🌍Money Transfers: Western Union Finally Opens Up to Stablecoins

Welcome to the Daily Tribune for Wednesday, July 23, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, July 23, 2025, and as every day from Tuesday to Saturday, we summarize for you the news from the last 24 hours that you should not have missed!

But first…

✍️ Cartoon of the day:

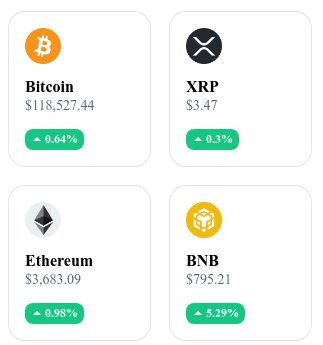

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

💱 Conflux launches an offshore yuan stablecoin and improves its network

Conflux unveiled AxCNH, a stablecoin backed by the offshore yuan (CNH), co-developed with AnchorX and Eastcompeace, intended for cross-border transactions within the Belt & Road initiative, during the Shanghai Summit (July 18–20). At the same time, the blockchain upgrades to Conflux 3.0, an update enhancing its throughput to 15,000 TPS, integrating compatibility with sovereign digital currencies and on-chain AI agents.

🏛️ FTX seeks judicial postponement amid $470M freeze

The FTX estate filed a "Motion for Leave" with the Delaware court to get additional time to respond to over 90 objections related to the freezing of $470 million USD in refunds intended for creditors in restricted jurisdictions such as China, Russia, or Egypt. Creditors, including Weiwei Ji, oppose this suspension, fearing a total loss of their rights if the Court grants the delay.

🌐 Ultra launches a $1 million fund to boost Web3

The Ultra platform announced a $1 million USD grant program to support Web3 developers by financing dApps, tools, games, and on-chain infrastructures. The program combines mentoring, funding, and decentralized governance to realize projects with real impact in the blockchain ecosystem.

💳 Western Union tests integration of stablecoins in its transfers

Western Union is exploring the use of stablecoins (notably USDC, USDT) for its international transfers, especially in Africa and South America, to reduce costs, accelerate cross-border payments, and facilitate fiat/crypto conversions. CEO Devin McGranahan confirmed that this strategy fits within a favorable regulatory evolution such as the GENIUS Act.

🌐 Credefi V3 launches a new era for DeFi backed by real assets

The Credefi platform has deployed its V3 version, transforming its architecture to fully integrate tokenization of real-world assets (RWA) via operational modules from launch: staking, marketing pools, peer-to-peer loans, and institutional vaults with internal risk assessment. This revamp invites users to migrate before July 20, with a unified staking system (xCREDI, Utility Stake, RevShare) and strengthened partnerships, aiming to firmly anchor DeFi in the real economy.

Crypto of the Day: Chainlink (LINK)

🧠 What innovation? What added value?

Chainlink is a decentralized oracle protocol that allows smart contracts to connect securely and reliably to data outside the blockchain. It solves the "oracle problem", namely the inability for a blockchain to independently read real-world data, such as asset prices, weather, or sports results.

Thanks to a network of independent nodes, Chainlink provides real-time data feeds used in DeFi, insurance, gaming, and DAOs. Its scalable architecture was enhanced with Chainlink 2.0, which introduces hybrid services, verifiable random functions (VRF), and off-chain capabilities. This positions Chainlink as a key Web3 infrastructure component, integrated by hundreds of major projects, including Aave, Synthetix, or even SWIFT.

💰 Native crypto: utility, distribution, and advantages

The LINK token plays a central role in the network's operation. It is used to reward oracle node operators who provide data to smart contracts. These nodes must deposit LINK as collateral (staking), which encourages reliability: poor behavior results in the loss of this collateral.

LINK also serves as an economic incentive for network maintenance. In the long term, it will participate in the governance system planned for the protocol’s evolution. With growing utility and presence on all major exchanges, the token benefits from strong liquidity and constant demand linked to Chainlink's network adoption.

📊 Recent Performance (July 23, 2025)

Current price: $19.62

24h change: +0.66%

Market capitalization: $12.96 billion

Rank on CoinMarketCap: #14

Circulating supply: 678,099,970 LINK

24h trading volume: $866 million

Solana: this chart signal predicts a surge to $6,000

The Solana crypto is making headlines again. As the bullish market sets in, a chart pattern rarely observed on major assets fuels the most ambitious forecasts. A long-term technical figure could propel SOL's price to unprecedented levels.

A massive chart signal on Solana draws attention

Solana recently crossed the $200 mark, reaching its highest level in five months. This progress is accompanied by a significant acceleration in open interest, with a gain of $1.5 billion in just three days, indicating increased speculation and investor interest.

But beyond short-term movements, it's a chart pattern that grabs all the attention: the formation of a “cup and handle” pattern over several years. This type of figure, well-known to technical analysts for its bullish potential, rarely appears on large-cap assets. According to the pseudonymous trader Tardigrade, who has 44,000 followers, this signal suggests Solana could target a price range between $4,800 and $6,300, representing an increase of over 3,000% from current levels, provided it crosses the critical threshold of $250.

Other industry voices share this analysis. Robert Mercer, notably, considers that the market is drawing the right side of the “handle”, generally viewed as a consolidation phase preceding a breakout. Mister Crypto, another widely followed analyst, refers to a “historic” opportunity in the medium and long term.

Solid fundamentals justify such a projection

Beyond technical considerations, the Solana ecosystem offers tangible arguments to support this bullish outlook. Its Total Value Locked (TVL) today reaches $10.3 billion, a clear increase, reflecting the blockchain’s growing anchorage in the DeFi ecosystem. Solana also benefits from increased adoption in NFTs, decentralized applications (dApps), and staking.

This adoption dynamic is supported by Solana’s technical performance, often praised for its processing speed and low transaction costs. In a context where users and developers look for alternatives to legacy blockchains like Ethereum, Solana positions itself as a preferred infrastructure.

Finally, this growth occurs within a general climate of renewed optimism in the crypto market, where several altcoins show strong performance. If the breakout above $250 is confirmed with robust volumes, the “cup and handle” figure could trigger a major bullish cycle for Solana.