🚀 Shkreli bets on Bitcoin at $1 million, Solana breaks records

Welcome to the Daily Tribune Wednesday, April 3, 2024 ☕️

Hello Cointribe! 🚀

Today is Wednesday, April 3, 2024, and like every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

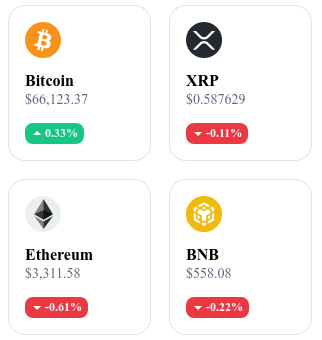

A quick look at the market…

🌡️ Temperature:

Cloudy ☁️

24-hour crypto summary ! ⏱️

🚀 Ethereum Layer 3: The Silent Revolution?

Ethereum continues to play a key role in the blockchain ecosystem, despite persistent challenges related to expansion and scalability. Recently, Vitalik Buterin has revived the debate about the potential of Layer 3, proposing lighter and promising alternatives to reduce costs and optimize efficiency. These additional layers, built on top of Layer 2 scalability solutions, are of great interest for their ability to decrease certain operational costs without necessarily significantly improving the overall transaction throughput. However, their added value and potential complexity invite careful analysis for the future of Ethereum.

Buterin has also mentioned the existence of simpler alternative approaches and potentially more effective solutions to scalability problems without adding complexity. While Ethereum finds itself at a decisive crossroads, these innovations and reflections open up promising prospects for solutions that are both simpler and more suitable.

💸 Bitcoin at $1 million in 2024? Martin Shkreli believes so!

Martin Shkreli, a controversial figure in the pharmaceutical industry, surprised with a bold prediction: he sees a 75% chance of Bitcoin reaching $1 million by the end of 2024. This forecast aligns with those of other finance visionaries such as Cathie Wood and Robert Kiyosaki, despite Shkreli not providing a clear justification. This prediction is based on a spectacular rise in the price of Bitcoin, which would require a twenty-fold increase from the current level, a prospect that has raised both skepticism and questioning regarding its foundation.

Notable figures like Tim Draper have also shared bullish visions for the future of Bitcoin, each with their own projections and expectations. These predictions, even though they vary in terms of numbers and timeframes, reflect a common belief in the long-term potential of Bitcoin to reach historical highs.

🌟 Solana DEXes Shake Up the Market

Decentralized exchanges (DEXes) on Solana broke all records in March, with a transaction volume reaching $60.34 billion. This impressive performance far surpasses the previous record and positions Solana just behind Ethereum in terms of DEX trading volume. This success is attributed to the growing interest in Solana-based memecoins, which have seen strong trading activity, attracting particular attention to decentralized exchange platforms on the blockchain.

The enthusiasm for cryptocurrencies such as Dogwifhat, Bonk, Book of Meme, and Slerf has played a key role in this surge in transaction volume. Even memecoins associated with political personalities like Donald Trump and Joe Biden have contributed to this dynamic. Orca, Raydium, and Phoenix, among Solana's DEXes, have been the main beneficiaries of this increase.

🌪️ Bitcoin: Storm and Resilience

Bitcoin experienced a sharp correction, resulting in a massive $500 million liquidation. The majority of liquidations were of long positions, revealing prior optimism that proved costly for many investors. This event also saw an increasing interest in put options, signaling growing nervousness and distrust among traders.

Several factors, including movements in the options market and the monetary policy of the United States, contributed to this instability. This correction, although severe, highlights the inherent volatility of the cryptocurrency market and its ability to readjust itself. Despite the uncertainty, the potential for high returns continues to attract investors, suggesting both an uncertain and promising future for Bitcoin and cryptocurrencies in general.

Crypto of the day: Ethena (ENA)

At the heart of blockchain innovation, Ethena positions itself as a promising player in decentralized finance (DeFi). Supported by renowned entities such as Binance Labs and OKX Ventures, Ethena aims to redefine access to financial services by offering a secure, transparent, and accessible platform.

ENA is the cornerstone of the Ethena ecosystem, serving as the currency for transactions, governance, and investment within the platform. ENA stands out for its central role in activating key features of the platform, including fast transactions, reduced fees, and user participation in governance decisions. ENA holders benefit from privileged access to DeFi services, attractive investment opportunities, and significant potential for value appreciation as the project develops.

Recent Performance

Current Price: The current price of ENA is around $0.9263.

Percentage Increase/Decrease: Ethena has seen an impressive increase of 46.52% over a 24-hour period.

Market Cap: Its market capitalization is around $1,341,931,265.

Rank on CoinMarketCap: 79th

Technical Analysis of the Day: Internet Computer (ICP)

Internet Computer (ICP) recently crossed the $20 mark. This is a notable progression, especially considering its journey from a previous high of $16.30. After a consolidation phase, where prices oscillated between $10.30 and $16.30, ICP managed to break out of this range on the upside, reaching a new high. This movement demonstrates resilience and persistent buying interest despite selling pressure. The current consolidation of ICP, at the Fibonacci retracement level of 38.2% from its last rally, could indicate a potential continuation of the uptrend, supported by ICP trading above its 50-day moving average.

Let's talk about the technical aspect and market signals. The ICP/USD chart clearly shows this dynamic. On the other hand, open interest in ICP/USDT perpetual contracts has more than doubled since the cryptocurrency's rebound, signaling predominantly bullish interest. However, the recent consolidation has introduced some caution, with a decrease in open interest and funding rates. This situation requires special attention as it could indicate future price movements based on investors' reaction to this consolidation.

Lastly, let's look at future projections for ICP. If the price manages to stay above $16, we could witness a continuation of the uptrend, with the potential to reach $21 or even $25. On the other hand, a decline below $16 could signal a correction towards $13 or even $10, marking a considerable decline. These scenarios illustrate the inherent volatility of cryptocurrencies and the importance of closely monitoring these critical thresholds. Internet Computer has demonstrated an impressive ability to overcome consolidation periods, highlighting ongoing interest in this cryptocurrency. As always, stay attentive to market signals and feel free to engage in our community for insightful discussions about these analyses.