🚀 Stablecoins flow into Binance, Russia bets everything on BTC!

Welcome to the Daily Tribune for Saturday, November 9, 2024 ☕️

Hello Cointribe! 🚀

Today is Saturday, November 9, 2024, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

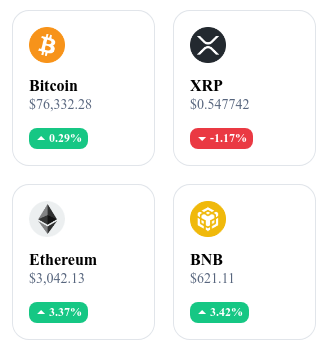

A quick look at the market…

🌡️ Temperature:

Partially sunny 🌤️

24h crypto recap! ⏱

🇷🇺 Russia plans a "strategic reserve of bitcoins"

In the face of Western sanctions and the weakening of its internal financial systems, Russia is steering its economic strategy towards Bitcoin. In addition to strong growth in the mining industry — facilitated by partnerships between miners and oil and gas companies — the country is planning an increased integration of cryptocurrency into its reserves.

With the support of the RDIF investment fund and alliances with BRICS, Russia hopes to build an alternative financial system by bypassing the dollar and using decentralized currencies. This approach comes in a context where the United States itself is exploring the establishment of Bitcoin reserves.

🚀 BlackRock ignites the market with its Bitcoin ETF

BlackRock's Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has shattered all records with an inflow of $1.1 billion in a single day, confirming investors' enthusiasm for crypto ETFs. The timing of this influx is favorably influenced by the return of Donald Trump, perceived as pro-crypto, and stable monetary and political conditions in the United States.

BlackRock captures 82% of total Bitcoin ETF flows in the United States, and the value of Bitcoin reaches new heights, exceeding $76,000. Other ETFs, including Grayscale, struggle to compete, as their high fees detract from their attractiveness compared to BlackRock's lower fees. With a trading volume reaching $4 billion in one day, some experts foresee an unprecedented crypto rally, reinforcing the role of ETFs in the rise of the crypto economy.

⚠️ A 46% drop for Bitcoin? The shocking warning from an expert

As Bitcoin hovers around $76,000, Benjamin Cowen, analyst and CEO of ITC Crypto, anticipates a risk of a drop of 12% to 46% in early December. This pullback could be triggered by the release of employment data in the United States on December 6, exacerbating economic and post-election uncertainties.

Cowen highlights two scenarios: a moderate correction around $65,000 or a more pronounced drop towards $40,000. Although this decline may be temporary, it should only reflect the consolidation cycles often followed by growth.

💸 $9.3 billion in stablecoins flow to Binance and Coinbase: What’s happening?

On November 6, 2024, Binance and Coinbase recorded a massive inflow of stablecoins, totaling $9.3 billion in a single day. Binance captured $4.3 billion, while Coinbase received $3.4 billion, marking the second-largest influx in the history of crypto exchanges. This phenomenon coincides with the election of Donald Trump, perceived as a favorable catalyst for the cryptocurrency market.

This influx of stablecoins, dollar-pegged assets, plays a central role in the infrastructure of crypto exchanges by providing liquidity and reducing volatility risks. This massive movement propelled Bitcoin to a new peak beyond $77,000, and analysts anticipate a continuation of the bullish trend into 2025, fueled by this capital injection and a favorable political context.

Crypto of the day: The Graph (GRT)

The Graph is a blockchain specialized in indexing and querying data from blockchains like Ethereum. Its innovation lies in creating a decentralized indexing ecosystem, simplifying access to information for decentralized applications (dApps) without requiring centralized servers. The native token, GRT, mainly serves as a means of payment for indexing queries and fees related to the use of subgraphs. Initially distributed through a public launch, GRT offers holders the opportunity to delegate, stake, and earn rewards by contributing to the security and stability of the network. This structure encourages maintaining a resilient and efficient system, essential for projects using The Graph's services.

Recent performances

Current price: €0.1659

Change: +5.47% (increase over 24 hours)

Market capitalization: €1.58 billion

Rank on CoinMarketCap: 56

🚀 Bitcoin reaches a new all-time high: towards $85,000 and beyond?

Bitcoin has just surpassed a new all-time high of over $77,000, paving the way for even more ambitious prospects, driven by strong institutional interest. Institutional investors, once cautious, are now driving the market, amplifying trading volumes on futures platforms like the CME. This enthusiasm is supported by increased adoption of spot Bitcoin ETFs, a more crypto-friendly U.S. policy, and a favorable economic environment. These combined conditions reflect a strategic confidence in Bitcoin, now regarded as a potential reserve asset and a diversification lever.

Experts believe that the next target for Bitcoin could reach $82,000 to $85,000, with solid support levels around $77,000. The Federal Reserve's interest rate cuts and signals of a favorable geopolitical environment, particularly with rumors of strategic Bitcoin reserves being created in the United States, fuel this bullish dynamic. This climate suggests a continuation of the rally, where institutional and retail traders see a long-term opportunity in the rise of Bitcoin, which seems yet to fully unveil its scope.

🔗 Read the complete analysis here.