🚀 Solana Surpasses Ethereum, Bitcoin Threatened by the Fed

Welcome to the Daily Tribune of Wednesday, January 8, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today, it is Wednesday, January 8, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you should not miss!

But first…

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Stormy ⛈️

24h crypto recap! ⏱

🚀 DEX: Solana Surpasses Ethereum Again

With $3.8 billion traded in 24 hours on its DEX platforms, Solana vastly surpasses Ethereum ($1.7 billion) and Base ($1.2 billion) combined. The blockchain records a spectacular increase in its total value locked, rising from $1.4 billion to $9.5 billion in a year. The impressive volumes come notably from Raydium, Solana's main DEX, whose monthly trading reaches $30 billion, surpassing Uniswap in November.

Crypto traders are flocking to this blockchain thanks to its reduced fees, speed, and attractive ecosystem, dominated by memecoins and tokens related to artificial intelligence. Solana, by consolidating its central role in Web3, continues to attract investors frustrated by Ethereum's limitations.

🌩️ Bitcoin and the Fed: The Duel Intensifies

The beginning of 2025 looks eventful for Bitcoin, caught between the optimism surrounding Donald Trump’s inauguration and the vigilance of the Federal Reserve (Fed). Traders are monitoring two key dates: the inflation announcement on January 15 and the FOMC meeting on January 29, where interest rates are expected to remain high between 4.25% and 4.50%.

Markus Thielen from 10x Research predicts a potential rise in BTC that could reach $98,000 if macroeconomic indicators are favorable. However, an unexpected tightening from the Fed could reverse this trend and lead to brutal corrections, like that of last December when Bitcoin lost 15% in a few hours.

⚠️ Tether Loses Ground: The Figures that Worry

Since mid-December 2024, Tether (USDT) has seen a notable decline, with its market capitalization falling from $141 billion to $137.1 billion and trading volumes dropping from $154 billion to $55 billion, a decrease of 64%. This situation, attributed in part to a seasonal pause, also reflects increased pressure from competitors like USDC and emerging stablecoins.

Although Tether retains 69.7% market dominance of stablecoins, the European regulation MiCA and rumors of delisting on certain exchanges fuel skepticism. Binance, however, continues to maintain USDT on its platform, alleviating concerns. Matrixport, optimistic, mentions a possible rebound post-holidays, but highlights that the absence of a rapid bounce could reveal deeper structural changes. Meanwhile, USDC shows an 80% growth in 2024, continues its ascent, and challenges Tether's historical dominant position.

