🔥Michael Saylor reaches $1 billion in BTC, first Solana ETF approved in Brazil

Welcome to the Daily Tribune Friday, August 9, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, August 9, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

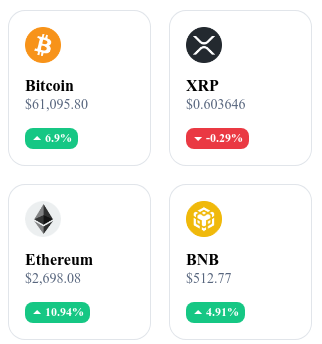

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24h crypto recap! ⏱

💰 Michael Saylor and his colossal bet on Bitcoin

Michael Saylor, founder of MicroStrategy, reaches a new milestone in his commitment to Bitcoin, with personal BTC holdings now exceeding $1 billion. This impressive figure reflects his massive investment in cryptocurrency since 2020, the year he began accumulating Bitcoin on a large scale. At the same time, under his leadership, MicroStrategy holds more than 226,000 BTC, valued at nearly $15 billion. Saylor sees Bitcoin as a store of value comparable to a "cyber Manhattan". To him, this cryptocurrency represents a durable and scarce asset. This approach, although hailed by some as visionary, is also criticized for the risks associated with such asset concentration. Despite the debates, Saylor remains resolutely optimistic about the future of Bitcoin. 🔗 Read the full article here.

⚖️ Ripple ordered to pay $125 million after landmark trial with the SEC

On August 7, 2024, Ripple was ordered by a federal judge to pay $125 million in civil penalties, ending a long-running trial with the SEC. The SEC had initially accused Ripple of selling unregistered securities through its XRP token, but the court made a crucial distinction: while Ripple violated federal laws by directly selling XRP to institutional clients, sales to retail customers through exchanges did not violate securities laws. The amount of the fine is significantly lower than the $1.9 billion initially sought by the SEC. In addition to the financial penalty, Ripple is now under an injunction that prohibits it from violating federal securities laws again and requires a registration statement for any future sale of securities. Ripple CEO Brad Garlinghouse expressed relief at this decision, stating that it would allow the company to focus on innovation in digital payments. 🔗 Read the full article here.

📈 Small investors continue to accumulate Bitcoin despite the downturn

Despite a significant drop in the price of Bitcoin, small investors show unwavering confidence, as evidenced by the record number of addresses holding more than 0.1 BTC. This number now stands at 4,580,424, nearing the all-time high, even in a context of increased volatility where the price of Bitcoin has dropped by nearly 24% from its historic peak. This sustained accumulation is seen by experts as a sign of the democratization of Bitcoin investment, beyond large institutional investors. The continued increase in small addresses, despite market fluctuations, demonstrates a growing adoption of Bitcoin, with investors seeing price drops as buying opportunities. This phenomenon also occurs in the context of Bitcoin scarcity, with nearly 19 million BTC already mined out of a possible total of 21 million, making each fraction of BTC even more valuable. 🔗 Read the full article here.

🌟 Brazil approves the first Solana-based ETF: a turning point for the crypto market

Brazil has just achieved an important milestone in the institutional adoption of cryptocurrencies by approving the very first Solana (SOL) based ETF, managed by QR Asset Management and supervised by Vortx. This decision, validated by the Brazilian Securities Commission (CVM), strengthens the country's position as a global leader in regulated crypto investments. This ETF, which is based on the CME CF's dollar reference rates for Solana, offers a new diversification opportunity for investors while bringing an additional dimension of legitimacy and security to the digital assets market. However, reactions are mixed: while some analysts see it as institutional recognition favorable to the adoption of Solana, others remain cautious due to the recent volatility of SOL, which has experienced notable fluctuations and a decrease in transaction volume. 🔗 Read the full article here.

Crypto of the day: Sui (SUI)

Sui is a next-generation blockchain designed to offer exceptional scalability and speed through an innovative consensus mechanism called \"Narwhal and Tusk\". This blockchain stands out for its ability to process a large number of transactions simultaneously while maintaining low fees, making it an ideal solution for decentralized applications (dApps) requiring high fluidity.

The native cryptocurrency of Sui, SUI, is mainly used to pay transaction fees, secure the network through staking, and participate in protocol governance. SUI has been distributed through a public sale and incentive programs, with benefits for holders such as the ability to participate in staking to generate returns. Additionally, SUI can be used in various dApps built on the Sui blockchain, further strengthening its utility in the ecosystem.

Recent Performance

Current price: €0.8373

Change in the last 24 hours: +30.33%

Market capitalization: €2.17 billion

Rank on CoinMarketCap: #34

🔻Bitcoin below $60,000: Golden buying opportunity or mere illusion?

The recent drop in Bitcoin, which saw its price fall below the $60,000 mark, has sparked passionate debates among investors and market experts. Some, like Gracy Chen, CEO of BitGet, see this correction as a strategic buying opportunity. She suggests that price levels around $43,000 to $47,000 could be attractive entry points to strengthen a Bitcoin portfolio. Indeed, Bitcoin's history shows that such corrections can precede significant rebounds, making it a potential opportunity for those with a long-term perspective. However, this volatility continues to fuel discussions about the caution to be exercised during such downturns, especially for less experienced investors.

Despite this volatility, Bitcoin's fundamentals remain strong. As the most decentralized cryptocurrency, Bitcoin benefits from unique resilience, protected against censorship and external interference. Moreover, in a global context marked by increasing inflation and expansive monetary policies, Bitcoin is increasingly seen as an attractive store of value, thanks to its limited supply of 21 million coins. The growing institutional adoption, notably with the approval of Bitcoin spot ETFs, further strengthens its legitimacy on the global financial stage. For savvy investors, the current drop could therefore represent a rare opportunity to strengthen their position in an asset with robust long-term prospects. 🔗 Read the full analysis here.