NFT: Cristiano Ronaldo facing US justice! 🚨

Welcome to the DailyTribune of Thursday, November 30, 2023 ☕️

Hello Cointribe! 🚀

Today is Thursday, November 30, 2023, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

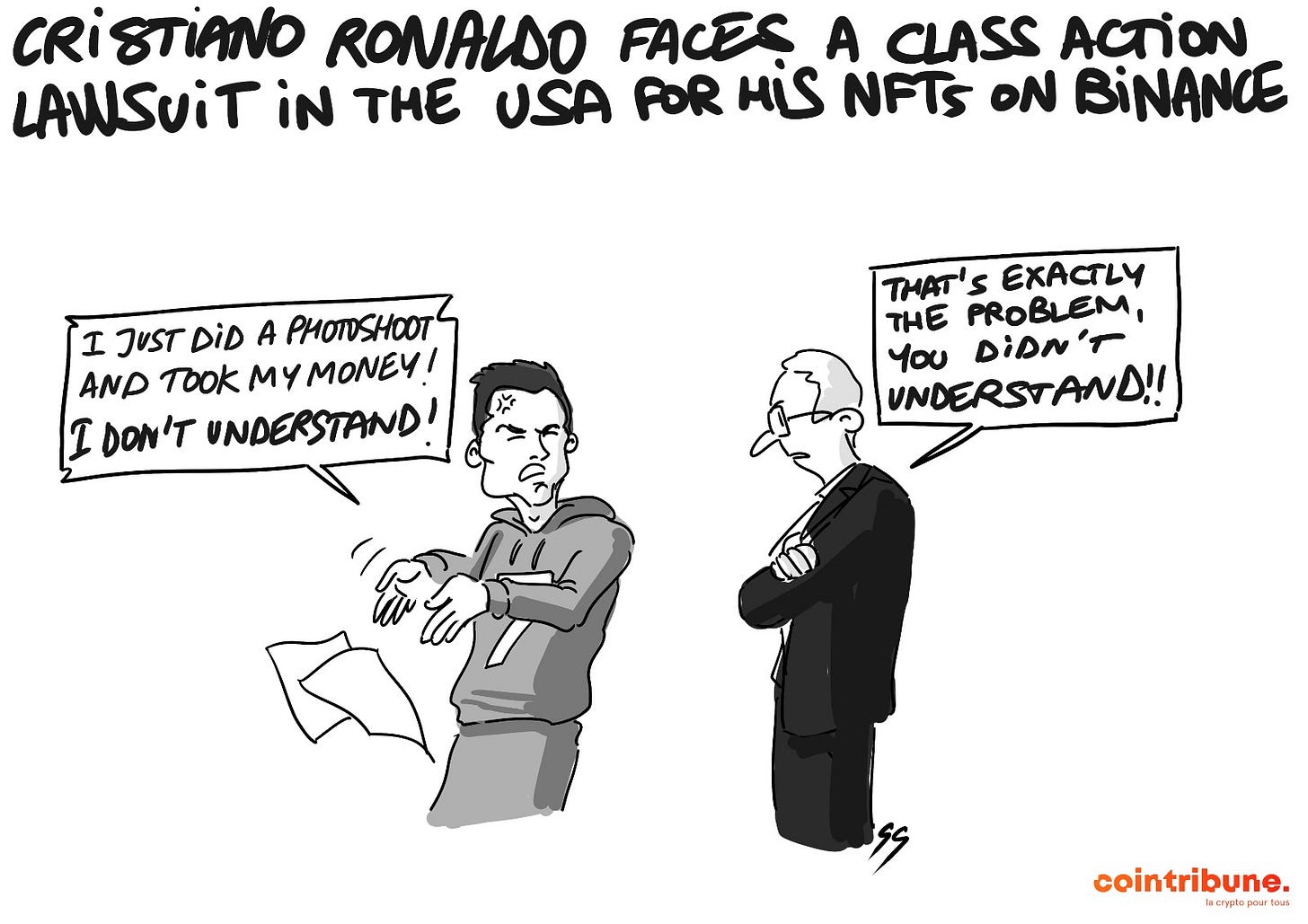

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24-hour crypto summary ! ⏱️

⚖️ Cristiano Ronaldo in legal trouble for his NFTs on Binance

Cristiano Ronaldo is facing a class action lawsuit in the United States, accused of promoting unregistered securities through Binance. One year ago, Ronaldo launched his collection of NFTs on Binance, but he is now at the center of a financial controversy. The complaint filed in Florida alleges that Ronaldo's NFTs prompted his millions of followers to invest in unregistered securities on Binance.

The plaintiffs highlight Ronaldo's key role in the increasing popularity of the exchange, with a 500% increase in searches on Binance following the NFT sale. The complaint relies on Ronaldo's alleged failure to disclose his financial ties with Binance, which could violate the SEC's guidelines on disclosure of payments related to the promotion of crypto.

The Ronaldo and Binance case goes beyond the simple question of NFT promotion. It highlights a broader cultural aspect: how celebrities, with their immense influence, shape the public's perception of financial investments. This case raises fundamental questions about modern financial culture, where the line between entertainment and serious investment becomes blurred. This could lead to a deeper reflection on the responsibility of influencers in the financial education of their followers, and the need for regulation adapted to the era of social media and decentralized finance.

