🚧 Solana adrift, Cardano reinvents governance, Ripple releases another 1 billion XRP

Welcome to the Daily Tribune Tuesday, September 3, 2024 ☕️

Hello Cointribe! 🚀

Today is Tuesday, September 3, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

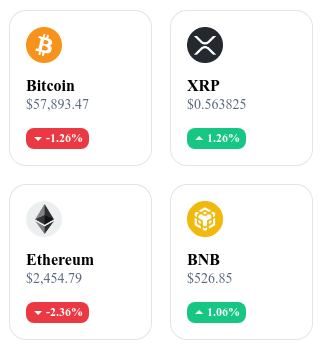

A quick look at the market…

🌡️ Temperature:

Partially Cloudy ⛅

24h crypto recap! ⏱

Cardano activates the Chang update: The Voltaire era begins 🚀

On September 1, 2024, Cardano launched the “Chang” update, marking a major turning point towards fully decentralized governance. This evolution now allows ADA token holders to actively participate in network decisions by voting for representatives and on development proposals. The update takes place in two phases: the first phase is already active, with a Transitional Constitutional Committee temporarily overseeing governance, and the second phase planned in 90 days will fully transfer powers to new community governance bodies, including the Constitutional Committee, Delegated Representatives (dReps), and Staking Pool Operators (SPOs). This transition also marks the beginning of the Voltaire era, focused on total decentralization of the network and aiming to return control to users rather than the founding entities of Cardano.🔗Read the full article here.

Ripple releases 1 billion XRP: A strategic movement that sparks debate 💥

On September 1, 2024, Ripple released another 1 billion XRP tokens from its escrow accounts, drawing attention to its supply management strategies. This release, valued at over 560 million dollars, is part of a series of monthly operations aimed at regulating the amount of XRP in circulation while maintaining some predictability in the market. Despite this approach, the price of XRP fell by 2.4%, raising questions about the effectiveness and transparency of these regular releases. Voices within Ripple itself, including Chief Technology Officer David Schwartz, question the relevance of this strategy, with potential suggestions for destroying the remaining tokens to enhance scarcity and potentially stabilize prices. This gesture could represent a critical step toward restoring investor confidence amid ongoing volatility and regulatory challenges. 🔗 Read the full article here.

BNB, Cardano, Avalanche: Why these cryptos are collapsing 🚨

Altcoins like BNB, Cardano, and Avalanche are experiencing a tough period, marked by significant declines and a lack of recovery prospects. Their dependence on Bitcoin is pointed out: without a significant rebound in Bitcoin, altcoins seem doomed to remain in difficulty. For example, Cardano, despite a market capitalization of 12.5 billion dollars, shows very low liquidity in stablecoins, reflecting a lack of investor confidence. Avalanche, once riding high thanks to GameFi hype, has seen its market capitalization tumble from 24 to 7 billion dollars. Technical indicators are also not reassuring: significant resistances on moving averages reveal a lack of confidence and the difficulty of altcoins in attracting capital. For many, these dynamics highlight a crisis of credibility and a structural fragility of altcoins facing unconvincing fundamentals. 🔗 Read the full article here.

Solana in free fall: Towards a rebound or another downturn? 📉

For nine consecutive days, Solana has been experiencing alarming drops, losing nearly 20% of its value and plunging into a critical price zone between 126 and 160 dollars. Attempts to rebound, despite temporary increases of 10.75% and 14.22%, have not allowed for surpassing the key resistance level of 160 dollars, leaving investors worried. Technical indicators show that Solana is approaching the oversold zone, suggesting a possible end to the bearish cycle. However, the lack of a durable breakthrough through resistance levels and ongoing selling pressure complicates the recovery scenario. Analysts estimate that Solana could drop further before finding an upward trajectory, with divided opinions on the future of the crypto. The situation remains tense, caught between hopes for a turnaround and fears of a new drop to even lower lows.🔗 Read the full article here.

Today's crypto: Hedera (HBAR)

Hedera stands out with its unique technology called Hashgraph, which differs from traditional blockchains by using a consensus mechanism based on a directed acyclic graph (DAG). This innovation enables fast, secure, and low-cost transactions, while providing great scalability. The added value of Hedera lies in its decentralized governance managed by a council of major global companies, ensuring stability and resistance to manipulation.

HBAR, the native crypto of Hedera, is primarily used to fuel transactions on the network, secure the platform through staking, and fund decentralized applications (dApps). Distributed through public sales and allocations to council members, HBAR allows holders to earn rewards by participating in securing the network and contributing to its governance. It can be used for instant payments, deploying smart contracts, and to benefit from low transaction fees on the Hedera network.

Recent performance:

Current price: €0.05102

Percentage increase/decrease: +2.46% (increase over 1 day)

Market capitalization: €1,831,867,633

Rank on CoinMarketCap: #42

🎯 Bitcoin in difficulty: Rebound in sight or new plunge? Technical analysis of September 3

Bitcoin is going through a tough phase after an attempt at a bullish recovery, recently dropping 12% to reach support at $57,700. Despite a slight rebound, BTC remains below its 50 and 200-day moving averages, indicating uncertainty for medium and long-term trends. Technical indicators show buying demand at this level, but the current price, around $59,100, struggles to find solid momentum. The situation is marked by a precarious balance between buyers and sellers, with major resistances to overcome to consider a sustainable recovery.

Analysis of BTC/USDT derivatives shows a decrease in open interest and buyer liquidations, reflecting dominant selling pressure. Bitcoin seems to oscillate between critical support and resistance zones, with potential increased volatility if the levels of $57,700 give way. If the price manages to hold, a rebound towards $61,200 is conceivable, but a breakdown could see BTC fall to $54,000 or lower.

🔗 Read the full analysis here.