📈 Standard Chartered bets on a Bitcoin at $200,000 by the end of 2025

Welcome to the Daily Tribune for Wednesday, April 30, 2025 ☕️

Hello Cointribe! 🚀

Today is Wednesday, April 30, 2025, and as every day from Tuesday to Saturday, we summarize the news of the last 24 hours that you shouldn't miss!

But first…

✍️ Cartoon of the day:

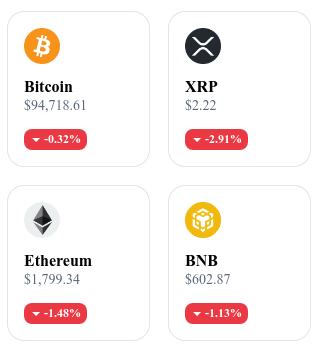

A quick look at the market…

🌡️ Temperature:

Rainy 🌧️

24h crypto recap! ⏱

💳 MetaMask launches an unprecedented crypto payment card

MetaMask unveils a card allowing direct spending from a self-custodied wallet, without prior conversion. The global launch is planned soon.

🏛️ Arizona considers integrating Bitcoin into its public reserves

Arizona could become the first U.S. state to hold a Bitcoin reserve, with a bill proposing to invest 10% of its public assets into the cryptocurrency.

🇨🇦 Mark Carney elected Prime Minister of Canada!

Mark Carney’s arrival at the head of Canada could mark a turning point for the country’s crypto economy, with possible strengthening of regulations and promotion of central bank digital currencies.

📈 Standard Chartered forecasts a record price for Bitcoin in 2025

Standard Chartered anticipates a rise of Bitcoin to $200,000 by the end of 2025, supported by massive ETF flows and accumulation by institutional investors.

Crypto of the day: Plume (PLUME)

Plume is a Layer 1 blockchain dedicated to the tokenization of real-world assets (RWA). It stands out for its modular approach, integrating a tokenization engine, an EVM chain, regulatory compliance tools, and standardization of RWA data. This infrastructure aims to facilitate on-chain integration of real assets and data and thus offers a comprehensive solution for decentralized finance focused on RWAs.

The native token PLUME is used to pay transaction fees, participate in protocol governance, and access asset tokenization services. The initial distribution was carried out via private sales and incentive programs, with a total supply capped at 10 billion tokens. PLUME holders enjoy privileged access to asset tokenization projects, as well as the ability to participate in governance and receive rewards for their involvement in the ecosystem.

Recent performance:

Current price: $0.1884 USD

24-hour change: +9.9%

Market capitalization: approximately $382.8 million

Rank on CoinGecko: #184

Bitcoin: A confirmed bullish signal, but caution remains necessary

After a weekly rise of more than 10%, Bitcoin (BTC) consolidates under a major technical resistance. Technical indicators suggest a bullish recovery, but macroeconomic factors could influence the future market direction.

Technical analysis: positive signals to watch

BTC is currently trading around $94,925, just below the key resistance at $95,150. The short, medium, and long-term moving averages (SMA 20, 50, and 200) are all trending upwards, indicating a positive trend over several time horizons. Momentum also shows signs of recovery, reinforcing the bullish bias.

Weekly volumes have increased by 73%, reaching $35 billion, which validates the renewed interest in BTC. Market sentiment, measured by the Fear & Greed index, has moved into the "greed" zone, reflecting an increased appetite for risk.

Scenarios to consider: bullish or bearish?

Bullish scenario: If BTC holds above $91,600, the following targets are possible: $95,150, $100,000, $107,000, with a potential peak at $109,354.

Bearish scenario: In case of a break below the $91,600 support, BTC could correct towards $84,000, $82,700, $81,300, or even $74,500.

The market's reaction to upcoming economic data, such as the U.S. GDP and PCE index, will be decisive in confirming one of these scenarios.