🚀 Bitcoin towards $100,000: Standard Chartered's forecast

Standard Chartered Bank maintains its April forecast, anticipating Bitcoin to reach $100,000 by the end of 2024. The analysts from the American bank expect the approval of several Bitcoin spot ETFs in the United States, an event that could occur earlier than expected. They also predict that Bitcoin's next halving in April 2024, which will halve the emission of new bitcoins, will be another catalyst for price increase.

Bitcoin's market share has risen from 45% in April to 50%, strengthening its dominance. Analysts suggest that price increases could mainly materialize before the halving, with the potential to reach $100,000 before the end of 2024.

Standard Chartered's prediction of Bitcoin reaching $100,000 suggests not only increasing acceptance of Bitcoin by traditional financial institutions but also possible maturation of the cryptocurrency market. However, this forecast is based on uncertain future events, such as the approval of Bitcoin ETFs, and could be influenced by external factors such as government regulation and macroeconomic fluctuations.

🐋 A mysterious Bitcoin whale makes massive purchases

A mysterious Bitcoin whale has been buying large amounts of BTC since the beginning of the month, potentially signaling an imminent bull run. Recently, this address acquired 859 BTC, bringing its total to over 11,260 BTC, or about $426 million.

Glassnode data shows that all Bitcoin addresses have been accumulating BTC since October, indicating a market sentiment reversal. Currently, over 83.6% of the BTC supply is in the green, a historically significant percentage that suggests the gestation of a bull run. The price of Bitcoin is approaching the $40,000 mark, and a breakout could lead to new popular enthusiasm.

The massive purchase of Bitcoin by a mysterious whale suggests growing optimism among large-scale investors. This could indicate a market turnaround and potential bull run. However, this also raises concerns about wealth concentration and the influence of large entities on the Bitcoin market.

🔥 Ethereum deflation: The two main reasons

Ethereum's supply is becoming deflationary due to two key factors: the slowdown in the number of validators and the increase in burned transaction fees through EIP1559.

The number of validators leaving staking pools has increased significantly, going from an average of 309 per day in October to 1018 in November, thus slowing down the network's growth and the creation of new ETH tokens. At the same time, increased network activity has led to an increase in gas fees, with a notable increase in ETH burned daily. In October, 899 ETH were burned per day, a figure that has climbed to 5,368 ETH in less than a month. This situation makes ETH an increasingly scarce resource, potentially influencing investor choices.

The deflation of Ethereum's supply, resulting from the decrease in validators and the increase in burned fees, could have significant implications for the Ethereum ecosystem. This could strengthen the long-term value of ETH but also exacerbate scalability issues and increase transaction costs, thus affecting the accessibility and adoption of Ethereum.

Crypto of the day: Nervos Network (CKB)

The Nervos Network (CKB) is a public open-source blockchain launched in November 2019. It stands out for its two-layer architecture: a base layer for consensus and smart assets, and a computation layer for transactions. This structure aims to optimize security and flexibility, allowing developers to create decentralized applications (dApps) compatible with various blockchain systems. Nervos' two-layer approach offers an innovative solution to the challenges of scalability and interoperability, two major challenges in the blockchain space.

Nervos' native cryptocurrency is CKByte (CKB). It plays a central role in the ecosystem, used to reward miners, manage network resources, and enable asset storage. CKB, operating on a Proof-of-Work (PoW) consensus mechanism, offers holders the opportunity to participate in network governance and benefit from its increased security. CKB holders can also use this cryptocurrency to interact with various applications and services within the Nervos ecosystem, benefiting from its versatility and integration into a growing network.

Recent CKB performance

Current price: €0.002879

Percentage increase/decrease: -3.07% (1-day increase)

Market capitalization: €123,929,338

Rank on CoinMarketCap: #254

Please note that this information is provided for informational purposes only and does not constitute investment advice. Always do your own research before making a financial decision.

Crypto analysis of the day: Chainlink (LINK)

Chainlink has really been on fire lately! In November, it rose by over 26%, and over the course of two months, it jumped by over 100%. That's huge, isn't it? With a new annual record of $16.60, LINK shows that it's not here to play around. Currently, it is stabilizing around $14, but keep an eye on it. Why? Because LINK remains above its 50 and 200-day moving averages, a clear sign of a bullish trend. But be careful, oscillators show a decrease in momentum, which could indicate a potential short-term correction.

Now, let's talk strategy. If LINK breaks through and maintains above $16, we could see a rise to $18-20. And if the trend continues, the next stop could be at $28, representing an increase of nearly 96%! But if LINK fails to hold above $16, we could see a decline to $11-12, or even $10, representing a decrease of about 30%.

In summary, Chainlink has broken out of its usual range and is flirting with new highs. But beware, it is crucial to monitor price reactions at these key levels. A breakthrough of $16 could mean a continuation of the uptrend, but until that happens, the risk of a correction remains. And don't forget, these analyses are based on technical data. Cryptocurrencies can evolve quickly, influenced by other more fundamental factors. So stay vigilant and informed!