👑 Saylor Holds Firm: Despite Ethereum’s Rise, Bitcoin Remains King

Welcome to the Daily for Tuesday, August 12, 2025 ☕️

Hello Cointribe! 🚀

Today is Tuesday, August 12, 2025, and as every day from Tuesday to Saturday, we bring you a summary of the last 24 hours’ must-know news!

But first…

✍️ Cartoon of the day:

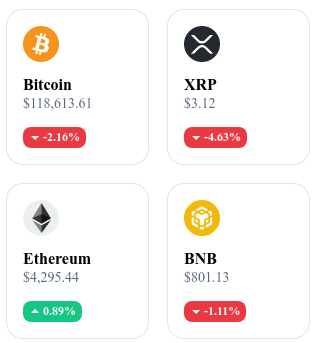

A quick look at the market…

🌡 Weather:

🌧️ Rainy

24h crypto recap! ⏱

⚖️ Do Kwon to Plead Guilty This Tuesday in New York

The plea change hearing is set for today, August 12, 2025, confirming his intention to admit guilt in the TerraUSD/Luna case. This development reignites the criminal proceedings in the U.S. and sets the stage for the sentencing phase.

🟡 BNC Becomes the Largest Corporate Holder of BNB After Purchasing 200,000 Tokens

BNC announces a position of approximately $160M in BNB, claiming the top spot among corporate treasuries. The move validates a strategy financed through a private placement and strengthens its governance around the asset.

👉 Read the full article

💵 Stablecoins Hit an All-Time High of $270.3B in Market Cap

The market posted a weekly increase of about $3.05B, confirming USDT’s dominance over USDC. Thirty-day volumes are nearing $2.7T, with DeFi-driven demand remaining strong.

👉 Read the full article

🟧 Michael Saylor Reaffirms Bitcoin’s Primacy Amid Renewed Interest in Ethereum

He champions BTC as the benchmark digital monetary asset while ether posts notable 30-day gains. Saylor highlights Bitcoin’s dominance and MicroStrategy’s position, dismissing the notion of a structural threat from ETH ETFs and staking.

👉 Read the full article

Crypto of the Day: Celestia (TIA)

🧠 Innovation and Added Value

Celestia is the first modular blockchain focused on data availability and consensus. Unlike monolithic blockchains, Celestia separates the consensus and execution layers, allowing other chains to use it as a data availability layer.

This approach lowers costs, improves scalability, and enables developers to quickly deploy their own custom blockchains (rollups, sidechains) without having to manage the full infrastructure.

💰 The TIA Token: Utility and Holder Benefits

The TIA token is used to pay for data publishing on Celestia, secure the network through staking, and participate in governance. Validators and delegators earn TIA rewards for maintaining data availability and integrity. This model incentivizes participants to support a high-performance, interoperable multi-chain ecosystem.

📊 Real-Time Performance (August 12, 2025)

Current Price: $6.28 USD

24h Change: –1.72%

Market Cap: ≈ $1.19B USD

CoinMarketCap Rank: #84

Circulating Supply: ≈ 190.2M TIA

24h Trading Volume: ≈ $47.5M USD

Bitcoin: Between Prolonged Consolidation and Correction Risk

After hitting an all-time high of $123,000, Bitcoin has entered a slowdown phase that is raising both curiosity and concern. The latest CryptoQuant analysis shows a marked weakening in key indicators, suggesting a prolonged consolidation period — or even a reversal if certain critical zones give way.

Technical Indicators Losing Momentum

The Bull Score Index, a barometer of market trend strength, has dropped from 80 to 60. This decline points to a loss of momentum, even though the market still retains a bullish bias. At the same time, stablecoin liquidity growth has slowed sharply, a sign of limited fresh capital inflows.

On-chain data reinforces this cautious sentiment: Bitcoin transaction volume is falling, inflows to major exchanges like Coinbase are contracting, and profit-taking is on the rise. The traders’ profit margin indicator has entered the red zone, signaling locked-in gains and reduced unrealized profits. Adding to this is an unfavorable seasonal factor — summer, historically associated with lower volumes, is further weighing on market momentum.

Signals Near a Tipping Point

Beyond the slowdown, several valuation indicators are approaching critical thresholds. The Bull-Bear Cycle Market Indicator, the P&L Index, and the MVRV Z-score are flirting with levels where a fresh correction could push them into bearish territory.

Such a shift could drag the Bull Score Index below 40, a level not seen since April 2023. This scenario becomes even more plausible given the limited expansion of Tether (USDT), with only $9.6 billion added over the past 60 days.

This fragility leaves the market vulnerable to renewed selling pressure, especially in the absence of immediate bullish catalysts.

A Market Waiting for Catalysts

The current market picture suggests less of an imminent crash and more of a transitional phase. The broader bullish structure remains intact, but the lack of significant inflows and favorable macroeconomic signals fuels a climate of caution.

The coming weeks could prove decisive. The emergence of a catalyst — whether technological innovation, institutional inflows, or a shift in economic conditions — could reignite the bullish trend. Conversely, a negative shock might push several technical indicators into bearish territory, increasing the likelihood of a correction.