Russia legalizes international payments with Bitcoin 🌍

Welcome to the Daily Tribune Friday, July 26, 2024 ☕️

Hello Cointribe! 🚀

Today is Friday, July 26, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

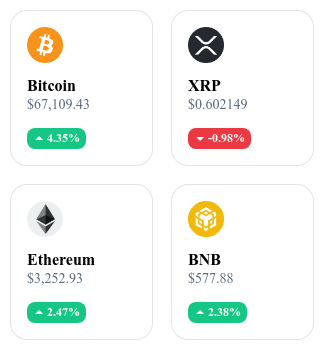

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24h crypto recap! ⏱

Bitcoin in free fall: JP Morgan sounds the alarm 🚨

Bitcoin is experiencing a correction period after briefly reaching $68,000. JP Morgan analysts predict a persistent downward trend, due to the current price being considered too high compared to its production cost, estimated at $43,000. According to them, the price adjusted for volatility should be around $53,000, suggesting a possible short-term drop. Despite differing opinions from other experts like Peter Brandt, who see long-term bullish potential due to growing interest in Bitcoin ETFs, the situation remains uncertain. Bitcoin is currently trading below $66,000, partially confirming JP Morgan's predictions. 🔗 Read the full article here.

Solana: The next ETF star 🌟

Following the success of Bitcoin and Ethereum-backed ETFs, Franklin Templeton is now turning to Solana for its next financial product. With its rapid adoption, robust technology capable of handling high transaction volumes per second, and attractive fees, Solana is positioned as a prime candidate to become the new star of crypto ETFs. Franklin Templeton has expressed confidence in Solana's potential to overcome technological challenges and mature in the crypto scene. With competitors like VanEck and 21Shares already vying to launch their own Solana ETFs, and final decisions from the SEC expected in March 2025, investor interest is growing significantly. If approved, a Solana ETF could attract a influx of new investors and significantly increase the liquidity of this cryptocurrency, further solidifying its position in the world of cryptoassets. 🔗 Read the full article here.

Bitcoin faces a critical deadline on July 26 🕒

July 26 marks a crucial date for the Bitcoin market with the expiration of $5.5 billion in options. This comes after massive selling movements, including the transfer of 42,583 BTC by Mt. Gox and the sale of Germany's bitcoin reserves. These transactions have increased selling pressure on the market. Genesis Trading, under a court order, also transferred 14,000 BTC to Coinbase, indicating more sales to come. Traders' strategies are being put to the test, especially for those betting on Bitcoin above $70,000. If Bitcoin stays in the $66,000 to $67,000 range at expiration, call options could favor optimistic traders, generating substantial profits. The outcome of this deadline is a key indicator of market health, which can validate or contradict investors' optimistic expectations. 🔗 Read the full article here.

Russia legalizes international payments with Bitcoin 🌍

The Russian Parliament has adopted a law in the first reading legalizing international payments with Bitcoin, with an effective date set for September 1, 2024. This unanimously approved decision aims to bypass Western financial sanctions and offer an alternative to the SWIFT network, which has been inaccessible to Russia for two years. Bitcoin payments will be allowed for international transactions, but not domestically, as the Russian central bank favors its own CBDC. The new legislation also includes strict regulation of Bitcoin mining, requiring miners to register and declare their electricity consumption. These measures aim to limit illegal transactions and regulate capital transfers. This initiative demonstrates Russia's willingness to break free from the financial constraints imposed by sanctions while integrating cryptocurrencies into its international economic system. 🔗 Read the full article here.

Coin of the day: Dogecoin (DOGE)

Dogecoin (DOGE) is a blockchain-based cryptocurrency that offers notable innovation in terms of fast and inexpensive transactions. Its blockchain uses a proof-of-work (PoW) algorithm based on Scrypt, different from Bitcoin's, allowing for faster block times and lower energy consumption.

Initially created as a joke, Dogecoin gained popularity thanks to its active community and frequent use for donations and microtransactions. The distribution of DOGE began with an open mining process available to everyone, without pre-mining or ICO. Advantages for holders include very low transaction fees and high liquidity on many exchanges. DOGE can be used for payments, online tipping, and charitable fundraising.

Recent performance

Current price: €0.11

Percentage increase/decrease: +4.33% (1-day increase)

Market capitalization: €17.07 billion

Rank on CoinMarketCap: 8

Bittensor (TAO): Analysis of July 25, 2024 📈

After a significant drop of over 70%, Bittensor (TAO) managed to rebound, reaching $270 before continuing its ascent towards $360, although this level acted as resistance. This rebound was fueled by the overall performance of the crypto market and Grayscale's announcements regarding its new fund dedicated to decentralized AI, including Bittensor. Currently, the price is around $330, above the critical zone of $280, but the short-term bearish structure is not yet completely overcome. Technical indicators, including oscillators and moving averages, show conflicting signs, with a potential death cross, making the continuation of the bullish trend uncertain.

Open interest in perpetual contracts on Bittensor has increased by 100%, with an addition of $27 million, indicating increased speculative activity and optimistic sentiment. Liquidations, mainly on the buy side, are not significant but show areas of tension around $300 and $235. If Bittensor manages to maintain its price above $230, it could test resistance levels at $360, $380, or even $400. On the other hand, failure to maintain could lead to a decline towards $190 or even $160. Investors must closely monitor market reactions at these key levels to validate or invalidate bullish assumptions. 🔗 Read the full analysis here.