💼 MicroStrategy strengthens its holdings, Hamster Kombat to distribute tokens, Bybit withdraws from France!

Welcome to the Daily Tribune on Saturday, August 3, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, August 3, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

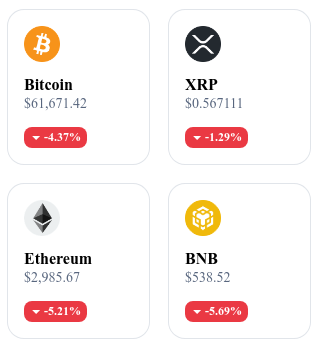

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

📉 Tech giants' financial results cause Bitcoin to drop!

The recent financial results released by major tech companies have caused turbulence in the Bitcoin market. Intel announced lower-than-expected earnings for the second quarter of 2024, with a revenue of $12.83 billion, well below expectations. Amazon also disappointed with a net sales of $147.98 billion, against a forecast of $148.78 billion. These poor performances led to a decline in the stocks of the companies involved, also impacting the price of Bitcoin, which is often seen as a technological asset. However, Apple's positive performance could provide some short-term stability. 🔗 Read the full article here.

🎮 Hamster Kombat offers 60% of its tokens to its players!

Hamster Kombat, a tap-to-earn game on the TON network, has published its new whitepaper and updated its roadmap, marking the end of its first season. The game, which has attracted over 300 million players, emphasizes the importance of its community by allocating 60% of its total token supply for community distribution. This strategy aims to reward players and strengthen their engagement. The announcement has generated a mix of enthusiasm and concerns, notably from Pavel Durov, CEO of Telegram, who supports the project, and Anatoli Aksakov, Chairman of the Financial Market Committee of the Russian State Duma, who expressed reservations. The launch of this airdrop is yet to be determined due to its technical complexity, but it is already generating great anticipation in the market. 🔗 Read the full article here.

🏦 MicroStrategy strengthens its Bitcoin holdings with $805 million!

MicroStrategy has announced a significant increase in its Bitcoin holdings, now totaling 226,500 BTC. During the second quarter of 2024, the company acquired an additional 12,222 BTC for a total of $805.2 million, at an average price of $65,882 per bitcoin. Despite a net loss of $102.6 million due to depreciation charges on its digital assets, MicroStrategy continues its aggressive strategy of strengthening its position in the crypto ecosystem. The introduction of the new metric "BTC Yield" aims to measure the company's bitcoin yield, with an annual target return between 4 and 8% over the next three years. Additionally, the company raised $800 million through a convertible notes offering and plans a 10 for 1 stock split. 🔗 Read the full article here.

🚪 Bybit leaves France under regulatory pressure

Bybit, an unlicensed crypto exchange in France, is withdrawing from the French market following a warning from the Autorité des Marchés Financiers (AMF). Starting from August 2, French users will no longer be able to open new positions and will only be able to close their existing operations. All unclosed positions will be automatically liquidated starting from August 13. This drastic measure affects all products offered by Bybit, including instant purchases, Bybit Card, P2P trading, Spot products, derivatives, Copy Trading, Trading Bots, and Bybit Earn structured products. Bybit advises its users to withdraw their funds quickly to avoid complications. 🔗 Read the full article here.

Crypto of the day: Flow (FLOW)

Flow is an innovative blockchain designed for next-generation applications, offering uncompromised scalability and decentralization. Its main value lies in its ability to handle a large volume of transactions while maintaining low latency, making it ideal for applications such as gaming and NFTs.

Flow's native cryptocurrency, FLOW, is used for transactions, staking, and fees on the platform. Initially distributed through an ICO and private sales, this cryptocurrency offers benefits such as rewards for stakers and participation in network governance. FLOW holders can also use it to access various services and applications on the Flow blockchain, thereby significantly strengthening the ecosystem.

Recent Performance

Current price: €0.5423

Percentage increase/decrease: -10.58% (decrease over 1 day)

Market capitalization: €826,935,970

Rank on CoinMarketCap: #69

Does Bitcoin really have value?

According to Matt Hougan, CIO of Bitwise, the value of Bitcoin lies in its unique service of securing wealth without the involvement of banks or intermediaries. Unlike companies like Salesforce that charge for their services, Bitcoin is a decentralized protocol that imposes no fees for its use. This characteristic, combined with the continuous increase in the number of users, has led to a dramatic increase in the value of Bitcoin, reaching approximately 9,700% over the past ten years. Hougan argues that if the demand for Bitcoin's service continues to grow, its value will continue to rise, making crypto a valuable asset despite the lack of traditional cash flow.

Furthermore, the interest in Bitcoin is not limited to individual investors. Influential figures such as Larry Fink, CEO of BlackRock, consider Bitcoin as a safe haven in times of economic uncertainty, an "investment instrument when one is afraid." This recognition is bolstered by recent political developments in the United States, where personalities like Donald Trump and Robert Kennedy Jr. are considering creating a national Bitcoin reserve. Hougan even envisions that G20 countries might precede the United States by adding Bitcoin to their national reserves. These dynamics suggest increased adoption of Bitcoin, and some even speculate about a future where the price of BTC could reach incredible heights, up to $23 million per unit. 🔗 Read the full article here.