Hello Cointribe! 🚀

Today is Thursday, December 14, 2023, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

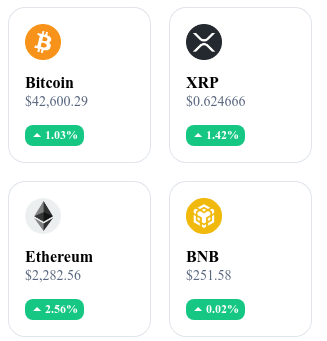

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24-hour crypto summary ! ⏱️

🐋 Bitcoin: Panic in the market, whales seize the treasure!

The recent drop in Bitcoin has created a unique scenario in the cryptocurrency market. The \"whales,\" which means wallets holding more than 1,000 BTC, have taken this opportunity to increase their holdings. This approach contrasts with the panicked reactions of small investors.

Despite efforts for a recovery, Bitcoin struggles to regain stability. However, whale accumulation is generally a positive indicator, often followed by periods of recovery. Their influence on the market, although sometimes subtle, is a key factor in the dynamics of Bitcoin.

The recent accumulation of Bitcoin by whales during the price drop highlights a contracyclical market strategy adopted by savvy investors. This trend indicates underlying confidence in the long-term value of Bitcoin, despite short-term volatility.

💸 Ethereum Fees: The painful truth about unfulfilled promises

Steven Nerayoff, founding advisor of the Ethereum Foundation, revealed that transaction fees on Ethereum were supposed to be minimal, between $0.01 and $0.02. This promise is far from the current reality, where fees can reach hundreds of dollars. This gap between the initially planned fees and the current fees primarily benefits early Ethereum investors and miners who enjoy larger ETH rewards.

To improve its performance, Ethereum has focused on developing \"Layer 2\" solutions. However, fees remain high despite these innovations. Competitors like Solana and Cardano offer significantly lower fees and put pressure on Ethereum. The platform must deliver on its scalability promises to remain relevant in the face of the emergence of these rival networks.

The gap between the initially promised fees for Ethereum and the current reality highlights a fundamental dilemma in blockchain design: the scalability, security, and decentralization trilemma. Ethereum, in seeking to maintain security and decentralization, faces scalability challenges. This situation underscores the complexity of maintaining a balance among these three pillars, which are essential for the long-term viability of any blockchain. It also suggests that Layer 2 solutions or the transition to Ethereum 2.0 are not just improvements but vital necessities for Ethereum's survival in an increasingly competitive market.

🚀 Avalanche (AVAX) makes a spectacular 79% jump in one week

The cryptocurrency Avalanche (AVAX) has experienced a remarkable 79% increase in one week, standing out in an overall slow crypto market. This performance is attributed to strategic partnerships with JPMorgan and Citi, as well as a significant increase in transactions and active addresses on the Avalanche network.

The Total Value Locked (TVL) on the Avalanche network has increased by 82% in three months, and the crypto exchange volume for Avalanche has surged by 2,436%. These indicators suggest that AVAX may be undervalued, with a possible revaluation of its worth in the crypto market on the horizon.

Avalanche's spectacular rise can be seen as an indicator of evolving value criteria in the crypto space. Rather than focusing solely on market capitalization or transaction volume, this increase suggests that investors are beginning to value more nuanced aspects such as energy efficiency, transaction speed, and integration capabilities with traditional financial systems.

🚨 Crypto: OKX falls victim to a $2.7 million hack

The crypto exchange platform OKX has fallen victim to a major hack, resulting in the theft of $2.7 million in digital assets. The attack exploited a private key leak in an outdated smart contract of OKX's DEX. This vulnerability allowed the hackers to access users' wallets and steal their funds.

In response, OKX has apologized and promised to fully reimburse the victims. Emergency measures have been implemented, including revoking hacker access and locking vulnerable accounts. OKX is collaborating with specialists to track down the hacker.

The OKX DEX hack illustrates a critical flaw in DEX security: dependence on smart contracts that, if poorly designed or outdated, can become major points of vulnerability.

Crypto of the day: Kujira (KUJI)

Kujira is a cryptocurrency launched in 2021, distinguished by its innovative approach in the DeFi (Decentralized Finance) ecosystem. It focuses on democratizing access to decentralized financial tools by making investments and trading operations more accessible and less risky for ordinary users. Kujira aims to bridge the gap between traditional investors and the world of DeFi by offering simplified and secure solutions.

The native crypto of Kujira, KUJI, plays a central role in its ecosystem, serving as a utility token for various functions. KUJI has been distributed through token sales and rewards mechanisms for participants in the ecosystem. KUJI holders enjoy benefits such as transaction fee discounts, governance rights within the ecosystem, and access to exclusive financial products. KUJI can be used to participate in liquidity pools, for staking, and for voting on platform governance proposals.

Recent performances

Current Price: €4.87

Increase/Decrease in Percentage: +20.35%

Market Cap: Approximately €595.70 million

Rank on CoinMarketCap: 216

Crypto Analysis of the day: Avalanche (AVAX)

Avalanche has experienced an impressive increase, almost 70% in just the first week of December. That's huge, isn't it? By breaking the psychological threshold of $20, AVAX reached a new annual peak around $40. This is a strong sign that Avalanche has reversed its medium and long-term downward trend. This kind of movement is not just a stroke of luck but the result of market dynamics and growing investor confidence in Avalanche's potential.

From a technical standpoint, the 50-day and 200-day moving averages of AVAX are trending upwards, which is a good sign. However, the Relative Strength Index (RSI) indicates an overbought situation. This could mean that a period of consolidation or correction is likely. Such corrections are normal in the world of cryptocurrencies. Corrections are often necessary for a healthy and sustainable growth.

The liquidations heatmap for AVAX shows key areas to watch. Just above the current price, the $42 zone is worth close attention. Below, the levels of $34, $31, and $25 are important. These zones could trigger buying or selling orders, increasing AVAX's volatility. If AVAX remains above $40, we could expect a continuation of the upward trend, with potential targets around $55 to $60.

In summary, Avalanche shows signs of a strong recovery and significant growth potential. However, as always in the world of cryptocurrencies, stay vigilant and informed. Markets can be unpredictable, and it's crucial to do your own research before investing.