🛑 Tensions at Ethereum: The lead developer jumps ship

Welcome to the Daily Tribune of Thursday, January 23, 2025 ☕️

Happy New Year to Cointribu! 🚀

Today is Thursday, January 23, 2025, and like every day from Tuesday to Saturday, we summarize the news from the last 24 hours that you shouldn't miss!

But first…

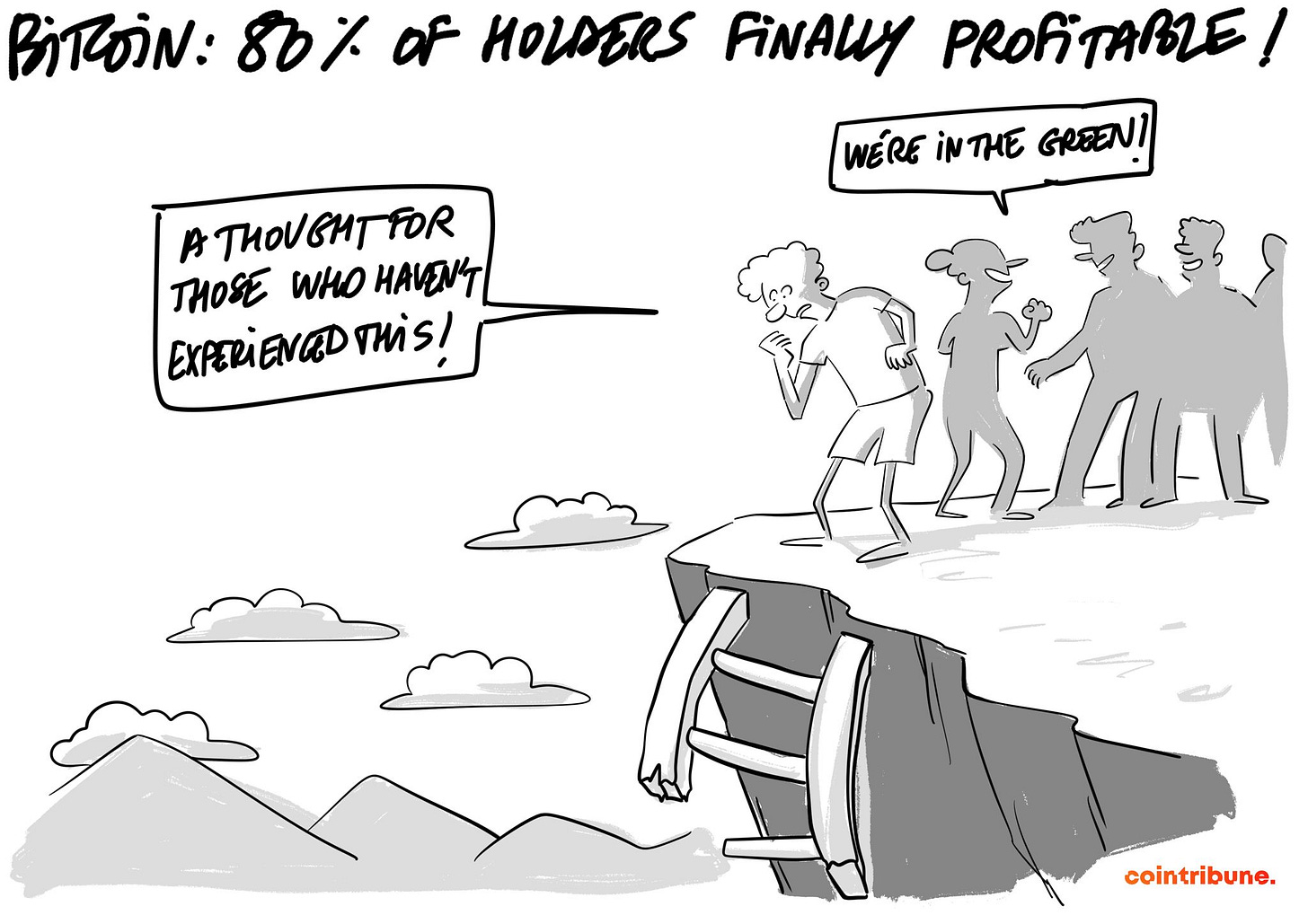

✍️ Cartoon of the day:

A quick look at the market…

🌡️ Temperature:

Sunny ☀️

24h crypto recap! ⏱

🎯 Bitcoin: 80% of holders in profit

For the seventh consecutive day, Bitcoin remains above the $100,000 mark. This allows 80% of short-term investors to see profits, a notable improvement compared to the 65% losses recorded at the beginning of the month. However, some worrying signals are emerging: the STH-SOPR ratio has entered negative territory, showing that recent holders are selling their assets at a loss despite the upward trend.

