🚀MicroStrategy strengthens its position with a historic purchase !

Welcome to the Daily tribune of Tuesday, November 19, 2024 ☕️

Hello Cointribe! 🚀

Today, it is Tuesday, November 19, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss !

But first…

✍️ Cartoon of the day:

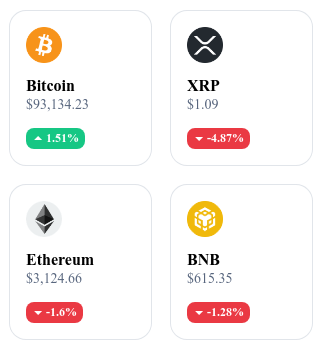

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

🏦 MicroStrategy strengthens its Bitcoin offensive despite volatility

MicroStrategy strikes hard by purchasing 51,780 Bitcoin for $4.6 billion, at an average price of $88,627 per unit. This movement, the largest ever made by the company, brings its total portfolio to 331,200 BTC acquired for $16.5 billion. Michael Saylor, its founder, remains confident in the future of cryptocurrency, despite its volatility.

As Bitcoin reaches historic highs, this massive bet relies on optimistic forecasts regarding institutional adoption and more favorable regulations, although the risks related to cryptocurrency dependency and unstable markets persist.

🌍 Two new regulated stablecoins shake up the crypto Europe

Europe takes a key step in the adoption of stablecoins with the launch of EURQ and USDQ, two tokens regulated according to the strict MiCA standards. Backed by heavyweights like Tether, Kraken, and Fabric Ventures, these stablecoins are respectively backed by the euro and the dollar, guaranteed by fiduciary reserves at 102%, and recognized as e-money tokens by the Central Bank of the Netherlands.

Available on Kraken and Bitfinex starting November 21, they promise fast and reliable transactions for businesses and individuals, consolidating Europe’s ambition to unify the rules for these digital assets. However, criticisms emerge regarding MiCA's requirements, such as the need to hold 60% of reserves in European banks, a point deemed risky by Tether in light of banking lending practices.

📊 Bitcoin ETFs on the rise: record numbers and institutional enthusiasm

Spot Bitcoin ETFs are experiencing phenomenal success, recording $1.67 billion in net inflows between November 11 and 15, a record in a series of six consecutive weeks of positive influx. These flows have brought managed assets to $95.4 billion, representing 5.27% of Bitcoin's total market capitalization. BlackRock's iShares Bitcoin Trust (IBIT) dominates the market with $29.3 billion in inflows, while Grayscale Bitcoin Trust suffers from significant outflows.

This trend coincides with a historic Bitcoin peak at $93,400 and increased engagement from institutional investors like Paul Tudor Jones and Goldman Sachs. This enthusiasm extends to Ethereum ETFs, which attracted $515 million in one week, reinforcing the idea of a growing maturity in the crypto market despite its volatility.

🇵🇱 Bitcoin as a national treasure: Poland positions itself

Sławomir Mentzen, a candidate for the Polish presidency for 2025, commits to creating a national strategic reserve of Bitcoin in the event of victory. Inspired by international initiatives like those of El Salvador or projects in the United States, this proposal aims to position Poland as a major player in the crypto ecosystem. Mentzen responds to the call of tech-savvy leaders like Lech Wilczynski, who advocates for the rapid adoption of Bitcoin as a sovereign asset.

While nations like Bhutan already hold significant digital portfolios, Poland is considering a similar strategy to diversify its national reserves and anticipate global financial trends. This initiative could mark a turning point for the management of sovereign assets on a global scale.

The crypto of the day: Tezos (XTZ)

Tezos is an innovative blockchain focused on code security, on-chain governance, and scalability. Through its Liquid Proof-of-Stake (LPoS) consensus mechanism, it allows users to participate in securing the network, either directly or by delegation, while earning rewards.

Its native crypto, XTZ, plays a key role in transactions, smart contracts, and governance proposals. Launched in 2018, the initial distribution was made via ICO, ensuring wide community participation. Holders of XTZ benefit from a voting right in the evolution of the protocol and can use their tokens for staking, offering potential profitability while contributing to the network's stability.

Recent performances

Current price : €0.99

Change (24h) : -16.96 %

Market capitalization : €1.066 billion

CoinGecko rank : #96

Technical analysis of the day: Bitcoin (BTC)

Bitcoin, after reaching a historic high of $93,433, enters a consolidation phase marked by a key resistance at $91,800. This dynamic, characterized by increasing highs and solid support levels at $85,000, reflects a continuous demand, although the market shows signs of a pause.

Technical indicators suggest a bullish trend in the short and medium term, with the potential to progress towards $95,437 if current resistances are broken. However, a correction remains possible, especially in the event of losing key supports, with critical thresholds identified at $81,600 and $76,000.

In the derivatives market, the stability of open interest and a bearish orientation of the CVD show increased caution from investors. Positive financing rates nevertheless indicate a majority of long positions, supporting a latent bullish dynamic.

The liquidation zones identified between $93,000 and $95,000 above the current price, as well as below $90,000, illustrate the critical levels to watch for anticipating increased volatility.

In summary, Bitcoin remains in a strategic position, with a fragile balance between consolidation and new bullish impulses.

🔗 Read the full analysis here.