Hello Cointribe! 🚀

Today is Friday, May 30, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you couldn’t miss!

But first…

✍️ Cartoon of the day:

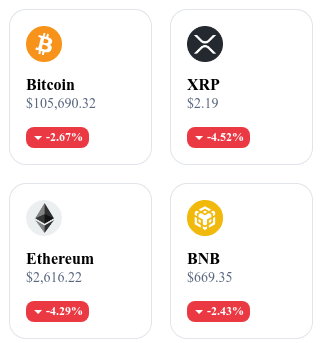

A quick look at the market…

🌡️ Temperature:

⛈️ Stormy

24h crypto recap! ⏱

⚖️ The SEC officially withdraws its complaint against Binance and CZ

On May 29, 2025, the SEC officially filed a motion to end its complaint against Binance, its founder Changpeng Zhao (CZ), and its American subsidiary Binance.US. This decision is part of a series of recent SEC actions aimed at easing pressure on major companies in the cryptocurrency sector.

🌍 Bybit obtains MiCA license and targets 500 million Europeans

Bybit has obtained the MiCA license in Austria, validating its compliance with European regulations. The platform has also established its European headquarters in Vienna, creating more than 100 jobs. This strategic move aims to capture the market of 500 million Europeans.

⚽ Paris Saint-Germain adopts Bitcoin as cash reserve

Paris Saint-Germain becomes the first European football club to integrate Bitcoin into its cash reserves. This decision marks a strategic turning point in the adoption of cryptocurrencies by sports institutions.

🧠 AI browsers want to compete with Google Chrome

New browsers integrating artificial intelligence, such as Neon and Dia, are emerging to compete with Google Chrome. These browsers rely on contextualized intelligent agents to reinvent the browsing experience. Despite their innovation, they still struggle to erode Chrome's dominance.

Crypto of the day: MultiversX (EGLD)

🧠Technology and innovation

MultiversX, formerly known as Elrond, is a layer 1 blockchain designed to offer exceptional scalability, efficiency, and interoperability. It uses a unique architecture based on adaptive sharding and a consensus mechanism called Secure Proof of Stake (SPoS), allowing up to 15,000 transactions per second with minimal fees.

This infrastructure is ideal for decentralized applications (dApps), decentralized financial services (DeFi), NFTs, and the metaverse. MultiversX aims to create a comprehensive digital ecosystem, facilitating the mass adoption of blockchain in various sectors.

💰EGLD Token – Utility and distribution

The EGLD is the native token of MultiversX. It is used for:

Staking: securing the network and participating in block validation.

Paying transaction fees: users pay fees in EGLD to execute transactions on the network.

Governance: holders can vote on protocol upgrade proposals.

The initial distribution of EGLD was carried out through private and public sales, with particular attention to decentralization and community engagement.

📊 Market data (as of May 30, 2025)

Current price: $16.16 USD

24-hour change: -$1.74 (-9.72%)

Market capitalization: approximately 455 million dollars

Rank on CoinMarketCap: #121

Circulating supply: 28.27 million EGLD

24-hour trading volume: approximately 26 million dollars

BlackRock legitimizes Bitcoin as a new store of value: The end of gold’s monopoly?

The paradigm of safe-haven assets is undergoing redefinition. BlackRock — the world's largest asset manager with over $10 trillion under management — has officially confirmed the integration of Bitcoin as a "strategic alternative to gold" in its model portfolios.

The digital gold thesis for Bitcoin now enters its phase of institutional validation.

Automatic allocation: a discreet yet decisive revolution

Unlike classic integrations through dedicated mandates or derivative products, BlackRock has crossed a threshold: BTC is now allocated by default in portfolio models offered to its institutional clients. These portfolios include Bitcoin at 1 to 2%, without requiring specific opt-in.

In other words, the asset is systematically included in the construction of a diversified portfolio on par with gold, sovereign bonds, or sector ETFs.

This evolution confirms Larry Fink's vision, CEO of BlackRock, who sees BTC as an apolitical asset, resistant to inflation and particularly suited to monetary disintermediation cycles.

Bitcoin versus gold: a complementarity or a replacement in progress?

Although Bitcoin does not have gold’s historical longevity, it already surpasses it in several key characteristics:

Absolute portability (100% digital),

Infinite divisibility,

Blockchain transparency and real-time auditability,

Algorithmic scarcity: supply capped at 21 million.

Gold remains a tangible asset, universally recognized and historically resilient in times of crisis. But BlackRock is not mistaken: in a world where supply chains are digitalized and financial flows disintermediated, Bitcoin offers a form of gold 2.0, more fluid, more agile, and more suited to the demands of the new generations of investors.

The official recognition of Bitcoin as an institutional alternative to gold by BlackRock marks a major turning point in the adoption trajectory of the digital asset.

The issue is no longer about debating BTC’s legitimacy, but about recognizing its transformation into a strategic asset, legitimized by the largest global financial institutions.

While gold maintains its place in the classic monetary architecture, Bitcoin now becomes the digital counterweight — more than a challenger: a new standard.