🌊 Ripple launches a pioneering project, 💎 Ethereum and Cardano captivate institutional investors!

Welcome to the Daily Tribune Thursday, February 15, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, February 15, 2024, and like every day from Tuesday to Saturday, we summarize the last 24 hours of news that you shouldn't miss!

But first…

✍️ Cartoon of the day:

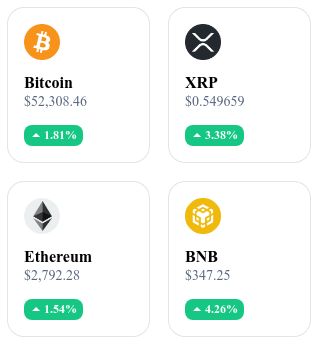

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24-hour crypto summary ! ⏱️

🚀 Revolution in crypto buying and storage with Ledger and Coinbase 🚀

Ledger, the giant of secure cryptocurrency wallets, has partnered with Coinbase, one of the leading cryptocurrency exchange platforms, to transform the experience of buying and storing cryptocurrencies. Announced on February 13, 2024, this collaboration aims to integrate Coinbase Pay into the Ledger Live interface, allowing users to buy cryptocurrencies directly on Coinbase and instantly transfer them to their Ledger wallet. This initiative promises to significantly simplify the process of buying and transferring cryptocurrencies while strengthening security for users.

Before this integration, transferring purchased cryptocurrencies from Coinbase to a Ledger wallet required several intermediate steps, increasing the risk of errors and theft. Now, thanks to this collaboration, users can make cryptocurrency purchases via Coinbase Pay and receive them directly on their Ledger device via Ledger Live, eliminating unnecessary steps and associated risks.

The alliance between Ledger and Coinbase goes beyond the mere convenience of buying and storing cryptocurrencies; it illustrates a crucial evolution towards securing the crypto ecosystem for the average user. This integration could serve as a catalyst for a new wave of security-focused innovations and user experiences, prompting industry players to rethink the way crypto services are designed and delivered.

🔥 Bitcoin surges: Racing towards historical highs 🔥

Bitcoin (BTC) continues to fascinate and captivate global attention, recording a remarkable surge reminiscent of science fiction stories. The year 2024 stands out with a combination of favorable factors for Bitcoin, combining sharp technical analysis, speculative enthusiasm among investors, and expanding institutional adoption. These elements contribute to a scenario where Bitcoin reaches unprecedented price levels, evoking the possibility of reaching and even surpassing its historical record. On February 14, Bitcoin crossed the $51,000 threshold, approaching the legendary $69,000 target, while leading the crypto ecosystem towards a total capitalization close to $2 trillion.

This period of growth is marked by the massive entry of Bitcoin exchange-traded funds (ETFs), particularly those managed by giants like BlackRock, which have accumulated over $3 billion in investments in record time. This institutional adoption signals increased confidence in Bitcoin as a long-term investment asset, with over $22 billion in open interest in Bitcoin futures contracts. All of this indicates not only a strong belief in the continuation of the Bitcoin rally, but also a preparedness by investors to embrace significant volatility to achieve historic gains.

The alignment of this surge with Bitcoin halving cycles suggests that we could be at the beginning of a major rally preceding the next halving.

🌊 Ripple embarks on an ambitious crypto custody project 🌊

Ripple, the company behind the XRP cryptocurrency, is not discouraged by its current legal challenges and is looking to expand its horizons by venturing into the field of crypto custody. This strategic initiative aims to diversify the services offered by Ripple beyond its traditional payment solutions. Ripple CEO Brad Garlinghouse recently announced the company's expansion into digital asset custody, highlighting a significant focus on improving its regulatory status. This move comes at a time when Ripple is facing a legal battle with the United States Securities and Exchange Commission (SEC), but it demonstrates a determination to continue its development despite these obstacles.

By aiming to acquire Standard Custody and Trust Company, Ripple hopes to obtain key regulatory licenses, including the highly sought-after New York trust charter. These licenses would allow Ripple to offer a comprehensive range of crypto services, including custody and settlement of digital assets, and provide complete blockchain solutions to financial institutions. Ripple President Monica Long emphasized the importance of these licenses in offering holistic solutions to financial institutions, combining technology and compliance. The planned acquisition of Standard Custody, with its New York trust license obtained in May 2021, is seen as a means for Ripple to strengthen its regulatory framework and expand its presence globally while navigating regulatory complexities.

