📈 Record Surge in Bitcoin Open Interest: Traders Bet Big on the Rebound

Welcome to the Daily for Wednesday, December 24, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, December 24, 2025, and just like every day from Tuesday to Saturday, we bring you a recap of the top news from the past 24 hours!

But first…

✍️ Cartoon of the day:

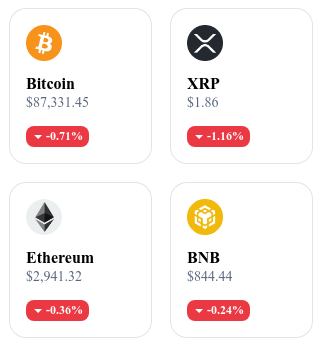

A quick look at the market…

🌡 Weather:

Rainy 🌧️

24h crypto recap! ⏱

📚 Read2Earn gets a fresh new look

Read2Earn is back in a redesigned version.

Same principle: you read, you participate, you earn.

But now everything is clearer, faster and more motivating: a modernized interface, better-structured missions, simplified points tracking and a truly more fun experience.

If you liked the first version, you’ll love coming back.

And if you took a break, this is the perfect moment to jump in again — your rewards are waiting for you.

📈 BlackRock’s IBIT ETF beats expectations despite Bitcoin drop

BlackRock’s iShares Bitcoin Trust (IBIT) spot ETF posted strong growth in Q3 2025, with Harvard University’s endowment holding 6,813,612 shares—around $443 million. That’s a +257% increase from the previous quarter. IBIT now makes up over 20% of Harvard’s U.S.-listed equities portfolio.

👉 Read the full article

🌍 IMF nears deal on selling El Salvador’s “Chivo” Bitcoin holdings, country sticks with BTC strategy

The International Monetary Fund is in advanced talks with El Salvador for a $1.4 billion loan, which includes plans to sell the country’s public Bitcoin wallet, Chivo. The agreement would limit government involvement in managing Chivo and its institutional BTC use. Still, El Salvador continues to acquire BTC through its Bitcoin Office.

👉 Read the full article

📉 U.S. economy beats forecasts, but Peter Schiff flags worrying signs

U.S. GDP hit 4.3% in the latest quarter—above the 3.3% forecast—and the ISM index stayed above 55, indicating strong activity. However, Peter Schiff questions the sustainability, citing falling trust in the dollar and rising gold and silver prices as signs of flight to safety. He also points to rising debt and growing foreign capital reliance as threats to long-term stability.

👉 Read the full article

💳 Kraken launches “Krak Card”, a crypto Mastercard for European users

Kraken unveils Krak Card, a payment card developed with Mastercard for European residents. It allows crypto-to-fiat conversion at the point of sale. Kraken says the card aims to simplify everyday crypto use through a global payment network.

👉 Read the full article

Crypto of the Day: NEAR Protocol (NEAR)

🧠 Innovation & Added Value

NEAR Protocol is a layer-one blockchain designed to solve scalability issues faced by existing networks like Ethereum. It stands out for its dynamic sharding, allowing horizontal scaling without compromising security or decentralization.

NEAR focuses on developer experience with advanced tooling, smart contract compatibility, and high execution speed. Its goal is to make blockchain accessible to the masses by simplifying the use, integration, and management of decentralized applications (dApps).

💰 The Token

The NEAR token secures the network through staking and is used to pay transaction fees. It also plays a governance role, enabling holders to vote on key network development decisions.

The total supply is capped at 1.28 billion NEAR. It’s widely used in smart contracts to ensure seamless, transparent interactions. Its central role in governance and network growth drives strong demand.

📊 Real-Time Performance (CMC)

💵 Current Price: €1.23

📉 24h Change: –3.66%

💰 Market Cap: €1.58B

🏅 CoinMarketCap Rank: #38

🪙 Circulating Supply: 1.28B NEAR

📊 24h Trading Volume: €108.44M

Bitcoin Open Interest Surges: A New Bullish Phase Ahead?

Open interest on Bitcoin perpetual contracts has reached new highs. According to data from Glassnode, it now exceeds 310,000 BTC—levels not seen since 2021. This surge signals renewed activity in the derivatives market and has reignited speculation about a potential trend reversal for Bitcoin.

Bitcoin Perpetual Contracts in Full Swing

Open interest reflects the total number of active positions on futures and perpetual contracts. A rise in this metric means more traders are allocating capital to the market, often anticipating significant price moves.

Glassnode reports that this increase coincides with a rise in the funding rate, which went from 0.04% to 0.09%. This rate, paid by long positions to short ones, generally reflects the market’s dominant sentiment. When it climbs, it indicates most traders expect Bitcoin’s price to rise.

Between Euphoria and Caution: A Market on Edge

However, rising open interest does not guarantee a lasting bull run. It can also point to excessive leverage. Historically, such peaks often preceded sharp corrections triggered by mass liquidations of long positions when prices pulled back.

Upcoming options expiries may amplify this tension. A heavy concentration of bets near key price levels increases the risk of sudden volatility. In such situations, the market can flip quickly—turning bullish momentum into a sharp corrective move.

Crossing the 310,000 BTC threshold marks a technical milestone for Bitcoin. It could signal a return of bullish speculation after months of cautious sentiment.