Hello Cointribe! 🚀

Today is Friday, October 4, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn’t miss!

But first…

✍️ Cartoon of the day:

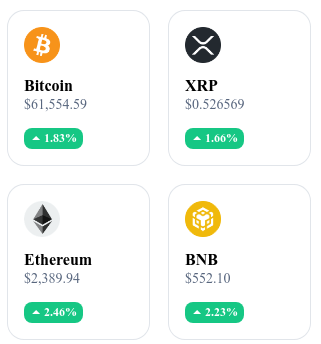

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

The dangers of Solana according to Edward Snowden 🚨

During the Token2049 conference in Singapore, Edward Snowden expressed severe criticism of Solana and notably denounced its excessive centralization. According to him, the network, by betting on speed and cost reduction, sacrifices decentralization, thus creating vulnerabilities for long-term security. He warns that this approach could facilitate future governmental control, particularly in authoritarian regimes, where levers of control could be exploited against users.

This viewpoint has sparked lively debates within the crypto community, particularly from supporters of Solana, who labeled these criticisms as unfounded. Snowden also cited Bitcoin as an example, highlighting its resilience against state pressures and its role as a bulwark against digital authoritarianism.

Buterin reignites the debate on Ethereum staking threshold 🔥

Vitalik Buterin, co-founder of Ethereum, proposes to reduce the minimum threshold for participating in staking on the Ethereum network, currently set at 32 ETH, to only 16 ETH, or possibly even 1 ETH in the future. This proposal aims to make staking more accessible and encourage participation from small investors, thereby strengthening the network's decentralization. However, this reduction would temporarily imply an increase in bandwidth requirements, raising technical questions.

Although this is viewed positively by solo staking advocates, the debate has been launched within the community. This proposal comes amidst a volatile market, where staking could play a stabilizing role against massive Ethereum sell-offs, like the one involving 19,000 ETH by an ICO-era "whale."

Bitcoin whales anticipate a massive rebound 💰

Bitcoin whales, these major investors who control a large part of the market, have accumulated 50,000 BTC in just 10 days, representing around $3.15 billion. These massive purchases come as the crypto market experiences a period of high volatility, marked by a recent decline in BTC. The whales seem to be betting on a short-term rebound, despite the current 10% correction on Bitcoin, which remains around $60,000.

The strategic accumulation by whales, often seen as a strong signal, could indicate a market turnaround, although Bitcoin's ability to break through key thresholds, like the 200-day moving average, remains uncertain. The market could plunge lower if this crucial support gives way, but the whales remain confident in a potential rebound.

Cardano faces an 11% drop: Can it recover? 📉

Cardano (ADA) has experienced a significant drop of 11% in just 48 hours, falling to $0.35. This plunge has jeopardized the profitability of 3.31 billion ADA tokens, representing a value of over a billion dollars. The crucial support now lies at $0.34, and holding this might allow a return to $0.37. Predictions for October remain mixed, with estimates of stabilization between $0.36 and $0.42, and a maximum potential of $0.455 by the end of the month.

However, for Cardano to reach higher levels, like $0.70, a broader crypto market rally, led particularly by Bitcoin, would be necessary. Investors remain attentive to market developments, hoping that this moderate decline could be an opportunity to reposition themselves.

The crypto of the day: Aave (AAVE)

Aave is a decentralized finance (DeFi) platform that allows users to lend and borrow cryptocurrencies without intermediaries. Its innovation relies on the creation of a decentralized liquidity market, where lenders deposit their assets to generate interest and where borrowers can access these funds by providing collateral.

Aave's native crypto, the AAVE token, plays a key role in the governance of the protocol, allowing holders to vote on strategic decisions and network improvements. In addition to offering governance benefits, AAVE allows users to reduce transaction fees and benefit from specific advantages when participating in staking on the platform.

Recent performance

Current price: €136.35

Variation (24h): +10.02%

Market capitalization: €2,241,182,641

Rank on CoinMarketCap: #38

🚨 USDT's drop: Are Altcoins ready to step up and shine?

The decline in USDT's dominance in the crypto market could well pave the way for a new dynamic for altcoins. A technical model identified by analyst Moustache shows signs of fatigue in Tether's dominance and suggests a potential redistribution of capital toward altcoins. This evolution could be a major opportunity for these alternative assets, which have already shown signs of ascendancy in March 2024, with a capitalization flirting with $1.27 trillion. The drop in USDT could thus catalyze a new altcoin season, freeing billions of dollars that could reignite the market.

At the same time, Solana is facing a difficult period with a 6.2% drop over a week and a concerning decrease in active addresses on its network. The value of open interest for Solana has also fallen, which could indicate a repositioning of capital toward other, more promising altcoins. Although these signs may seem worrying, they could also signal a rebalancing in favor of other projects, further reinforcing the idea that altcoins are about to shine in this new phase of the market.

🔗 Read the full analysis here.