🌍 Russia allows Bitcoin for trade: The beginning of a new era?

Welcome to the Daily Tribune Wednesday, July 31, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, July 31, 2024 and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

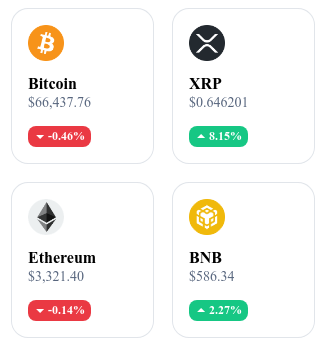

A quick look at the market…

🌡️ Temperature:

Partly cloudy ⛅

24h crypto recap! ⏱

🚀 Bitcoin triumphs, Ethereum falls

Crypto ETFs have different dynamics. While Bitcoin ETFs recorded a massive inflow of $124.1 million, attracting investors due to a drop in BTC to $66,000, Ethereum ETFs experienced significant outflows, with a loss of $98.3 million in one day. Notably, BlackRock's IBIT ETF attracted $205.6 million, solidifying its leadership position with a total of $19.9 billion. On the other hand, Grayscale's ETHE saw $210 million evaporate, increasing total outflows to $1.7 billion. Some notable exceptions include BlackRock's ETHA ETF, which managed to attract $58.2 million. 🔗 Read the full article here.

⚖️ SEC revises complaint against Binance, Solana, and other threatened tokens

The SEC has amended its complaint against Binance, raising questions about the legal status of several crypto-assets, including Solana (SOL) and Polygon (MATIC). In a filing on July 30, 2024, the SEC redefined "third-party crypto asset securities" to avoid premature judgments on these tokens, which had been accused of being unregistered securities. The tokens in question include SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI. This amendment comes after a controversial court decision and aims to clarify the SEC's intentions while streamlining the ongoing legal process. Binance's lawyers have expressed the need to see the revised version of the complaint before continuing discussions. This case could have significant implications for the entire crypto industry, establishing precedents for the regulation of platforms and digital assets. 🔗 Read the full article here.

💨 Gas fee decrease: Ethereum takes off

Ethereum has recently benefited from a historic decrease in gas fees, reaching an average of 4 Gwei, which propelled the price of ETH to $3,309 with a 1.11% increase in 24 hours. This reduction in transaction costs is mainly due to the adoption of layer 2 scaling solutions and the introduction of blob transactions via the Dencun hard fork in March. The decrease in fees has led to a reduction in the amount of ETH burned, with less than 200 ETH burned, making Ethereum's supply inflationary at a rate of 0.67%. This situation promotes increased accessibility to the network for end users while raising questions about supply management and future ETH price pressure. 🔗 Read the full article here.

🇷🇺 Bitcoin now legal for international trade in Russia

Russia has taken a historic step by legalizing the use of Bitcoin for international payments, a decision ratified by the State Duma and effective from September 1, 2024. Faced with severe international sanctions, this measure allows Russia to bypass the limitations imposed by its exclusion from the SWIFT network for the past two years. Now, Bitcoin is recognized as a foreign currency, offering a strategic alternative for Russian companies to continue their international transactions. This change also marks a notable evolution of the Central Bank of Russia, which is moving towards the use of cryptocurrencies despite its previous more conservative positions. In parallel, Russia is working on the development of a digital ruble, a digital version of its national currency controlled by the state, aimed at enhancing the security and traceability of transactions. 🔗 Read the full article here.

Crypto of the day: XRP (XRP)

XRP is the native cryptocurrency of the Ripple blockchain, designed to offer fast and low-cost transactions on a global scale. Ripple's main innovation lies in its ability to facilitate near-instant cross-border payments through a decentralized but uniquely centralized network optimized for financial institutions. The added value of XRP lies in its transaction speed and low fees compared to other cryptocurrencies like Bitcoin.

The crypto has been primarily distributed through issuances by the Ripple company, with a significant portion of the total supply still held by the company. XRP holders benefit from fast transactions, low cost, and high liquidity, enabling usage in global payments, speculation, or as a reserve asset.

Recent Performance

Current price: €0.6459

Percentage increase/decrease: +7.88% (rise over 1 day)

Market capitalization: €36,233,766,738

Rank on CoinMarketCap: 6

Bitcoin falls to $65,000 again: What is the queen of cryptos up to?

Bitcoin has recently experienced a significant drop, falling to $65,000 after a $2 billion BTC transfer by the US government. This massive movement of nearly 28,000 BTC, initially seized by the Department of Justice in 2020, was distributed to unidentified addresses, sparking numerous speculations. The transaction, perceived as an institutional deposit, had an immediate impact on the market, pushing the price of Bitcoin below $66,000.

The crypto community is buzzing with this unexpected maneuver. Influential figures, such as David Bailey from Bitcoin Magazine, suggest that this action could be politically motivated, potentially to counter the pro-crypto policies of former President Donald Trump. Furthermore, Mike Novogratz criticized the timing of the transfer, calling it "ill-advised," and speculated a link with Coinbase for asset management. 🔗 Read the full article here.