⛏️ Miners are capitulating... could this be the start of a new Bitcoin bull run?

Welcome to the Daily for Tuesday, December 23, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, December 23, 2025, and just like every day from Tuesday to Saturday, we bring you a recap of the last 24 hours’ must-know news!

But first…

✍️ Cartoon of the day:

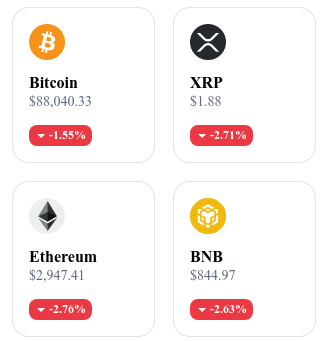

A quick look at the market…

🌡 Weather:

Rainy 🌧️

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

💶 EU validates two versions of the digital euro, including a privacy-focused one

The European Council and the European Central Bank have officially approved the development of two versions of the digital euro: an online version and an offline version focused on transaction privacy. The offline version will allow payments without an Internet connection via certified devices, with transaction traceability similar to cash.

👉 Read the full article

⚖️ Controversial vote stirs Aave protocol community

A vote launched on the Snapshot platform proposes transferring control of Aave’s brand assets to a legal entity controlled by the DAO. Some actors, including former CTO Ernesto Boado, claim they never approved the vote, denouncing a rushed process. The community is intensely debating the transparency and legitimacy of the governance process.

👉 Read the full article

📊 Uniswap finally activates protocol fees after massive vote

The “UNIfication” vote on Uniswap validated the activation of protocol fees for versions v2 and v3. Nearly 62 million votes were cast, surpassing the required quorum, and 100 million UNI tokens were burned to address the historical lack of fees. The protocol’s governance has been reorganized, with Uniswap Labs and the Foundation now aligned under a legal framework in the state of Wyoming.

👉 Read the full article

🏦 JPMorgan considers offering crypto trading services to institutional clients

JPMorgan Chase is exploring the possibility of offering cryptocurrency trading services to its institutional clients, potentially including spot and derivative products. This decision is part of a broader strategy to expand into the digital asset space.

👉 Read the full article

Crypto of the Day: Hedera (HBAR)

🧠 Innovation & Added Value

Hedera is a public blockchain with Byzantine Fault Tolerance (BFT) that stands out thanks to its hybrid consensus mechanism: Hashgraph. Unlike traditional blockchains like Ethereum, Hedera uses a proprietary algorithm that ensures speed, scalability, and security for transactions.

The project is designed for applications requiring high transaction throughput with low fees and minimal latency. Hedera is backed by tech giants such as Google, IBM, and Boeing, which gives it strong institutional credibility. It is tailored to sectors like finance, IoT, utilities, and supply chains.

💰 The Token

The HBAR token plays a key role in the Hedera ecosystem. It is used to secure the network via staking and to pay for transaction fees. The token issuance follows a controlled inflationary policy to meet the network’s growing needs.

HBAR is also used in network governance: holders can participate in major decisions regarding the platform’s development. Hedera’s growing adoption in institutional sectors boosts demand for the token, reinforcing its central role in enterprise-grade applications.

📊 Real-Time Performance (CMC)

💵 Current price: €0.09434

📉 24h change: –3.91%

💰 Market cap: €4.03 B

🏅 CoinMarketCap rank: #23

🪙 Circulating supply: 42.77 B HBAR

📊 24h trading volume: €104.79 M

Bitcoin: Does the Drop in Miners’ Hashrate Signal a Price Surge Ahead?

The Bitcoin mining sector is going through turbulent times. Yet, according to VanEck’s analysis, this rough patch could paradoxically signal a BTC price rebound. Historically, a drop in hashrate has often preceded market recoveries. Let’s break down this underestimated technical indicator that could mark the return of the bulls.

Falling Miner Hashrate: A Historical Signal of Bullish Reversals

In December, Bitcoin’s network hashrate — the total computing power securing the blockchain — fell by around 4%. This drop is often seen as a sign of miner capitulation, where less profitable operators shut down due to insufficient revenue to cover operating costs.

This isn’t new. VanEck’s historical analysis shows that such declines have often preceded Bitcoin price recoveries. Since 2014, hashrate drops were followed by a 90-day positive return in 65% of cases, compared to 54% when hashrate was rising. Over 180 days, 77% of these declines led to price gains, with an average return exceeding 70%.

This makes hashrate not just a technical network indicator, but also a potential market sentiment barometer and a contrarian investment signal.

Between Economic Stress, Energy Reallocation, and Recovery Hopes

Today’s hashrate drop isn’t merely cyclical. It reflects deeper structural dynamics. Energy costs have shifted: in some regions, reduced electricity prices let miners remain competitive, while others—especially those with older equipment—have had to shut down.

Another key factor is China’s energy reallocation. About 1.3 gigawatts of mining capacity have been decommissioned and redirected to high-value computing like AI. This shift highlights how intensive computing is becoming a strategic priority in some parts of the world.

Despite pressure on miners, some regions continue supporting the industry through favorable energy rates, tax incentives, and tailored regulatory frameworks—elements that could shape the future geographical distribution of hashrate.

Bitcoin’s historical cycles suggest that when miners suffer, the market may be primed for a surprise. If past trends hold, today’s hashrate decline could signal a price inflection point for BTC.