Shiba Inu on fire, Ordinals reignite the NFT market 🚀

Bienvenido a la tribuna diaria del jueves 26 de septiembre de 2024 ☕️

Hello Cointribe! 🚀

Today is Thursday, September 26, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

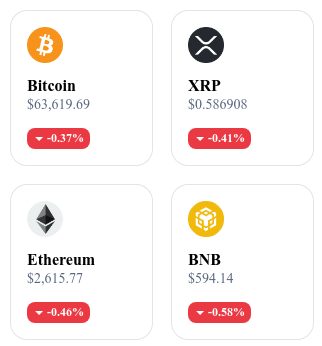

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24h crypto recap! ⏱

Ethereum under the influence of Vitalik Buterin? ⚡️

Charles Hoskinson, founder of Cardano, criticizes the governance of Ethereum by labeling it a "dictatorship" dominated by Vitalik Buterin. He believes that Buterin exerts too much influence over the network, which contradicts the principle of decentralization promoted by Ethereum. Hoskinson compares this situation to Bitcoin, where there is no centralized leader, with the protocol being managed in a more immutable manner. He argues that, without Buterin's presence, Ethereum's future is uncertain. Despite Ethereum's claims regarding community involvement in governance, Hoskinson raises the question of the network's actual independence from its creator.

The SEC again postpones its decision on Ethereum ETF options ⏳

The SEC has once again delayed its decision on the listing of options related to Ethereum ETFs, causing impatience among investors. The dates are now set for November 10, 2024, for Nasdaq ISE and November 11, 2024, for NYSE American LLC. Although the SEC has already approved options on BlackRock's Bitcoin ETF, it continues to carefully analyze Ethereum's derivatives before giving the green light. BlackRock and Grayscale's applications aim to offer investors options on Ethereum, increasing the diversification of available crypto products. This delay could maintain a certain volatility in the market until the final decision, which could redefine the future of Ethereum ETFs.

Shibarium explodes with 7 million blocks processed and a burn rate that is skyrocketing 🔥

Shibarium, the Layer 2 solution of Shiba Inu, has reached an impressive milestone by processing over 7 million blocks since its launch in August 2023. With nearly 420 million total transactions, this blockchain continues to gain popularity, strengthening the credibility of the Shiba Inu ecosystem. The number of smart contracts has surged by 700%, illustrating growing adoption. At the same time, the burn rate of SHIB has soared by over 7,000% in 24 hours, with about 8 million tokens burned, thereby reducing the available supply. These developments, combined with a decrease in SHIB reserves on exchange platforms, create a favorable context for a potential increase in the crypto price, which has already recorded a 14% rise on a weekly basis.

Ordinals propel the NFT market on Bitcoin 🚀

The Ordinals, these NFTs based on Bitcoin, are experiencing a spectacular resurgence after months in the shadows. Despite the temporary dominance of the Runes protocol, Ordinals collections on platforms like Magic Eden are seeing their value explode. Certain collections, like NodeMonkes, are reaching a floor price of 0.2 BTC (approximately $13,000), while others like Quantum Cats and Pizza Ninjas are recording increases of 10% to 18%. This dynamism sharply contrasts with the traditional NFT market on Ethereum and Solana, where gains are more modest, if not nonexistent. Since their creation in early 2023, the Ordinals continue to redefine the NFT ecosystem, with a market now valued at $759 million according to CoinGecko. This resurgence highlights the vitality of Bitcoin and the rapid evolution of investor preferences.

The crypto of the day: Worldcoin (WLD)

Worldcoin stands out with its goal of using blockchain to revolutionize digital identity. It is based on a major innovation, the global identity protocol, allowing each individual to prove their uniqueness online through advanced technologies such as zero-knowledge proofs.

Its native crypto, WLD, is primarily used to incentivize the adoption of the protocol and facilitate transactions within its ecosystem. The initial token distribution was conducted through biometric sign-ups, providing benefits to holders such as access to verified digital services, as well as increasing use in payments and incentive systems within digital economies.

Current price: €1.88

Increase/Decrease: +15.68% (increase over 1 day)

Market capitalization: €995,434,748

Rank on CoinMarketCap: 71

China injects billions: a monetary easing that shakes up the markets! 💸

The People's Bank of China (PBoC) recently decided to further ease its monetary policy by lowering its benchmark rate by 0.20%, bringing it down to 1.5%, as well as the reserve requirement ratio for banks. This is the first time since 2015 that these two parameters are lowered in tandem, allowing banks to create more money. This easing aims to support the Chinese economy, which has faced difficulties related to the property crisis and international tensions. This move is expected to facilitate the issuance of 10 trillion yuan in government bonds to finance major Chinese projects. Despite low inflation in the country, the long-term consequences of this easing, particularly on overall inflation, remain to be monitored.

Meanwhile, the Chinese stock market has benefited from this influx of liquidity, bouncing back after several stagnant years. The Shanghai, Shenzhen, and Hang Seng stock indices had suffered significant losses at the beginning of the year, but saw a positive turnaround following the announcement by the PBoC. Chinese stocks, considered undervalued, are increasingly attracting investors, but geopolitical tensions and caution over Western sanctions still hinder a complete recovery. Monetary easings, combined with China's desire to avoid exclusion from Western markets, suggest a more optimistic future for the markets, especially for assets like bitcoin, which could benefit despite China's restrictions.

🔗 Read the full analysis here.