Glassnode analyses identify a key zone between $90,000 and $95,000, marked by significant losses in November 2024. This zone serves as a strategic support, while experts anticipate increased volatility fueled by FOMO. The technical levels between $90,000 and $80,000 are considered essential to maintain the current market momentum.

🔥 Ethereum in crisis: Departure of lead developer Eric Conner

The departure of Eric Conner, a key developer of Ethereum, highlights growing tensions within the project. Criticizing the excessive centralization of leadership under Vitalik Buterin, Conner expressed his disagreement with a governance he finds contrary to the fundamental principles of decentralization. His departure reflects a shared concern among some of the community, who fear an authoritarian drift around the co-founder.

Conner is redirecting towards artificial intelligence with his project Freysa.ai, leaving behind an Ethereum marked by an uncertain future. While Vitalik promises reforms to soothe the critics, debates around governance are intensifying. This departure raises crucial questions for the future of one of the flagship projects of blockchain.

💎 Historical margins for Bitcoin miners

Before falling again last night, Bitcoin had exceeded $105,000, allowing miners to benefit from record margins, with an average production cost of $33,900 and a selling price more than tripled. Despite a network difficulty up 24% since August 2024 and computing power reaching between 700 and 900 EH/s, miners are doubling down on creativity to stay competitive.

Some have chosen to diversify their income, like Hive Digital, which recycles its machines for artificial intelligence, while others hold onto their BTC, betting on a future rise. The network, reinforced by this intensity of activity, shows remarkable resilience.

⚖️ The U.S. justice system lifts sanctions against Tornado Cash

The federal court of Texas overturned the OFAC sanctions against Tornado Cash, the famous crypto mixing protocol accused of facilitating the laundering of $455 million by the North Korean group Lazarus. The judges found that Tornado Cash, as a decentralized program operating via smart contracts, cannot be equated to a sanctionable entity under U.S. law. This decision marks a turning point in the regulation of decentralized technologies and immediately caused a 120% increase in the value of the TORN token, temporarily reaching $22.

However, debates around privacy protocols continue, particularly regarding the arrest of Alexey Pertsev, developer of Tornado Cash, by Dutch authorities. This legal victory redefines the regulators' relationship with decentralized innovations and should pave the way for regulatory frameworks better suited to the blockchain ecosystem.

Today's crypto: Pudgy Penguins (PENGU)

Pudgy Penguins is built on the Solana blockchain and emphasizes a fast and economical approach to transactions. This project stands out for its focus on NFTs and community culture and creates a bridge between cryptocurrency enthusiasts and the general public.

The native crypto, PENGU, is used to support the NFT ecosystem of Pudgy Penguins and promote activities around art and entertainment. Initially distributed through public and private sales, it offers benefits such as access to exclusive events, rewards within the ecosystem, and staking opportunities. Holders can use it to purchase NFTs, access services, or participate in the project's governance.

Recent performances

Current price: €0.02539

24h change: +6.7%

Market capitalization: €1.59 billion

Rank on CoinMarketCap: #82

Bitcoin: A credible alternative to gold as a store of value

In 2024, gold showed an increase of 25%, a remarkable figure in the tense economic context, but it is still largely overshadowed by Bitcoin, whose average annual return over five years reaches 77%. Bitcoin's performance demonstrates its ability to eclipse gold as a store of value, especially with a market capitalization still well below that of the precious metal.

Geopolitical tensions and loss of confidence in traditional financial assets (like U.S. Treasury Bonds) favor a gradual shift of investments towards assets with no counterparty risk, such as gold and potentially Bitcoin.

A global movement in favor of gold and alternative assets

Faced with increased distrust towards American foreign policy and the militarization of the dollar, many central banks are increasing their gold reserves. In 2024, countries like China, India, and Turkey made massive purchases, propelling global demand for gold to record levels. This movement reflects a rejection of imperial currency and a desire to protect against the risk of economic sanctions.

At the same time, diversification into Bitcoin is being considered, even though it is still hampered by the absence of a movement initiated by the United States. Some analysts predict that including Bitcoin in strategic reserves could trigger global adoption, transforming its role in the global financial system.

Bitcoin: A strategic asset with multiple advantages

Bitcoin offers unique characteristics that differentiate it from gold. With a supply limited to 21 million units and 94% already in circulation, it embodies absolute scarcity, unlike gold, which increases its extraction as its price rises. Moreover, its dual function as a store of value and a payment network makes it particularly attractive. Initiatives like the "Bitcoin Act" bill in the United States, which proposes a strategic reserve of one million Bitcoins, testify to the growing recognition of its advantages.

If major powers, starting with the United States, officially adopt Bitcoin, its market capitalization could catch up with that of gold, pushing its unit price close to one million dollars, thus disrupting global markets.