Nobitex, an Iranian crypto exchange, loses $81M in a pro-Israel cyberattack

Welcome to the Daily Tribune of Thursday, June 19, 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, June 19, 2025 and as every day from Tuesday to Saturday, we summarize for you the news of the last 24 hours you couldn’t miss!

But first…

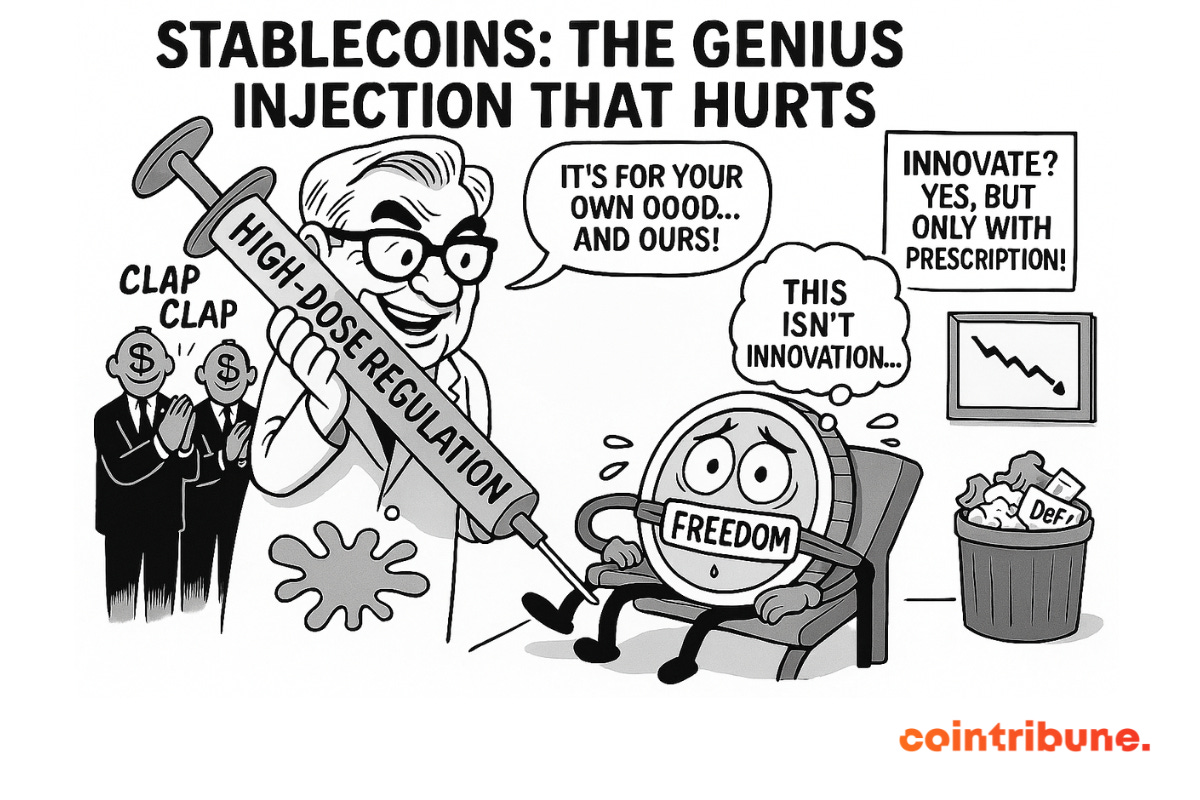

✍️ Cartoon of the day:

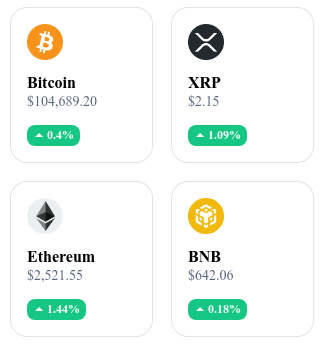

A quick look at the market…

🌡️ Temperature:

☀️ Sunny

24h crypto recap! ⏱

💥 Nobitex loses over $81M in a cyberattack

The Iranian exchange Nobitex suffers a theft of more than $81M orchestrated by a pro-Israeli group.

🌐 China betting on e-CNY to counter the dollar

The People's Bank of China strengthens the use of the digital yuan (e-CNY) via CIPS, UnionPay and mBridge to create a multipolar monetary system.

🏦 JPMorgan launches the JPMD token on Base

JPMorgan launches JPMD, its institutional deposit token on Coinbase's Base blockchain, allowing 24/7 transactions at reduced fees.

🏛️ The US Senate officially approves the GENIUS Act

The Senate adopts the GENIUS Act (68 votes for, 30 against) to regulate stablecoins in the United States with backed reserves and disclosure obligations

🧬 Naoris Protocol offers post-quantum defense for Web3

Naoris Protocol introduces a post-quantum protocol compatible with EVM to secure Web3/Web2 infrastructures against future threats.

Crypto of the day: DeXe (DEXE)

🧠 Technology & Innovation

DeXe is a decentralized finance (DeFi) platform focused on social trading. It allows amateur users to follow, copy and automatically invest according to professional traders’ strategies, all on-chain and without intermediaries. Transparency is total: every transaction is recorded on the Ethereum blockchain. DeXe also incorporates smart staking features, facilitating the launch of customized investment pools.

💰 The role of the DEXE token

The DEXE token plays a central role: it is used to pay fees on the platform, offer rewards to strategy providers and secure the protocol via staking. To encourage active participation, holders can lock their tokens and receive benefits proportional to their commitment.

📊 Market data (as of June 19, 2025)

Current price: $8.55 USD

24-hour change: –1.16 %

Market capitalization: approximately $716.9M USD

CoinMarketCap rank: #87

Circulating supply: 83.7 million DEXE

24-hour trading volume: approximately $8.38M

Inflation, rates and crypto: Powell plays for time, markets groan

While some hoped for an accommodative shift, Jerome Powell preferred to maintain the course, creating a shockwave reaching crypto-assets spheres.

The Fed holds rates, Powell firm on inflation

Yesterday, at its latest meeting, the Federal Reserve decided not to change its interest rates, keeping them in a range of 5.25% to 5.50%. This stance comes amid a slowdown in inflation momentum, but still above the 2% target threshold.

Jerome Powell clearly stated that now is not the time to relax, emphasizing the need to observe more data indicating a solid and lasting decline in inflation. Although markets had anticipated three rate cuts for 2024, the Fed committee now expects only one by the end of the year. This change in trajectory is based on a cautious analysis: the risk of premature easing outweighs that of prolonged high rates.

Impact on markets: cryptos on the front line

The announcement of this status quo was immediately followed by a reaction in financial markets. Bitcoin, in particular, saw its price drop to $66,000 before slightly recovering. This volatility is explained by increased sensitivity of high-risk assets to any interest rate changes. Indeed, in a restrictive monetary policy environment, speculative investments become less attractive.

Digital assets are not the only ones reacting to this inflexibility. US stock indices also slowed down, reflecting the impact of a Fed considered more cautious than expected. This situation leads many investors to reconsider their strategies, especially those counting on quick rate cuts to restart risk-taking.

For crypto market observers, this period could mark a turning point. If uncertainty persists, fluctuations should continue, unless a new macroeconomic factor disrupts forecasts.