Ripple's move into crypto custody amidst legal battles can be seen as a strategic maneuver to solidify its legitimacy and compliance amid an uncertain regulatory framework. Ripple's acquisition of Standard Custody and Trust Company could be an attempt to position itself as a bridge between the traditional financial world and the crypto space by offering services that meet both regulatory requirements and industry innovation needs.

🌟 Ethereum and Cardano: The new darlings of institutional investors 🌟

While Bitcoin has long dominated institutional investors' attention, particularly with the recent enthusiasm for Bitcoin ETFs, Ethereum (ETH) and Cardano (ADA) are starting to stand out as the new favorites in the cryptocurrency space. These altcoins, backed by strong fundamentals and high potential for gains, are now attracting substantial capital, marking a turning point in diversifying institutional investment portfolios. A recent study by CoinShares reveals that in 2024 alone, Ethereum recorded inflows of $16 million, while Cardano attracted $6 million. These figures, though modest compared to investments in Bitcoin, clearly indicate an emerging trend towards altcoins.

The growing interest in Ethereum and Cardano can be attributed to several factors. Firstly, their lower valuation compared to Bitcoin offers greater long-term potential for growth. Secondly, their potential applications in areas such as decentralized finance (DeFi) and smart contracts present significant potential for future adoption. However, this enthusiasm for altcoins is not without risks. The increased volatility of these assets, as well as the technical and regulatory challenges they face, such as Ethereum's scalability issues and Cardano's slow development of the DeFi ecosystem, highlight the importance of rigorous fundamental analysis before any investment. Despite these challenges, institutional interest in Ethereum and Cardano reflects the constant search for attractive returns and a willingness to explore opportunities beyond Bitcoin in the cryptocurrency universe.

The growing interest in Ethereum and Cardano by institutional investors may signal a strategic diversification within the cryptocurrency space, where the pursuit of value extends beyond mere price appreciation to include functionality and technological impact.

Crypto of the day: Dymension (DYM)

Dymension presents itself as a major innovation in the blockchain space, focusing on the concept of modular blockchain and Rollups-as-a-Service (RaaS). This approach aims to address thorny issues such as scalability, transaction speed, and flexibility, offering significant added value compared to traditional blockchains. By adopting a modular structure, Dymension allows for increased customization and scalability, making blockchain technology more accessible and efficient for various use cases.

The native cryptocurrency DYM plays a central role in this ecosystem, facilitating not only transactions and interactions within the platform but also serving as a key to access advanced services such as custom Rollups. The distribution of DYM has been designed to encourage broad adoption and active community participation, offering benefits such as rewards for network participation, governance rights, and incentives for developers. DYM holders thus benefit from direct involvement in the evolution of the platform, with the ability to use their tokens to access specific services or trade them on various platforms.

Recent performance

Current price: $8.14 (approximately €7.57)

Percentage increase/decrease: +0.09% in 1 day

Market capitalization: $1,187,924,981 (approximately €1,103,858,000)

CoinMarketCap rank: 63

Crypto analysis of the day: Polygon (MATIC)

Polygon (MATIC) has recently experienced notable volatility, marked by a significant rebound from its critical support at $0.50. This price action indicates not only resilience in the face of downward pressure but also potential for a bullish recovery, highlighting the importance of closely monitoring support and resistance levels to anticipate future movements. The recent rebound from the $0.70 support and the move towards the $1 threshold indicate positive momentum, although this ascent has been temporarily interrupted, reminding investors of the unpredictable nature of the cryptocurrency market.

Technical analysis reveals that MATIC is in a potentially bullish phase, supported by its positioning above the 50-day moving average and the rebound from the 200-day moving average. These indicators suggest a short-term bullish trend, although the flatness of the moving averages also indicates a period of uncertainty and consolidation. Oscillators, having bounced above the mid-level, reinforce the assumption of a resumption of bullish momentum. However, investors must remain cautious as markets are subject to rapid changes, influenced by external factors and investor psychology.

In the derivatives front, the increase in open interest in MATIC/USDT perpetual contracts, coupled with a slightly positive funding rate, indicates increasing speculative interest oriented towards buying. However, the presence of liquidations mostly on the buyers' side could signal excessive optimism, requiring increased vigilance to avoid potential market traps. Identified support and resistance zones, particularly around $0.81 and between $0.95 - $0.97, will be crucial in determining MATIC's future trajectory. A breakthrough or rejection at these levels could trigger increased volatility, offering strategic opportunities for astute investors.

In conclusion, although Polygon (MATIC) shows signs of a bullish recovery, the current market environment demands thorough analysis and a flexible investment strategy.