Hello Cointribe! 🚀

Today is Saturday, August 10, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

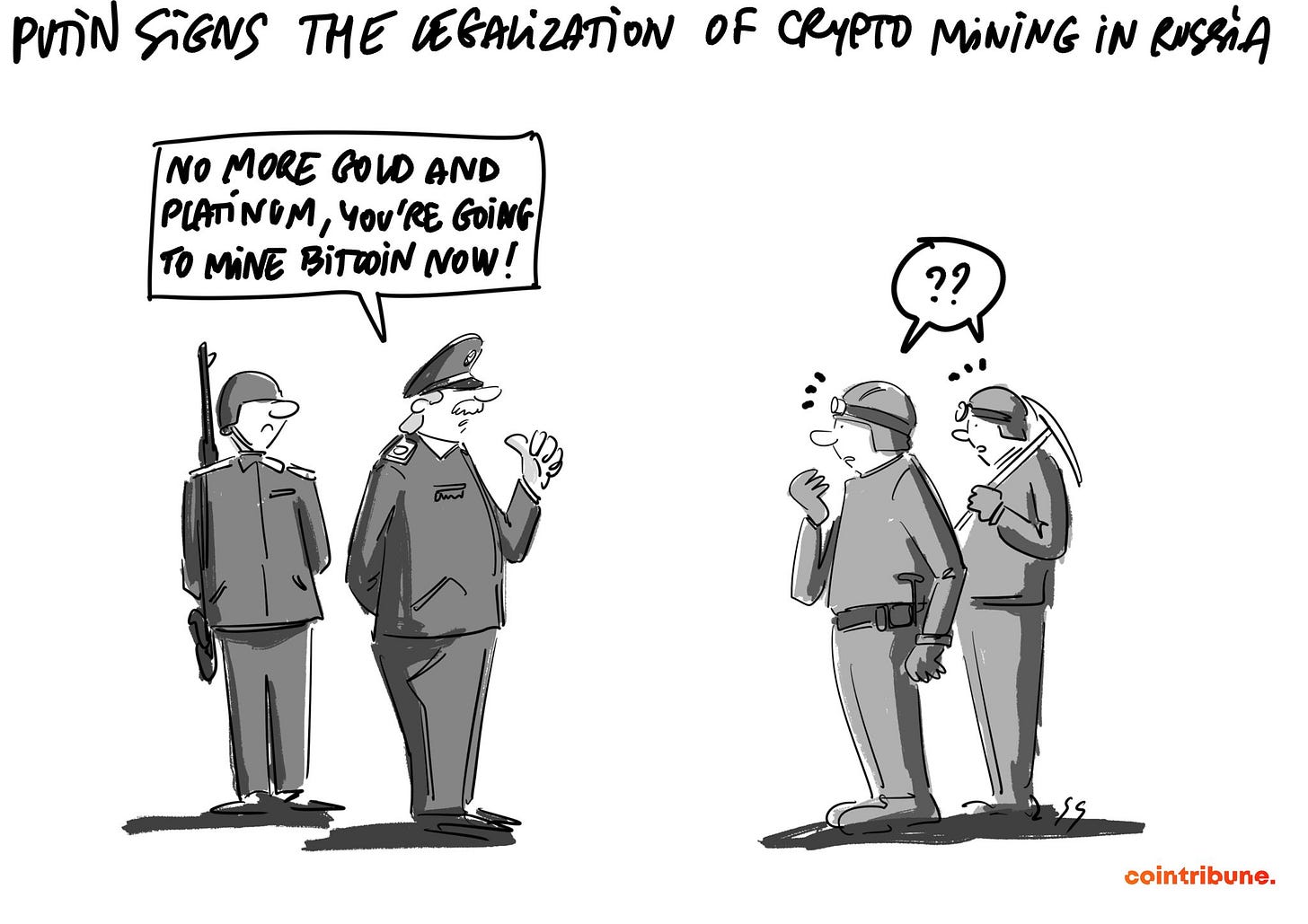

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24h crypto recap! ⏱

🚀 Putin legalizes cryptocurrency mining in Russia

Russia takes a major step by officially legalizing cryptocurrency mining, including Bitcoin, after several years of debate. This new law, signed by President Putin, regulates mining for Russian companies and individual entrepreneurs, introducing concepts like mining pools. In addition, individuals adhering to an energy consumption limit will be able to mine without registration. This legislation positions Russia competitively on the international mining scene, particularly against the United States, while offering an economic alternative to Western sanctions related to the invasion of Ukraine. This legislative framework could also pave the way for innovative financial products such as crypto ETFs, thus strengthening the crypto industry in Russia and attracting investments. 🔗Read the full article here.

