⚠️ Solana facing its biggest crisis: the end of a too fragile economic model?

Welcome to the Daily Tribune of Thursday, March 13, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Thursday, March 13, 2025, and as every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

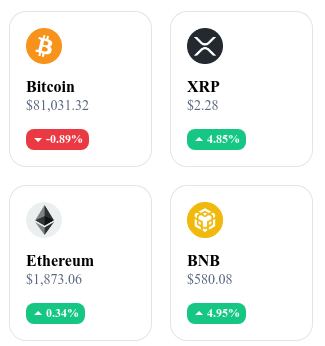

A quick look at the market…

🌡️ Temperature:

Partially sunny 🌤️

24h crypto recap! ⏱

⚠️ Solana tumbles heavily: its revenues collapse by 93% in two months!

Solana is facing an unprecedented crisis following the explosion of the memecoin bubble. While in January, its revenues reached $55.3 million per week, they no longer exceed $4 million today. The end of the speculative frenzy surrounding the tokens TRUMP and MELANIA has led to a collapse in volumes on Pump.fun, a platform that represented 80% of the network's revenue. Meanwhile, the total value locked (TVL) on Solana has fallen by 50%, from $12 billion to $6.4 billion. The SOL, for its part, has lost 58% of its value in a few weeks, dropping below the $122 mark. The future of the network will depend on its ability to diversify its uses and not solely rely on the speculative cycles of memecoins. 🔗 Read the full article

⚡ Marine Le Pen suggests mining Bitcoin with nuclear energy!

During a visit to the EPR of Flamanville, Marine Le Pen presented a project aimed at powering Bitcoin mining with excess nuclear electricity. According to her, France underutilizes its nuclear fleet, operating at 70% of its capacity compared to 90% in the United States. Her plan proposes to use these energy surpluses to produce cryptos, thereby generating revenues for EDF instead of reducing production during periods of low demand. This initiative is part of a broader vision of reindustrialization and energy independence, also integrating hydrogen production and strategic crypto reserves for France. 🔗 Read the full article

🚨 The SEC postpones its decision on the XRP ETF again: a brake on adoption?

The Securities and Exchange Commission (SEC) has once again postponed its decision on the conversion of the Grayscale XRP Trust into an ETF, leaving uncertainty about the future of the token. This delay immediately affected the market, causing XRP to drop by 1.2% after an intraday peak of $2.2. The SEC remains cautious regarding alternative cryptos, especially as BlackRock and Fidelity have refused to file XRP ETF applications, choosing instead to focus on Bitcoin and Ethereum. Meanwhile, players like 21Shares and Canary Capital are still awaiting the green light for their own XRP ETFs. If this decision is ultimately approved, it could boost institutional adoption, but for now, the American agency remains in a position of wait-and-see. 🔗 Read the full article

🇺🇸 The United States wants to secure 1 million BTC over 20 years!

A bill titled Bitcoin Act of 2025 has been introduced in the U.S. Congress to establish a strategic reserve of one million BTC over the next two decades. Championed by six elected officials, including Addison McDowell and Pat Harrigan, this proposal aims to accumulate bitcoins without using taxpayer money, through internal financial mechanisms and transfers from the Federal Reserve. This program is part of a major geopolitical strategy, placing Bitcoin on par with Fort Knox gold. To ensure transparency and control, the text provides for a regular public audit, while protecting the individual rights of Americans to own and trade BTC. If this project is adopted, the United States could dominate the crypto market by positioning itself as the first country to officialize a sovereign Bitcoin reserve. 🔗 Read the full article

Today's crypto: NEAR Protocol (NEAR)

NEAR Protocol is a layer 1 blockchain platform designed to be a cloud computing platform managed by the community. It aims to eliminate some of the limitations that have hindered competing blockchains, such as low transaction speeds, low throughput, and poor interoperability. This creates an ideal environment for decentralized applications (dApps) and offers an accessible platform for developers.

The native token of NEAR Protocol, NEAR, is used to pay transaction and storage fees on the platform. NEAR holders can also participate in the consensus mechanism by delegating or staking their tokens, thus contributing to the network's security while earning rewards. Additionally, NEAR serves as a governance token, allowing holders to participate in decisions regarding the evolution of the protocol. The initial distribution of NEAR took place during the mainnet launch in April 2020, with a total supply of 1 billion tokens.

Recent performances:

Current price: $2.58 (approximately €2.40)

24-hour variation: +5.89%

Market capitalization: $3.07 billion

Rank on CoinMarketCap: #31

Pi Network soars: A real signal of growth or just market hype?

The crypto market is often marked by sudden bursts followed by brutal corrections. In the last 24 hours, Pi Network has experienced a spectacular increase of 20%, reaching $1.74, while still remaining well below its all-time high of $2.99. Is this the beginning of broader adoption or simply a temporary speculative movement? Two key elements seem to have triggered this surge: the approach of Pi Day and persistent rumors of a forthcoming listing on Binance.

Every year, Pi Day, celebrated on March 14, rekindles interest in the project. This event, widely followed by the community, is generally accompanied by significant announcements and increased speculation. In the past, this meeting has often coincided with a rise in the value of Pi, indicating that investors are trying to anticipate a windfall effect. Furthermore, rumors are circulating about a possible listing of Pi Network on Binance, which would represent a decisive turning point for the project. A listing on a leading exchange platform like Binance would provide Pi Network with far greater liquidity, enhancing its credibility and attracting a wider audience. However, no official confirmation has been provided, and this speculation is based on elements that are still uncertain.

While this price surge may seem promising, it is important to remain cautious regarding the many uncertainties surrounding the project. Pi Network, although benefiting from a significant community, still has no official listing on major platforms and its mainnet remains closed, which significantly limits its real adoption. This opacity hampers institutional investors' interest, who generally prefer assets with a functional and transparent ecosystem. Additionally, the current high volatility of the market raises concerns about a possible rapid correction, especially if Pi Day and the rumor of a listing on Binance do not lead to concrete announcements.

March could be decisive for the future of Pi Network. If tangible advances, such as the opening of the mainnet or an official listing, validate the market's enthusiasm, the project could enter a new phase of development. Conversely, if this rise is solely based on an announcement effect, the risk of a sharp price reversal is high.

Only time will tell if Pi Network is establishing itself sustainably or if it is simply a passing phenomenon.