🚀 Michael Saylor doesn’t give up: Strategy strengthens its position with a new massive purchase of BTC!

Welcome to the Daily Tribune of Tuesday, February 11, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Tuesday, February 11, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

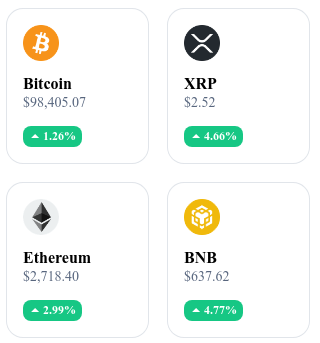

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🏦 Strategy continues its accumulation with 7,633 BTC more!

Strategy (formerly MicroStrategy) continues its aggressive expansion into Bitcoin with the acquisition of 7,633 BTC for a total amount of 742.4 million dollars. This new purchase brings its treasure to 478,740 BTC and solidifies its position as the largest institutional holder of Bitcoin. The average acquisition price is now $65,033 per BTC. Despite a net loss of $3.03 per share in the last quarter, the company remains committed to its engagement with BTC. 🔗 Read the full article

⚠️ Are altcoins dead? The CEO of Pump.fun decides!

According to Alon Cohen, CEO of Pump.fun, altcoins have no real value and are now just disguised memecoins. He believes that the majority of crypto projects imitate existing concepts without real innovation, surfing on speculation and virality to attract investors. This explosion of memecoins, especially with Dogecoin and its derivatives, diverts capital from high-utility projects and poses a problem for the future of the sector. 🔗 Read the full article

📉 The memecoin TRUMP collapses: 813,000 investors ruined!

The memecoin TRUMP, launched with the direct support of Donald Trump and his associates, saw a meteoric rise to $75, before collapsing to $17, causing colossal losses. 813,000 investors suffered a financial carnage with cumulative losses of $2 billion. A handful of savvy traders pocketed $669 million thanks to well-timed sales, while the majority of investors find themselves stuck with devalued tokens. This crypto-political scandal highlights the risks of highly speculative memecoins and the need for better market regulation. 🔗 Read the full article

🏆 Ethereum attracts $883M: a major bullish signal?

Ethereum records a record influx of $883 million, marked by massive accumulation of 330,705 ETH on long-term accumulation addresses. These inflows, usually linked to whales and institutional investors, indicate a strong bullish sentiment. Historically, these inflows often precede price rallies, such as the 35% observed in 2023 after a similar movement. Despite a 20.75% drop since January, this massive influx could signal a new bullish wave, and some analysts foresee a target of $4,000 for ETH. 🔗 Read the full article

The crypto of the day: Virtuals Protocol (VIRTUAL)

Virtuals Protocol is a decentralized platform that integrates artificial intelligence (AI) and the metaverse to enhance virtual interactions. It enables the creation of co-owned, humanized, and ready-to-use game AIs, thus providing immersive and interactive experiences in virtual environments. This approach aims to enrich user interactions by combining cutting-edge technologies to create more dynamic and engaging virtual worlds.

The native token of Virtuals Protocol, known by the symbol VIRTUAL, serves as currency within the ecosystem. It is used to facilitate transactions, access platform services, and participate in the network governance. Holders of VIRTUAL can benefit from rewards by participating in staking programs and contributing to community development.

Recent performances:

Current price: $1.41 (approximately €1.30)

24-hour change: +20.7%

Market capitalization: $910.5 million

Rank on CoinMarketCap: #79

Can we really destroy Bitcoin? The shocking hypothesis that divides experts

The shocking claim by Justin Drake, a researcher linked to Ethereum, that $10 billion would be enough to destroy Bitcoin sparks a heated debate.

According to him, a 51% attack, where an actor would control the majority of the network's computational power, would be feasible with this investment. Theoretically, such an attack would allow manipulation of transactions, but in practice, this hypothesis faces several major barriers. First, executing such an operation would require months, if not years of coordination among states or financial institutions, making it nearly impossible to hide. Furthermore, the colossal energy cost associated with such an attack makes its execution economically absurd. Moreover, an attack of this magnitude would lead to the immediate collapse of mining equipment values, rendering the investment irrecoverable.

Bitcoin owes its robustness to its proof-of-work mechanism, which converts energy into security. Mining equipment (ASIC) is designed solely to protect the network and has no other utility. Thus, in the case of an attack attempt, these machines would instantly lose value, making any takeover of the network ineffective in the long term. In comparison, Ethereum, based on a Proof-of-Stake model, relies on a system where governance is more easily influenced by large amounts of capital, making the network more vulnerable to manipulation. Moreover, the Bitcoin mining industry is moving towards more energy-efficient solutions, exploiting hydropower, flared gas, and soon nuclear or green hydrogen, making the network even more resilient to criticisms of its energy footprint.

Finally, Bitcoin stands out due to its programmed scarcity and immutability, unlike Ethereum, which continually adjusts its economic model. With a fixed cap of 21 million BTC, Bitcoin is designed to be a deflationary asset, while Ethereum oscillates between inflation and deflation depending on its protocol updates. This monetary and technological stability explains why Bitcoin has survived every major crisis since its inception, unlike other crypto projects. If Bitcoin were to disappear, it would take the entire cryptocurrency market with it, as it remains the foundational bedrock of the blockchain ecosystem. Despite alarming predictions, Bitcoin has already proven its resilience and continues to assert its position as a global store of value.