⚠️ Pump.fun accused of fraud: Imminent fall of the memecoin giant?

Welcome to the Daily Tribune of Saturday, January 18, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Saturday, January 18, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

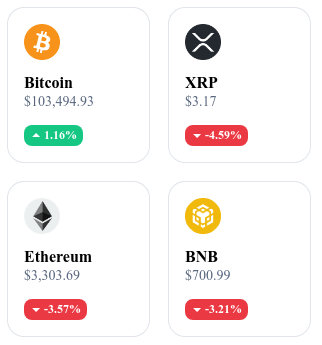

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

🚀 Nasdaq paves the way for a Litecoin ETF in 2025

Nasdaq has filed a request with the SEC to launch a Litecoin ETF in collaboration with Canary Capital. This ETF, which would hold physical Litecoins through custodians like Coinbase Custody and BitGo, aims to provide direct exposure to this cryptocurrency, known for its speed and low transaction costs. If approved, this would be the first altcoin ETF of the year, marking a major milestone in the integration of cryptos into financial markets.

Although Litecoin development has been stagnant in recent years, its recognition as a commodity by the SEC facilitates this initiative. Analysts predict that this ETF could boost the liquidity and institutional adoption of Litecoin while positively influencing its price and market sentiment. 🔗 Read the full article here.

🌟 Aave ventures into Bitcoin mining with record ambition

Aave is exploring a groundbreaking project: integrating Bitcoin mining to boost its revenues. In partnership with Blockware Solutions, the DeFi protocol proposes utilizing mining equipment to generate an estimated net annual yield of 33.03%. The goal also includes integrating the GHO stablecoin into the Bitcoin network, allowing its adoption by miners and clients through GHO transactions.

Although promising, this initiative is divisive. The community questions the profitability and structural challenges, as the mining sector faces high costs and financial pressures. The project must convince Aave token holders, who will vote to determine its future. 🔗 Read the full article here.

🌍 Bitcoin DeFi explodes with 2,000% growth in 2024

Decentralized finance on Bitcoin (BTCFi) had an exceptional year in 2024, with a TVL skyrocketing from 307 million to 6.5 billion dollars. This success is largely attributed to the launch of Babylon, a sector leader, which holds over 80% of the TVL. Babylon revolutionized the ecosystem by introducing native Bitcoin staking and leveraging the Runes protocol, a fungible token standard for Bitcoin.

These innovations have paved the way for increased institutional adoption, propelled by the approval of spot Bitcoin ETFs. BlackRock dominates this market, while the rise of BTC beyond 100,000 dollars and political developments have reinforced investor confidence. This virtuous circle has solidified Bitcoin as the cornerstone of a secure and robust DeFi. 🔗 Read the full article here.

🚨 Pump.fun in turmoil!

Pump.fun, a major player in the memecoin universe based on Solana, is facing serious allegations of fraud and dubious practices. The platform is suspected of orchestrating deliberate pump-and-dump schemes, exploiting vulnerable groups through aggressive marketing campaigns, and allowing the creation of tokens associated with offensive and illegal content. The situation is worsening with the ban on its activities in the UK by the FCA and accusations of violations of the Howey Test, which could classify it as an illegal securities distributor.

If Pump.fun collapses, it could trigger massive delistings and damage the image of Solana and memecoins. The anonymous creators of the platform, accused of having amassed millions while ignoring legal and ethical standards, find themselves at the center of this regulatory storm. 🔗 Read the full article here.

Crypto of the day: Jupiter (JUP)

Jupiter is a DEX aggregator (decentralized exchanges) built on the Solana blockchain, offering optimized solutions for token swaps with reduced fees and low slippage. It stands out for advanced features such as limit orders, dollar-cost averaging (DCA), and a bridge aggregator, allowing seamless inter-chain transactions.

The native token JUP is primarily used to access premium services, support protocol governance, and incentivize the use of network features. Initially distributed through crowdfunding mechanisms and community incentives, JUP offers benefits such as transaction fee discounts and an active role in governance while allowing its use as a trading asset.

Recent performance

Current price: €0.99

24h change: +20.67%

Market capitalization: €1.34 billion

Rank on CoinMarketCap: #82

XRP: SEC reignites its offensive on Ripple

The SEC has filed an appeal against the July 2023 decision that concluded that programmatic sales of XRP via exchanges were not securities transactions. According to the agency, Ripple had created an expectation of profit among investors through its active promotion of XRP, which would classify it as a security under the Howey test. This new appeal is based on the argument that all XRP sales, whether institutional or retail, must be subject to strict regulation as securities.

For its part, Ripple maintains that XRP is a digital currency and not a financial security. The company argues that XRP sales do not meet the criteria for an investment contract. Stuart Alderoty, Ripple's legal director, referred to the SEC's initiative as a rehashed and unsuccessful attempt of already dismissed arguments. He is confident in the rejection of this appeal, especially since the anticipated departure of Gary Gensler, SEC chairman, could weaken the agency's position.

The stakes of this case go beyond Ripple, as a victory for the SEC could set a precedent for the classification of cryptos as securities, which would influence the entire industry. However, the arrival of a potentially more cryptocurrency-friendly US administration could work in Ripple's favor, bolstering hopes for a definitive resolution. The outcome of this legal battle could redefine the foundations of digital asset regulation in the United States.

In any case, for now, XRP seems unflappable and continues to break the scales! Hopefully it lasts….