🛑 SEC blocks Solana, WikiLeaks chooses Bitcoin

Welcome to the Daily tribune of Saturday, December 7, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, December 7, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

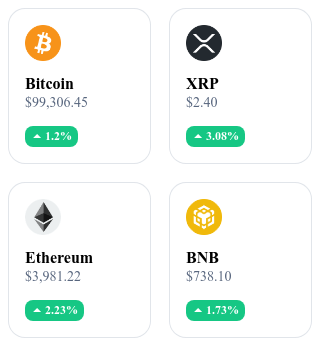

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🚫 The SEC halts Solana ETFs

The SEC has rejected several proposals for ETFs based on Solana (SOL), hindering investors' ambitions in this field. At least two of the five potential issuers have been notified of the rejection of their 19b-4 filings. This decision illustrates increased caution from the SEC regarding crypto financial products, adding hurdles to innovation in this sector.

However, evolving prospects are anticipated with the arrival of Paul Atkins at the head of the SEC in 2025, who could adopt a more favorable stance. This rejection reflects the persistent challenges of integrating cryptos into traditional financial markets.

💰 Ethereum ETFs break records: 9 days of positive flows

Ethereum ETFs show impressive performance with nine consecutive days of inflows, culminating in a record influx of $431.5 million on December 5, 2024. This dynamism reflects increased investor confidence in Ethereum, bolstered by major players such as BlackRock and Fidelity. The BlackRock iShares Ethereum Trust (ETHA) recorded $295.7 million in one day, bringing its total to $2.3 billion. Meanwhile, the Fidelity Ethereum Fund (FETH) raised $113.6 million, while the Grayscale Ethereum Mini Trust (ETH) added $30.7 million.

ETH, supported by these massive inflows and strong institutional demand, reached a peak of $3,946, with optimistic projections of surpassing $5,000 in December.

🛡️ WikiLeaks engraves Afghan archives on Bitcoin

WikiLeaks launches the Spartacus project to permanently preserve 76,911 sensitive documents related to the war in Afghanistan on the Bitcoin blockchain. By using the Ordinals protocol, these classified data, detailing notably civilian casualties and controversial practices of the American military, will be recorded indelibly.

The announcement was made in London by Gabriel Shipton, brother of Julian Assange. This initiative strengthens the historic alliance between WikiLeaks and Bitcoin, which began in 2010 when the organization was already relying on this crypto to counter a global banking blockade. By embodying resilience against censorship, Bitcoin asserts itself as an indispensable tool for preserving the freedom of information.

⚠️ XRP under pressure: a major risk ahead

After reaching an annual high of $2.85 on December 3, XRP is undergoing a significant correction, recording a drop of 18%. Analysts warn of a potential "bloodbath" if Bitcoin's dominance, currently at 55.30%, continues to rise towards 60-70%. This dynamic could divert capital from altcoins, such as XRP, towards Bitcoin. Despite a record open interest of $3.44 billion on XRP derivative contracts, high funding rates and substantial accumulation of long leveraged positions increase the risks of massive liquidations.

A simple drop of 7%, bringing the price to $2.18, could lead to estimated losses of $104.4 million. A stabilization of Bitcoin would be crucial to soothe the markets and avoid a cascading liquidation.

Crypto of the day: Hedera (HBAR)

Hedera is a unique public blockchain based on the Hashgraph protocol, offering high performance with low latency and minimal fees. It stands out for its decentralized governance model managed by a global council of renowned companies such as Google and IBM.

Its native crypto, HBAR, is essential for powering applications, securing the network through staking, and paying transaction fees.

Initially distributed through controlled allocations, it offers holders added value through incentives to secure the network and participate in its ecosystem. HBAR is used in various use cases, including micropayments, supply chain management, and data verification services.

Recent performances

Current Price: €0.31

Variation (1 Day): +14.50%

Market Capitalization: €12.83 billion

Rank on CoinMarketCap: #20

🚀 Memecoins, record fees, and structural challenges: The behind-the-scenes of a Bull Run like no other

The current Bull Run in the cryptocurrency sector is reshaping the dynamics of the ecosystem with record trading volumes and unprecedented enthusiasm for memecoins.

The real winners of this excitement are the decentralized platforms and blockchain infrastructure providers. On Solana, for instance, daily volumes have soared from $1.6 billion to $10 billion in just a few weeks, generating significant revenue in transaction fees.

Raydium, a decentralized automated trading platform, illustrates this trend with daily gains reaching $11 million. These figures highlight the importance of infrastructures in the ecosystem and recall the analogy of the gold rush where tool and shovel sellers benefited more than the seekers themselves.

Big names in the industry, such as Bitget or Pump.fun, position themselves as essential pillars, also benefiting from record transactions and frenetic activity in the market.

However, this prosperous period is not without challenges. High transaction fees, ranging from $1 million to $2 million per day on the Solana blockchain, underscore the limits of current infrastructures.

This situation could quickly become an obstacle to widespread adoption if no sustainable solution is implemented. Furthermore, the strong concentration of volumes in niches like memecoins raises questions about the long-term viability of this dynamic.

Analysts recommend diversifying use cases by directing efforts towards stable sectors like decentralized finance or blockchain gaming. These segments could strengthen market resilience and enable sustainable growth, while avoiding over-dependence on speculative assets.

For savvy investors, this period represents a unique opportunity to maximize their gains, but it also acts as a real-world stress test for blockchain technologies and underlying business models.