"No one sells Bitcoin": Experts predict a bullish storm!

Welcome to the Daily Tribune of Wednesday, April 02, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Wednesday, April 02, 2025 and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

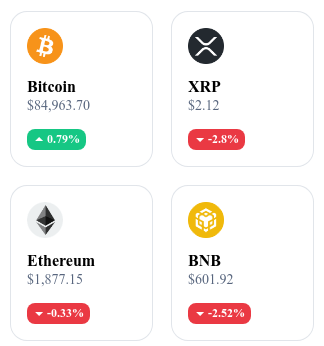

A quick look at the market…

🌡️ Temperature:

Partially cloudy ⛅

24h crypto recap! ⏱

Tether holds 92,646 BTC after a new purchase of 735 million

Tether bought 8,888 BTC in March for 735 million dollars. Its Bitcoin treasury reaches 92,646 BTC, or about 7.4 billion dollars.

Michael Saylor: "Don't be fooled, buy bitcoins"

Saylor reaffirms his Bitcoin accumulation strategy. He sees this market drop as an opportunity.

No one sells Bitcoin: experts reveal a crazy scenario

Flows to exchanges are dropping to their lowest levels in two years. Analysts mention a risk of shortage if demand rises.

Metaplanet continues its Bitcoin purchases despite an unstable market

The Japanese company raised 13.3 million dollars to buy Bitcoin. It aims for a reserve of 21,000 BTC by 2026.

Crypto of the day: EOS (EOS)

EOS is an open-source blockchain platform designed for the development, hosting, and execution of decentralized applications (dApps) at an industrial scale. It stands out for its high performance, flexibility, and enhanced developer experience. Using the Delegated Proof of Stake (DPoS) consensus mechanism, EOS allows for almost instant transactions with minimal fees, thereby promoting broader adoption of dApps.

The native token EOS is primarily used to secure the blockchain and pay for the resources needed for dApp execution, such as bandwidth, storage, and computing power. EOS token holders can also participate in network governance by voting for block producers, influencing the platform's evolution.

Recent performances:

Current price: $0.8057 USD

Change over 24 hours: +18.8 %

Market capitalization: about 1.22 billion dollars

Rank on CoinMarketCap: #56

Binance ends USDT in Europe: What choices for users?

USDT, long considered the cornerstone of crypto exchanges, is gradually disappearing from European platforms. Since March 31, 2025, Binance has suspended spot trading of USDT, in accordance with the MiCA regulation that came into effect in December 2024. This decision forces European investors to adapt their strategies.

MiCA imposes its rules: USDT ousted from the European market

The new MiCA regulation (Markets in Crypto-Assets) requires stablecoin issuers to comply with stringent criteria, including obtaining European approval, ensuring financial transparency and prudent management of reserves. Tether, the issuer of USDT, not meeting these requirements, Binance was forced to remove this stablecoin from its spot trading pairs for all users located in the European Union.

Although USDT remains available for off-spot transactions (futures contracts, transfers between wallets, deposits, and withdrawals), this measure significantly reduces its liquidity in European markets. Other exchanges like Kraken have followed this route, while MEXC and some Asian platforms continue to offer it, often outside MiCA standards.

What alternatives for European investors?

In this new regulatory landscape, users are logically turning to MiCA-compliant stablecoins, notably:

USDC, issued by Circle, which has established itself as a reliable alternative, with growing adoption in regulated areas.

EURI, a euro-backed stablecoin, gaining relevance for those wishing to limit their exposure to the dollar.

Binance also recommends converting USDT to these assets via its dedicated interface to maintain flexibility in spot markets. The emergence of USDC as a substitute standard is notably reinforced following its official approval in Dubai. Meanwhile, some investors prefer to convert their stablecoins directly into euros to avoid any future regulatory friction.

The ban on USDT on Binance in Europe marks a turning point in the regulation of cryptocurrencies. While it mandates technical adjustments for users, it primarily illustrates the European Union's desire to firmly regulate the flow of stablecoins. For investors, it is now about choosing compliant assets and rethinking their liquidity tools in an ecosystem undergoing significant changes.