Hello Cointribe! 🚀

Today is Wednesday, June 4, 2025 and as every day from Tuesday to Saturday, we summarize for you the news from the last 24 hours that you should not have missed!

But first…

✍️ Cartoon of the day:

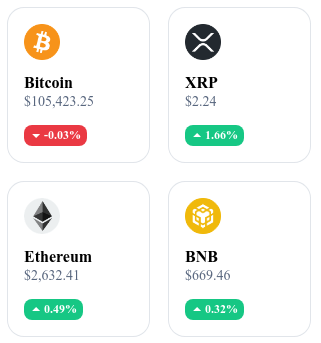

A quick look at the market…

🌡️ Temperature:

🌤️ Partly sunny

24h crypto recap! ⏱

💼 Robinhood acquires Bitstamp for 200 million dollars

On June 2, 2025, Robinhood announced the acquisition of the cryptocurrency exchange platform Bitstamp for 200 million dollars in cash. This operation, started a year earlier, marks Robinhood's entry into the institutional cryptocurrency market. The acquisition was finalized after obtaining regulatory approvals in several jurisdictions.

🧑💻 The Ethereum Foundation restructures its core team

The Ethereum Foundation has carried out layoffs within its core team and renamed the team. This decision is part of an internal reorganization process aimed at adapting the team's structure to the foundation's future goals.

💵 Stablecoins reach a record capitalization

Dollar-backed stablecoins have reached a total capitalization of 245 billion dollars, out of a total of 250 billion for all stablecoins. Among them, USDT represents 153 billion dollars and USDC 60 billion. Euro- or yuan-backed stablecoins remain marginal, due to the choices of European and Chinese authorities in favor of central bank digital currencies.

🌾 Moscow considers using cryptocurrencies for its agricultural exports

Russia plans to use cryptocurrencies to receive payments for its exports of 49.5 million tons of cereal. This project aims to bypass restrictions imposed by the SWIFT system following international sanctions. The use of cryptocurrencies could extend to other sectors if the experience in agriculture proves successful.

Crypto of the day: Arbitrum (ARB)

🧠 Technology and innovation

Arbitrum is a layer 2 solution for Ethereum, which uses optimistic rollups to improve scalability and reduce transaction fees. It allows the execution of smart contracts more efficiently, while benefiting from the security of the Ethereum network.

The protocol is designed to be compatible with existing decentralized applications on Ethereum, thus facilitating their migration to Arbitrum without major modifications. This compatibility promotes rapid adoption and an improved user experience.

💰 ARB Token – Utility and distribution

The ARB is Arbitrum's native token. It is used for:

Governance: holders can participate in decisions concerning the protocol's evolution.

Fee payment: the token is used to pay network transaction fees.

Incentives: users can be rewarded in ARB for their participation in the ecosystem.

The initial distribution of ARB was carried out via an airdrop to active Ethereum users, aiming to encourage them to adopt the Arbitrum network.

📊 Market data (as of June 4, 2025)

Current price: $0.3683 USD

24-hour change: +$0.0037 (+1.01 %)

Market capitalization: 1.79 billion dollars

Rank on CoinMarketCap: #50

Circulating supply: 4.86 billion ARB

24-hour trading volume: approximately 160 million dollars

The European economy wobbles: the trade war reignites fear of a crash

The European economy faces a confluence of unfavorable factors: increased trade tensions, downward revisions of growth forecasts, and financial market instability. The pan-European STOXX 600 index fell 0.5%, reflecting widespread loss of confidence, especially in the banking and mining sectors. This situation recalls concerns of a potential recession, exacerbated by protectionist trade policies and geopolitical uncertainties.

Trade tensions revive economic fears

Recent announcements by the Trump administration about increasing tariffs on European imports have revived memories of the 2018 trade war. This tariff escalation, combined with intensified frictions between Washington and Beijing, led the OECD to revise down its global growth forecasts, highlighting increased risks for the European economy. Exporting companies, faced with weakened global demand, are freezing their investments, thus increasing pressure on the Old Continent's economy.

Financial markets reflect growing anxiety

The decline of the STOXX 600 index, particularly in sectors sensitive to economic conditions, shows investor concern. Banking and mining stocks, dropping respectively by 1.4% and 2.3%, illustrate this nervousness. Meanwhile, some companies are adopting restructuring measures to adapt to this uncertain climate. In this context, Bitcoin emerges as an alternative safe haven asset, with some European investors turning to digital assets to diversify their portfolios amid traditional market instability.

The European economy is going through a turbulent period, marked by growing trade tensions and shaken investor confidence. The combination of protectionist policies, revised downward growth forecasts, and volatile financial markets underlines the need for Europe to strengthen its economic resilience. Greater coordination of economic policies and diversification of trading partners could be essential to navigate this uncertain period.