Hello Cointribe! 🚀

Today is Tuesday, September 2, 2025, and as every day from Tuesday to Saturday, we bring you a recap of the last 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

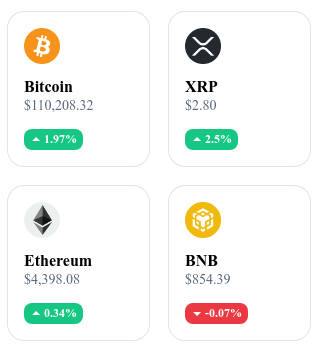

A quick look at the market…

🌡 Weather:

Sunny ☀️

24h crypto recap! ⏱

🚀 Michael Saylor predicts Bitcoin at one million dollars

Michael Saylor believes bear markets are a thing of the past and foresees BTC reaching between $500,000 and $1 million, fueled by growing institutional adoption, a limited supply (450 BTC per day), and attractive yields. He claims that under current regulations, an inflow of just $50M is enough to spark momentum across the entire crypto ecosystem.

👉 Read the full article

⛰ Alpenglow (Solana) gets over 99% approval for its ultra-fast upgrade

The Solana community has overwhelmingly approved Alpenglow with 99% of votes, aiming to replace the old TowerBFT protocol. This upgrade reduces transaction finality from 12.8 seconds to around 150 milliseconds and paves the way for future validator clients like Firedancer.

👉 Read the full article

🪙 Trump’s post-war plan for Gaza mandates land tokenization

The "GREAT Trust" plan proposes tokenizing Gaza’s land, distributing tokens to displaced residents in exchange for property rights, which can be traded or redeemed for housing or financial compensation. The system foresees temporary control by the United States and has drawn criticism from NGOs over its legality and implicit coercion.

👉 Read the full article

🏚 Metaplanet faces funding crisis despite holding 18,991 BTC, stock plunges 54%

The platform must raise $880M through the issuance of 555M preferred shares, or else its model tied to Evo Fund warrants becomes unviable. Its Bitcoin reserves remain high (18,991 BTC ≈ $2.1B), but the premium that once supported its valuation has dropped from 8x to 2x, severely reducing its strategic leverage.

👉 Read the full article

Crypto of the Day: Aptos (APT)

🧠 Innovation and Added Value

Aptos is a Layer 1 blockchain born from Meta’s Diem project. It combines fast consensus (AptosBFT), a parallel execution engine, and the Move programming language, designed to enhance the security of smart contracts.

This architecture positions Aptos as a high-performance platform, capable of handling a large volume of transactions while remaining accessible to developers.

💰 The APT Token: Utility and Benefits for Holders

APT is used to settle transactions, secure the network through staking, and participate in governance. It aligns validators, developers, and users, supporting both protocol security and ecosystem growth.

📊 Real-Time Performance (September 2, 2025)

Current Price: $4.28 USD

24h Change: +2.45 %

Market Cap: ≈ $2.955 billion USD

CoinMarketCap Rank: #38

Circulating Supply: ≈ 687.52 million APT

24h Trading Volume: ≈ $173.68 million USD

BRICS: Putin Buries the Dollar in Sino-Russian Trade

The shift is now official. At the BRICS summit, Vladimir Putin confirmed a radical change: the U.S. dollar no longer has a place in trade between Moscow and Beijing. This declaration goes beyond mere commercial transactions and redefines global monetary balances.

Putin Confirms the End of the Dollar in Russia-China Trade

From Johannesburg, the Russian president formalized a move already underway: bilateral transactions between Russia and China are now conducted “almost exclusively” in rubles and yuan. The dollar and the euro, long dominant in international trade, are now relegated to the status of mere “statistical units.”

This is not a minor choice. It aligns with solid trade dynamics. Since 2021, trade between the two powers has grown by more than $100 billion, particularly in energy and automotive sectors. This growth accelerated under Western sanctions against Moscow, which strengthened the interdependence of the two economies.

To support this shift, an autonomous financial settlement system has been established. According to Putin, it avoids any form of external pressure while ensuring operational and monetary stability. This alternative structure, breaking away from SWIFT standards, illustrates the determination of both countries to build resilience against Western-dominated circuits.

Toward a Global De-Dollarization Driven by BRICS?

This Sino-Russian monetary realignment resonates more broadly within the BRICS forum, which also includes Brazil, India, and South Africa. The summit highlighted growing calls to end the dollar’s monopoly in global trade. Several members advocated expanding settlements in local currencies or even creating a common BRICS currency, still under discussion.

China, with its economic and monetary weight, plays a central role in this shift. The yuan is gradually establishing itself as an alternative for international transactions, particularly in emerging markets where it benefits from the expansion of the Belt and Road Initiative.

Faced with global monetary fragmentation, BRICS seeks greater financial sovereignty, reduced exposure to economic sanctions, and an affirmation of its weight in a multipolar world. The Sino-Russian choice to abandon the dollar is a concrete and strategic expression of this vision.