Regulated Stablecoins and Challenges for Ethereum 🔄

Welcome to the Daily Tribune Wednesday, January 24, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, January 24, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

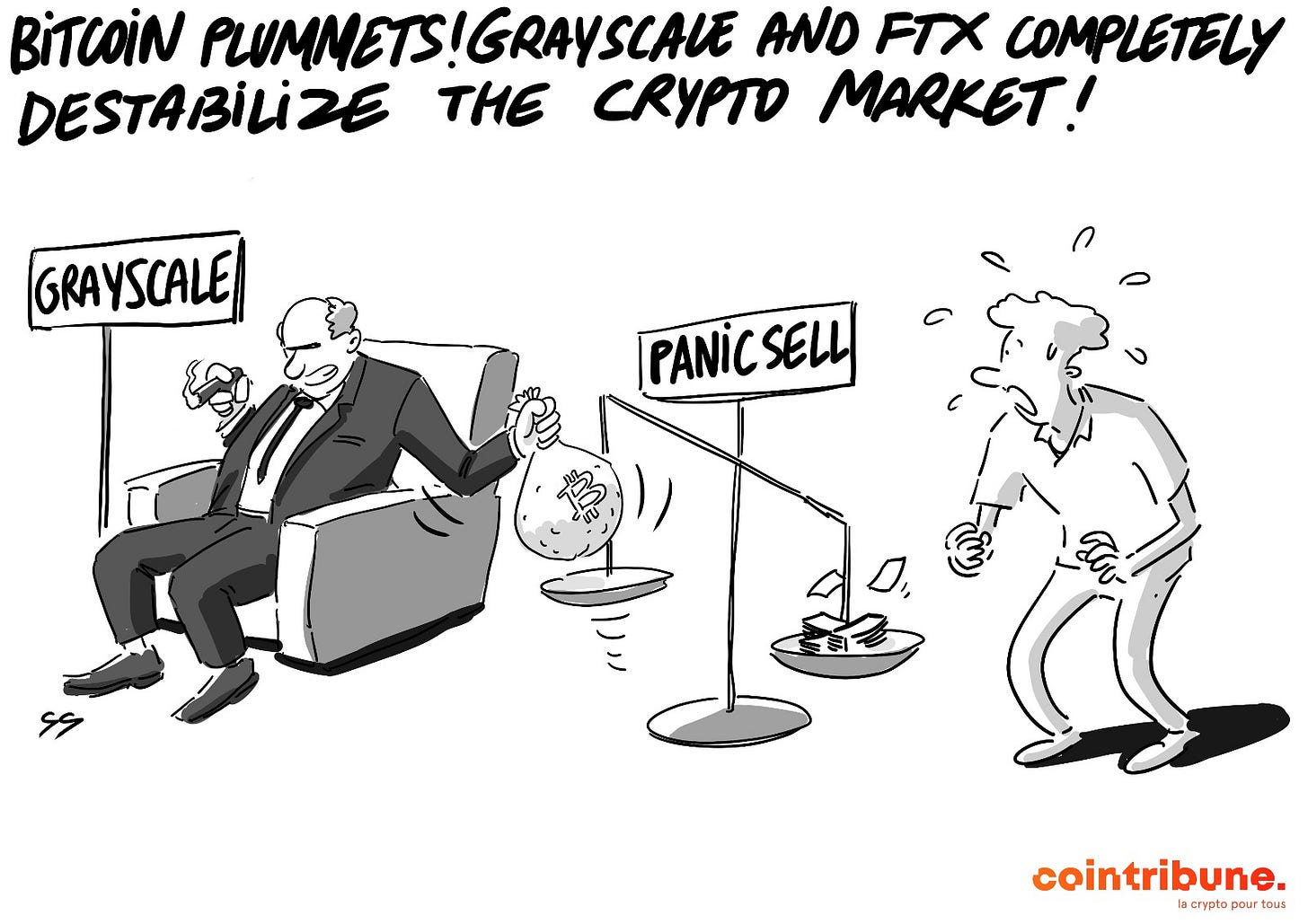

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24-hour crypto summary ! ⏱️

📉 Bitcoin (BTC): The drop may just be the beginning

Bitcoin is going through a difficult period, with a noticeable downward trend since the beginning of the year. After flirting with $47,000, its price has dropped and is currently around $40,000. This decline has raised concerns among investors and analysts, with some fearing it may be just the beginning of a darker period for the leading cryptocurrency. Figures like Jim Cramer from CNBC and Arthur Hayes have expressed bearish predictions, fueling speculation of a deeper drop.

The current situation of Bitcoin is reminiscent of its historical volatility. Recent market movements have highlighted a critical support zone around $41,000, which has been broken, raising fears of a drop towards $38,000. Options data shows increased interest in call options, but caution is still advised due to uncertainties related to expiration dates and a potential overbought phase. The future price movement of Bitcoin should be closely monitored, despite some analyst's belief that the situation could reverse.

The break of a critical support zone and the increased interest in call options indicate a period of uncertainty and potential volatility for the leading cryptocurrency.

