🚀 RWA Reach $8 Billion, Hong Kong ETFs Cushion US Losses

Welcome to the Daily Tribune on Thursday, May 2, 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, May 2, 2024, and like every day from Tuesday to Saturday, we summarize the news of the past 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

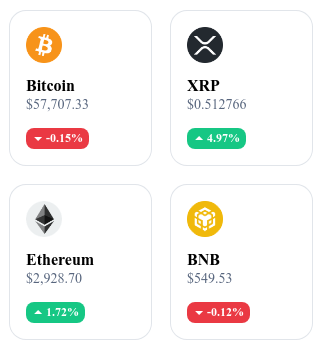

A quick look at the market…

🌡️ Temperature:

Partly sunny 🌤️

24h crypto recap! ⏱

🚀 The Spectacular Rise of RWA Cryptos

The decentralized investment sector is experiencing a remarkable surge, especially with the tokenization of real-world assets (RWA), whose total locked value (TVL) has almost reached $8 billion. This nearly 60% increase since February highlights a shift in investor preferences, who are abandoning traditional speculative investments for more profitable alternatives in the crypto universe.

Tokenization encompasses a wide range of assets, including commodities, securities, and real estate, offering stable returns and capturing the attention of a growing number of users. The diversification and increased involvement in sectors such as the digital carbon market and real estate tokenization, as well as the popularity of tokenized US bonds, illustrate the growing interest in safe and regulated investments within the blockchain. 🔗 Read the full article here.

🌏 Hong Kong ETFs: A New Beacon in the US Crypto Storm

April 30, 2024 marked a turning point for the crypto financial market in Hong Kong with the launch of six spot ETFs for Bitcoin and Ethereum, involving key players such as China Asset Management, Bosera HashKey, and Harvest International. Although the beginning was modest, with mixed results on the first day, long-term prospects remain optimistic.

The CAM Bitcoin ETF stood out with $123.61 million in assets under management, signaling significant potential despite initial timid trading volumes. Bosera Hashkey's ETFs also recorded promising figures, capturing $70.34 million in assets. 🔗 Read the full article here.

⚖️ SEC vs. Ripple: The Legal Battle Intensifies

The conflict between Ripple and the Securities and Exchange Commission (SEC) has recently heated up with the SEC's opposition to Ripple's request to quash the testimony of Andrea Fox, an SEC witness. Ripple disputes this testimony, considering it undisclosed expert testimony, although they have not questioned the accuracy of the presented financial summaries.

For lawyer Bill Morgan, although the SEC maintains that Fox's testimony does not address specific financial damages, the SEC's argument on overall financial harm appears weak. This legal development highlights not only the regulatory challenges of the crypto industry but also the major implications for the future of Ripple and the global regulatory framework of cryptocurrencies. 🔗 Read the full article here.

🇪🇺 MiCA in Motion: Europe United to Regulate Cryptos

European Union member states are mobilizing for the implementation of MiCA, significant regulation that defines standards for crypto asset markets, including stablecoin issuers and cryptocurrency service providers. Planned for June with a transition period of 18 months, although reduced to 12 months in some countries, this law aims to standardize practices while allowing for certain national variations in technical standards.

France and Croatia have already appointed their regulators, while other countries are organizing around their central banks. MiCA requires close collaboration among states to adapt effectively and overcome the challenges posed by the fragmentation of the European crypto market. 🔗 Read the full article here.

Coin of the Day: Aerodrome Finance (AERO)

Aerodrome Finance is a decentralized finance (DeFi) platform that operates on an innovative blockchain, offering automated financial solutions through an Automated Market Maker (AMM) protocol. This blockchain aims to optimize transactions by reducing costs and speeding up processes, providing significant added value for users seeking efficient alternatives to traditional systems. The main utility of AERO is to facilitate exchanges and liquidity in the DeFi ecosystem, offering increased flexibility and accessibility for decentralized financial operations.

AERO holders enjoy several benefits, such as transaction fee discounts, voting rights in the protocol's governance, and the opportunity to participate in liquidity pools for passive rewards.

Recent Performance

Current Price: €1.05

Percentage Increase/Decrease: 16.48% (1-day increase)

Market Cap: €458,533,025

Rank on CoinMarketCap: 220

Technical Analysis of the Day: Axelar (AXL)

After reaching an all-time high of $2.72, Axelar (AXL) experienced a significant decline, losing up to 67% of its value. Recently, the cryptocurrency has shown signs of recovery, with prices fluctuating around $1.15 and appearing to stabilize near the important psychological threshold of $1. Technical analysis indicates that support at $0.90 is crucial, and if AXL manages to maintain this level, it could potentially rebound towards higher resistances such as $1.30 and $1.60.

The analysis shows a recent period of volatility with renewed buyer interest around the $1 zone, which could indicate a potential renewal of market confidence. However, selling pressure and external market influences, including unfavorable Bitcoin movements, raise doubts about AXL's ability to maintain an upward trend. Investors should monitor key levels for signs of consolidation or breakout while remaining cautious in the face of rapid cryptocurrency market fluctuations.