Hello Cointribe! 🚀

Today is Friday, December 26, 2025, and as we do every day from Tuesday to Saturday, we bring you a recap of the last 24 hours’ key news!

But first…

✍️ Cartoon of the day:

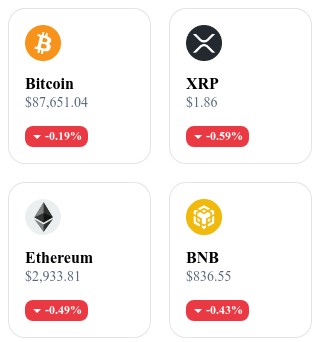

A quick look at the market…

🌡 Weather:

Rainy 🌧️

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

Bitcoin: Extreme Fear Takes Over the Market This Christmas 🎄

The leading cryptocurrency faces a period of intense uncertainty, fueling extreme fear within the community on December 25, 2025. Bitcoin remains anchored below the $90,000 threshold for several days, while the Fear & Greed Index drops to a critical level of 17 out of 100.

👉 Read the full article

Trust Wallet: Major Security Breach Leads to $6.4 Million Stolen 🚨

A critical vulnerability in the Trust Wallet extension resulted in a large-scale theft on December 24, 2025. Cybersecurity expert ZachXBT identified around 400 wallets impacted by the attack, with total losses reaching $6.4 million.

👉 Read the full article

Bitcoin ETFs: Massive $825 Million Outflow Over Five Days 📉

Bitcoin ETFs listed in the U.S. have seen a capital outflow of $825 million over five consecutive sessions. Fidelity’s FBTC recorded the largest single-day withdrawal, with a net loss of $240.6 million on December 23, 2025.

👉 Read the full article

Cardano and Solana: Founders Deploy Interoperability Bridge 🌉

Charles Hoskinson and Anatoly Yakovenko announced a new technical bridge to connect the Cardano and Solana networks. This infrastructure enables seamless asset transfers between both protocols, aiming to enhance DeFi liquidity as 2025 ends.

👉 Read the full article

Crypto of the Day: Aave (AAVE)

🧠 Innovation & Added Value

Aave is a decentralized finance (DeFi) protocol specialized in lending and borrowing digital assets. The platform allows users to deposit cryptocurrencies to earn interest or borrow against on-chain collateral.

Aave stands out for advanced features like flash loans, variable and stable interest rates, and fine-tuned risk management. It is a key infrastructure in the Ethereum DeFi ecosystem and several layer 2s. Its broad adoption by users and developers strengthens its role as a pillar of the decentralized credit market.

💰 The Token

The AAVE token plays a key role in the protocol’s governance and security. Holders vote on risk parameters, upgrades, and treasury allocations.

AAVE also supports the Safety Module, which protects the protocol during extreme events. Users can stake their tokens to bolster system stability and receive incentives in return. The token’s utility grows with increasing loan volumes and total value locked (TVL) on the platform.

📊 Real-Time Performance (CMC)

💵 Current Price: €131.67

📈 24h Change: +1.4%

💰 Market Cap: €2.01B

🏅 CoinMarketCap Rank: #35

🪙 Circulating Supply: 15.3M AAVE

📊 24h Trading Volume: €293.68M

🎄 No Christmas Miracle for Memecoins: The (Harsh) 2025 Recap

While the holiday lights are still glowing, the Christmas tree for memecoin investors is painted in one dominant color this year: red.

After the wild euphoria and spectacular gains of 2024, the year 2025 ends on a much more sober note for assets driven by pure speculation. Here’s a recap of this “Christmas hangover” in the memecoin sector.

A painful yearly drop

According to recent data, the memecoin sector has recorded a significant annual decline by December 2025. Despite a few seasonal surges, market leaders like Dogecoin (DOGE), Shiba Inu (SHIB), and PEPE have failed to maintain their previous highs.

Many of these assets have posted double-digit losses over 12 months, a stark contrast to the performance of Bitcoin or projects tied to real-world assets (RWA) and AI.

Why the lack of love in 2025?

Several reasons explain why Santa delivered coal to meme holders this year:

Market saturation: By 2025, creating “shitcoins” has become so easy (thanks to AI and automated launch platforms) that liquidity has fragmented. Too much supply, not enough demand.

Return to fundamentals: After several loss-heavy cycles due to rug pulls, investors seem more mature. Capital is shifting toward protocols with real utility.

Regulatory pressure: Financial regulators have tightened the screws on decentralized exchanges (DEXs), making speculation on small tokens harder and less profitable for retail users.

Are memecoins doomed in 2026?

Not quite. While 2025 has acted as a purification filter, memecoins are not going away. They remain the main entry point for new blockchain users due to their community and viral appeal.

However, this year’s message is clear: the selection will be ruthless. Projects without strong cultural backing or tech innovation (like integration in gaming or payments) may continue their slow slide toward zero.