🚀 Crypto: The first regulated stablecoin is coming

The cryptocurrency industry is about to experience a revolution with the imminent arrival of the first regulated stablecoin in the United States. Figure Technologies Inc., under the leadership of Mike Cagney, is preparing to launch this innovative stablecoin. This ambitious project aims to introduce a new type of digital asset that combines the stability of fixed-income securities with the flexibility and efficiency of crypto. This initiative could offer a credible alternative to traditional stablecoins, which are often surrounded by regulatory uncertainties.

Figure Technologies Inc. has taken a significant step by filing an S-1 form with the SEC to register a stable interest-bearing crypto as \"certificates of nominal value.\" If approved, this bold move could transform the cryptocurrency landscape, offering investors a haven of stability and security. The complexity of this project lies in balancing innovation and regulatory compliance, a major challenge in the cryptocurrency sector.

Once launched, this stablecoin could serve as a bridge between traditional fiat currencies and the world of cryptocurrencies, offering stability and regulatory compliance that are lacking in many current stablecoins.

🌐 Republike: The last chance to join the innovative social network

Republike, an innovative social network, stands out for its Pay-to-Own model and is about to reach a major milestone. The platform, which has already attracted attention since its alpha release, invites enthusiasts to join the adventure before its public opening on February 22. Republike promises a high-quality user experience with healthy and authentic exchanges and a different online interaction.

Users have the opportunity to financially engage in the Republike ecosystem through different statuses: Citizen, Father, and Consul, each offering proportional benefits based on engagement. These statuses allow acquiring $AURE tokens, symbolizing active participation in the ecosystem and influencing its future development. This registration period is a unique opportunity for those looking to invest in the future of social networks and participate in the emergence of a new way to interact online.

Republike challenges the traditional model of social networks by introducing a reward system based on the blockchain, which could redefine how users interact and are valued on social media platforms. This model could incentivize greater transparency and fairness in the distribution of user-generated content's revenues, questioning the centralized power structures of current social media giants.

📉 Ethereum in turmoil: Intriguing financial movements and decline in ETH price

The Ethereum Foundation recently sold 700 ETH for $1.7 million, a move that raised questions and exerted downward pressure on the market. This action has generated speculation about the intentions behind this fund transfer, particularly if it is related to financing needs for Ethereum-related projects. In a context of cryptocurrency volatility, such actions can influence investor confidence and market sentiment.

Meanwhile, the price of ETH has experienced a significant decline, losing its critical support at $2,400 and trading at $2,235.13. Investors and observers are trying to understand the implications of this development for the future of Ethereum crypto.

The recent actions of the Ethereum Foundation, including the sale of 700 ETH, could indicate a proactive risk management strategy or financing for innovative projects within the Ethereum ecosystem.

Coin of the day: Sui (SUI)

Sui (SUI) is a cryptocurrency operating on the Sui Network platform, an innovative blockchain distinguished by its speed and scalability. This blockchain uses a unique consensus model and offers a robust infrastructure for the development of decentralized applications (dApps).

The native crypto SUI plays a central role in the Sui ecosystem, serving as a utility token for transactions and network fees. It has been distributed mainly through funding events and reward programs for early users and contributors. SUI holders benefit from various advantages, including governance rights in the ecosystem and the opportunity to participate in key decisions. The crypto can be used for transactions, payments in decentralized applications, and as an investment asset.

Recent Performance

Current price: $1.255955176205576 USD (approximately €1.16)

Percentage increase/decrease: +16.54% (1-day increase)

Market capitalization: $1,382,740,352.85 USD (approximately €1,275,000,000)

Rank on CoinMarketCap: #51

Crypto analysis of the day: Ethereum (ETH)

Like Bitcoin, Ethereum has also experienced a corrective phase, falling from its peak at $2,700 to a critical level around $2,150. What is interesting here is that despite this decline, the medium and long-term trend remains bullish. But beware, a break below this support could change the situation in the short term. Currently, ETH is trading around $2,200, but it has fallen below its 50-day moving average, which could indicate a trend reversal. For investors, this is a key moment to observe and perhaps reconsider their strategies.

Ethereum's oscillators are currently below the midline, suggesting an oversold condition. This can be interpreted in two ways: either Ethereum is undervalued, presenting a buying opportunity, or it is a sign that the momentum is turning bearish. There is also a divergence between the price of Ethereum and its oscillators, reinforcing the hypothesis of a possible reversal. It is a delicate moment for traders: should they seize the opportunity or remain cautious?

Open interest for Ethereum has decreased by nearly 15%, which represents a significant withdrawal on ETH/USDT perpetual contracts. But what is fascinating is that the open interest appears to be more stable than the ETH price itself. This could mean that market entry and exit are not extreme, or that new traders are offsetting those who are leaving. The liquidation heatmap shows that Ethereum has reached a critical zone between $2,200 and $2,150. If the price does not hold above this level, the next significant liquidation zone is around $2,000.

In conclusion, Ethereum's current movements require careful observation. The key levels to watch are $2,200 - $2,100 for a potential bullish trend and $2,000 - $1,900 for a bearish trend. Remember, these analyses are based on technical criteria, but the crypto market can evolve quickly based on other factors. Stay vigilant and informed!