⚠️ S&P questions the strength of USDT reserves

Welcome to the Daily for Thursday, 27 November 2025 ☕️

Hello Cointribe! 🚀

Today is Thursday, 27 November 2025, and as every day from Tuesday to Saturday, we bring you a summary of the key news from the last 24 hours that you shouldn’t have missed!

But first…

✍️ Cartoon of the day:

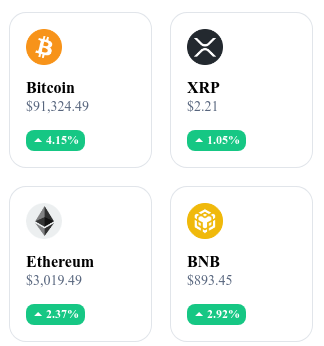

A quick look at the market…

🌡 Weather:

☀️ Sunny

24h crypto recap! ⏱

🏛️ The Trump family conducts massive buybacks in an attempt to save WLFI after a 50% drop

The WLFI token, backed by World Liberty Financial (controlled by Donald Trump’s family), has lost nearly 50% since January 2025, despite a buyback of 46.5 million tokens at $0.167 for approximately $7.79M. These buybacks aim to reduce the circulating supply in hopes of boosting the price, but the market remains strongly bearish.

👉 Read the full article

🔄 Polygon co-founder reignites debate over bringing back the MATIC ticker

One of Polygon’s co-founders has suggested reintroducing the MATIC ticker (instead of POL?) to clarify the token’s identity for users and markets. This proposal comes in the context of a potentially strategic repositioning for the project.

👉 Read the full article

🔐 Grayscale prepares a “revolution” with a potential ETF launch on Zcash

Grayscale announces that it is considering the creation of an ETF backed by Zcash, which would represent a first for a privacy-focused asset and strengthen institutional legitimacy for this type of cryptocurrency. This initiative could pave the way for broader regulated exposure for traditional investors.

👉 Read the full article

🤖 OpenAI faces a major challenge: a business model still fragile despite technological success

Despite widespread adoption and strong media enthusiasm around its AI tools, OpenAI is struggling to consolidate a sustainable business model with stable recurring revenue. The financial structure is considered vulnerable by some analysts due to significant costs and competitive pressure.

👉 Read the full article

Crypto of the day: Kadena (KDA)

🧠 Innovation and added value

Kadena is a Layer-1 blockchain founded by former JPMorgan engineers, built to deliver the scalability of a multi-chain architecture while retaining the security of proof-of-work (PoW).

Its technology is based on Chainweb, a unique system where multiple blockchains run in parallel and connect with each other. This structure enables increased transaction throughput by adding new chains, without compromising network security.

Kadena also offers Pact, a smart contract language that is readable, formally verifiable, and designed to prevent many common vulnerabilities found in the Ethereum ecosystem.

💰 The token

KDA is used to pay transaction fees, reward miners, and execute smart contracts in Pact.

The economic model is based on securing the network through PoW mining, but with a “scalable” approach thanks to the Chainweb architecture.

KDA is also used in the economic governance of the protocol and in managing execution costs across the different chains of the network.

Holders can also use KDA in DeFi applications built on Kadena, while benefiting from a smart contract language that reduces the risk of errors.

📊 Real-time performance (CMC)

💵 Current price: $0.01185

📈 24h change: +5.7%

💰 Market cap: $3.97M

🏅 CoinMarketCap rank: #1440

🪙 Circulating supply: 335.29M KDA

📊 Trading volume (24h): $58.06K

USDT in turmoil: S&P raises concerns over its reserves and sounds the alarm

Tether, the world’s largest stablecoin issuer, is under scrutiny after S&P Global Ratings assigned USDT the lowest stability rating on its scale. This evaluation raises numerous questions about the composition of USDT reserves, their liquidity, and the transparency of the issuing company. The analysis highlights the challenges of financial stability within the world of crypto assets.

A severe downgrade with multiple justifications

S&P Global Ratings has placed the USDT stablecoin at the bottom end of its rating scale, estimating that its reserves contain a proportion of volatile assets considered too high. The report mentions that 5.6% of Tether’s reserves are invested in Bitcoin, well above the 3.9% corresponding to overcollateralization. Additional risky assets include gold, loans, and corporate bonds. This combination concerns S&P, which also points to the lack of full independent audits and a regulatory framework considered permissive in El Salvador, the country where Tether is registered.

What S&P highlights is not only an accounting issue, but a systemic risk: in case of market shock, these assets could become difficult to liquidate quickly. Yet, nearly 75% of USDT reserves consist of U.S. Treasury bills or highly liquid short-term instruments. This suggests a degree of stability, but does not offset the concerns raised by the agency’s analysts.

Tether defends its solidity against criticism

Following this evaluation, Tether rejects the conclusions of the report, arguing that traditional agencies rely on outdated models. The company’s CEO notes that these same models once gave favourable ratings to institutions that later collapsed. He claims that Tether holds more than 112 billion dollars in U.S. Treasury bills — making it the world’s 17th-largest holder — and around 116 tonnes of gold. These substantial reserves, in his view, justify USDT’s robustness and confirm its role as a global digital currency.

The gap between rating agencies and crypto players raises a fundamental question: are traditional financial analysis models suitable for assessing digital asset issuers? While S&P applies a strict risk management framework, Tether asserts that it follows a strategic flexibility adapted to the nature of cryptocurrencies.

S&P’s decision to downgrade USDT may mark a turning point for stablecoins. This questioning of the stability of such a central asset within the crypto ecosystem calls for greater transparency and discipline. Although USDT still retains market confidence for now, the future of stablecoins now appears closely tied to their ability to inspire trust — not only through words, but through independent audits, clear regulation and prudent reserve management.