primarily to reward contributors to the network and fund the development of new models. Distributed via a mining mechanism based on proof of work, TAO offers benefits such as rewards for staking and reduced transaction fees. Holders can use TAO to participate in the governance of the network and earn passive income by supporting the development of AI on the platform.

Recent performances

Current price: €283.70

Increase/decrease percentage: +9.04% (increase over 1 day)

Market capitalization: €2,094,570,384

Rank on CoinMarketCap: #36

Ethereum on the edge of a razor!

Ethereum, the second largest cryptocurrency in the world, faces significant challenges that could threaten its dominant position. According to an analysis by Coinbase, the crypto ecosystem is evolving rapidly, with growing investor interest in riskier altcoins. This trend concentrates capital in less liquid projects, reducing the flow of funds to Ethereum. Moreover, the lack of a strong narrative and the inability to stand out against competition from other smart contract blockchains further weaken its position.

The Total Value Locked (TVL) on Ethereum, a key indicator of user engagement, fell from $67 billion in June to only $44 billion, indicating a concerning disengagement. This retreat erases several months of growth and reflects Ethereum's difficulty in attracting developers and investors. Ethereum thus has an interest in finding a new catalyst, such as the launch of spot Ethereum ETFs, to revitalize interest from institutional capital. Without innovation and better market education, it risks losing its status as a leader in smart contracts in the very near future.

🔗 Read the full analysis here.