📉 Steep decline in profitable Bitcoin addresses

In 2024, the Bitcoin market is experiencing high volatility, marked by a sharp decline in profitable addresses, dropping from 100% in March to 80% in August. After reaching a historical peak of $70,000 before the April halving, Bitcoin saw its price fall below $55,000, resulting in a significant drop in profitable addresses. This trend reflects the typical cycles of the crypto market, where periods of euphoria are often followed by significant corrections. Investors take advantage of these highs to sell, increasing downward pressure on the price of Bitcoin. Although unsettling, this trend is consistent with historical market patterns and highlights the cyclical and volatile nature of cryptocurrencies. 🔗 Read the full article here.

⚠️ Solana: 65% of transactions fail, reliability questioned

Solana, long praised for its exceptional speed, is facing a major crisis of confidence with a transaction failure rate reaching 65%, or even 80% on some days. This critical situation questions the actual performance of the blockchain since only two out of ten transactions are successful. For users, this results in frustrating experiences and unnecessary costs, seriously damaging Solana's reputation. This instability may discourage developers and hinder institutional adoption, especially by giants like Visa. Solana faces a huge challenge in resolving these technical issues to remain competitive and regain user and investor confidence. 🔗 Read the full article here.

⚖️ Ripple: Legal victory, but SEC threat persists

Ripple recently won a major battle against the SEC, marked by a decision from Judge Analisa Torres, who reduced the fines from $2 billion to $125 million. However, this victory is tempered by the acknowledgment of Ripple's violations in its direct sales to institutional investors, while sparing secondary sales of XRP. The SEC, dissatisfied with the verdict, is considering an appeal that could challenge this victory and prolong legal uncertainty surrounding Ripple and the cryptocurrency market in general. If pursued, this appeal could have profound repercussions on cryptocurrency regulation in the United States and maintain constant pressure on the industry, with legislative stakes that could also come into play before a final judicial resolution. 🔗 Read the full article here.

Crypto of the day: Cronos (CRO)

Cronos, formerly known as Crypto.com Coin, is a blockchain designed to provide a high-performance decentralized infrastructure for executing smart contracts and managing decentralized applications (dApps). Innovative with its interoperability with the Cosmos ecosystem, Cronos aims to offer fast and cost-effective transactions while supporting a wide range of DeFi and NFT projects.

The native cryptocurrency of this blockchain, CRO, is primarily used to facilitate transactions on the network, offer staking rewards, and pay transaction fees. Initially distributed through an ICO, CRO presents advantages for holders, such as reduced fees on the Crypto.com platform and rewards for staking, making it attractive for participants in the Cronos ecosystem.

Recent performance:

Current price: €0.0948

Percentage increase/decrease: +11.16% (1-day increase)

Market capitalization: €2,509,178,872

Rank on CoinMarketCap: 30

🎯 Top 5 cryptocurrencies to watch in August: Not to miss out on opportunities and potential rebounds!

In August 2024, five cryptocurrencies stand out as opportunities to closely monitor for investors. Ethereum, despite a recent price drop, continues to play a central role in DeFi and NFT solutions, supported by its recent Shanghai upgrade that strengthened network security and efficiency. Ripple, on the other hand, is regaining stability after winning a legal victory against the SEC, which could pave the way for wider adoption by financial institutions. Solana, benefiting from the approval of the first dedicated ETF for its cryptocurrency, positions itself as a serious alternative in the ecosystem despite previous technical challenges. Bitcoin, despite its volatility, remains a dominant force in the market, continuously attracting institutional investors. Lastly, Cardano, with its methodical and scientific approach, continues to gain credibility, especially in the smart contract and DeFi solutions field.

These cryptocurrencies, each with its own advantages and challenges, represent strategic investment options for this month of August. Ethereum and Ripple offer rebound prospects, while Solana could see significant growth thanks to financial recognition through the ETF. Bitcoin, although volatile, remains a safe haven, and Cardano attracts investors looking for stability in an often unpredictable market. However, it is important to approach these opportunities with a cautious investment strategy, taking into account the unpredictable nature of the cryptocurrency market.

🔗 Read the full analysis here.