📉 Ripple shines, Hamster Kombat shows resilience!

Welcome to the Daily Tribune of Saturday, November 16, 2024 ☕️

Hello Cointribe! 🚀

Today, it is Saturday, November 16, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🚨 End of crypto freedom? The EU tightens the screws with strict measures.

The European Union imposes new drastic directives on crypto service providers to strengthen financial security. At the behest of the European Banking Authority (EBA), payment service providers (PSPs) and crypto-asset service providers (CASPs) must now implement strict controls to monitor all fund and cryptocurrency transfers.

These measures aim to prevent money laundering and terrorist financing, but raise concerns about the impact on decentralization and financial freedom, fundamental values of Bitcoin and cryptocurrencies. Sector players, having until December 30, 2025, to comply, will need to balance adherence to the new rules with the preservation of the essence of cryptocurrencies, risking Europe losing its appeal to investors.

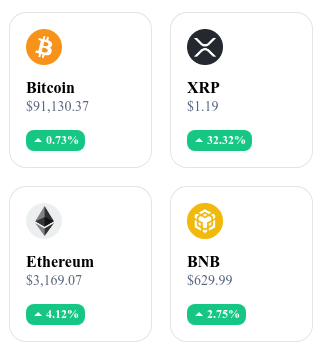

📉 Bitcoin, Ethereum, and Solana collapse, but Ripple surprises!

The crypto market shows signs of weakness, with Bitcoin down 2%, reaching even $89,184, and Ethereum falling 4% to trade at $3,098, although they rebounded afterwards. Solana follows this trend with a drop of 3%, to $213. Meanwhile, Ripple (XRP) stands out with a spectacular rise of 15%, reaching $0.81, while Hedera (HBAR) records a 13% increase.

These fluctuations highlight the pressure on major players, exacerbated by the transfer of 25,000 BTC by miners to exchange platforms. This period of instability offers opportunities for experienced traders but underscores the uncertainty dominating the crypto ecosystem, requiring heightened vigilance.

🤝 Chainlink joins Trump’s crypto project: a major step for DeFi.

World Liberty Financial, the crypto project initiated by Donald Trump, teams up with Chainlink to integrate its price oracles on Ethereum. This strategic collaboration, based on the Aave v3 protocol, allows the platform to access reliable, real-time data, essential for decentralized financial services.

By choosing Chainlink, recognized for its leadership in oracles with 46% of the total value guaranteed in October 2024, the project bets on a technology that has already proven itself with giants like SWIFT. This integration symbolizes a step towards increased convergence between traditional finance and DeFi, and strengthens the institutional attractiveness of blockchain solutions.

🐹 Hamster Kombat: Resilience and record volumes despite the turmoil.

Despite a massive drop of 86% in active users since August, Hamster Kombat maintains its place thanks to an impressive daily trading volume of $5.3 billion and a loyal community. With 11 million holders and a resurgence of interest, the price of the HMSTR token rose from $0.0022 to $0.0044 on November 14.

This positive dynamic is supported by 73% of favorable sentiments expressed by voters on CoinMarketCap. Although the game has lost its peak of 300 million active users, its creators are betting on innovations to revive interest.

The crypto of the day: Stellar (XLM)

Stellar is a blockchain designed to connect global financial systems through fast, low-cost, and interoperable transactions. Its added value lies in its ability to simplify cross-border payments and integrate financial services for unbanked populations.

The native crypto, XLM (Lumens), plays a key role in facilitating transactions and acting as an intermediary to reduce conversion costs. Initially, Lumens were distributed through partnerships, donations, and educational programs to promote adoption. Holders benefit from fast and secure usage in transactions, as well as low network fees. XLM is also used to access decentralized financial services and to guarantee liquidity.

Recent performances

Current price: €0.2081

Increase (24h): +49.6%

Market capitalization: €6.209 billion

Rank on CoinMarketCap: 27

Bitcoin: Is the rise to $100,000 imminent?

Bitcoin's ascent to $100,000 seems increasingly likely due to converging geopolitical and financial factors.

The new American administration, composed of several Bitcoin supporters, plans favorable initiatives, including the creation of a strategic reserve of BTC, equivalent to Fort Knox's gold. Influential figures like Senator Cynthia Lummis advocate for massive Bitcoin adoption, even proposing to replace gold reserves with BTC, thereby enhancing the appeal of this unique and limited digital asset.

Institutional support is also exploding, with finance giants like Goldman Sachs doubling their investments in Bitcoin. Meanwhile, Bitcoin ETFs, like BlackRock's, are breaking adoption records and consolidating the asset's position as a digital safe haven.

Companies like MicroStrategy continue to massively accumulate BTC, highlighting a widespread shift of institutional treasuries towards this currency.

Finally, some U.S. states are even considering allocating a portion of their public funds to Bitcoin, confirming a movement that could propel the price beyond $100,000 in the coming months.

🔗 Read the full analysis here.