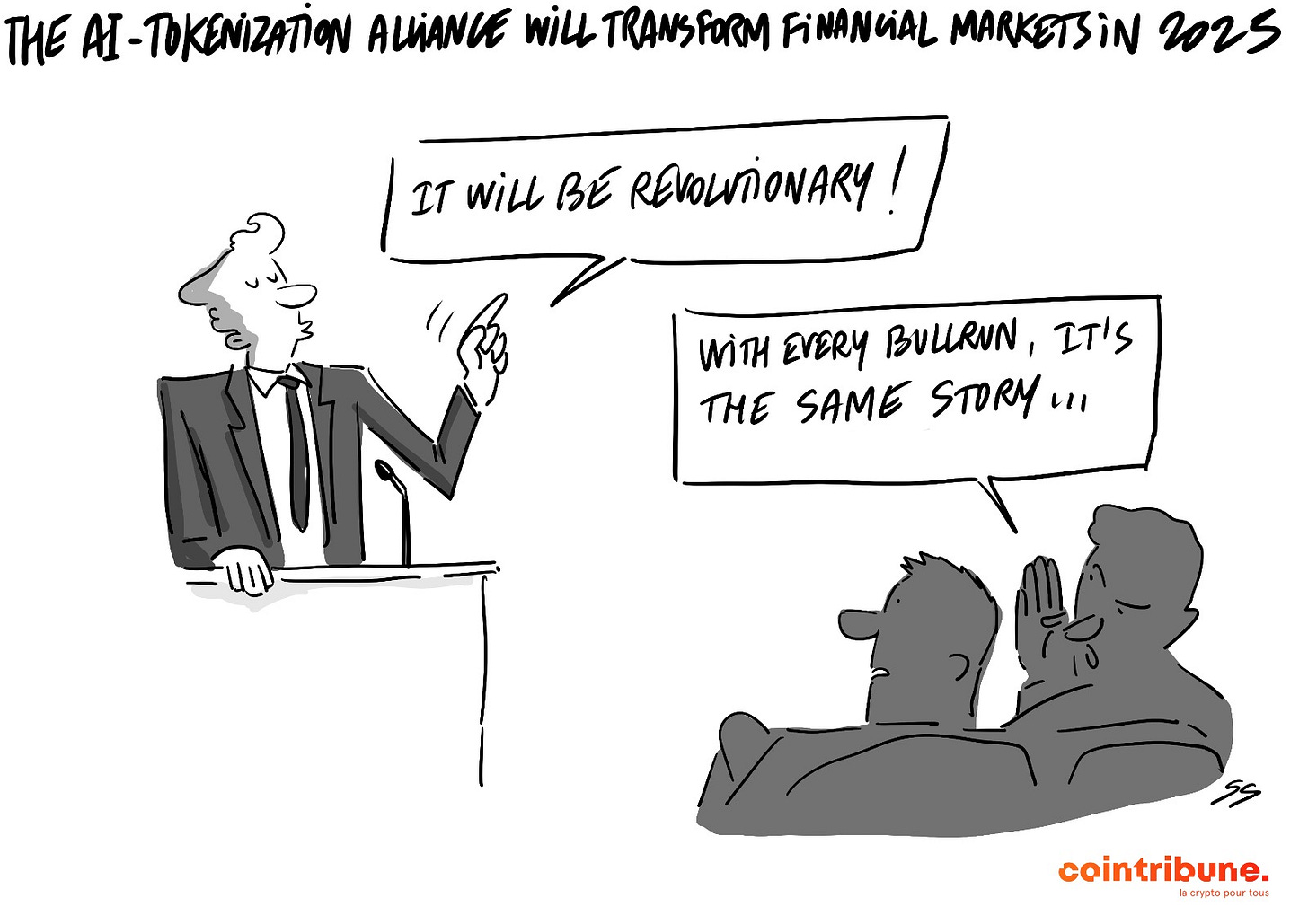

🌟 AI and Tokenization: Towards a Revolution in Financial Markets in 2025

The combination of artificial intelligence (AI) and asset tokenization is set to profoundly transform financial markets in 2025. This innovation is expected to benefit small businesses, historically excluded from traditional financing, by democratizing access to capital through digital assets. Edwin Mata, CEO of Brickken, regards the tokenization of real assets, such as real estate and stocks, as a future pillar of the crypto ecosystem.

Moreover, companies like MicroStrategy, with an impressive portfolio of 446,400 bitcoins, illustrate the growing adoption of cryptocurrencies by institutions. AI will also accelerate this transition, enabling many niche businesses to access financial markets. This transformation occurs in a favorable political context in the United States, with anticipated rules being less stringent under the Trump administration.

Crypto of the Day: Flare (FLR)

Flare is a Layer 1 blockchain based on the Ethereum Virtual Machine (EVM), designed to natively integrate decentralized data infrastructures. It stands out with its protocols such as State Connector for integrating static data and the Flare Time Series Oracle (FTSO) for dynamic data. This architecture offers unique solutions for DeFi applications, social networks, and real-world assets, creating increased interoperability between blockchains and the Internet.

FLR, the native token of Flare, is used to pay transaction fees, prevent spam attacks, and participate in staking to validate the network. Holders can also delegate their FLR via FTSO to earn rewards or use them in EVM-compatible dApps. Initially distributed via an airdrop to XRP holders, FLR positions itself as a flexible and participative crypto, with strong integration potential in DeFi ecosystems.

Recent Performances

Current Price: €0.02476

Change (24h): -7.86%

Market Capitalization: €1.4 billion

CoinMarketCap Rank: 73

Crypto: Correction or New Historical Rally?

Since 2023, the cryptocurrency market has experienced a bullish dynamic, driven by increasing institutional adoption and massive capital inflows. However, technical signals identified by CryptoQuant suggest an imminent correction.

In the last quarter of 2024, 36% of bitcoins traded were exchanged over a month, an indicator often associated with market peaks preceding a redistribution or correction. Despite these warnings, players like VanEck and Steno Research predict a continuation of the bullish trend, estimating that Bitcoin could reach $180,000 and Ethereum $6,000 by the end of 2025, thanks to increasing institutionalization and regulatory advances.

CryptoQuant emphasizes that short-term trading activity, fueled by new capital, often reflects a final phase of a bullish cycle. Analyst Crypto Dan's cautious approach warns against overexposure to volatile assets. In contrast, VanEck and Steno Research bet on sustained institutional demand, imminent crypto ETFs, and favorable regulations to prolong the rise. Predictive markets like Polymarket share this optimism and bet on records for Bitcoin and Ethereum.