Hello Cointribe! 🚀

Today is Wednesday, October 22, 2025, and as every day from Tuesday to Saturday, we bring you the top crypto news from the past 24 hours you shouldn’t miss!

But first…

✍️ Cartoon of the day:

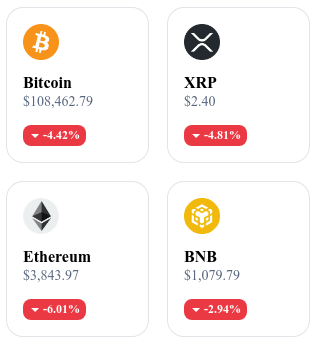

A quick look at the market…

🌡 Weather:

⛈️ Stormy

24h crypto recap! ⏱

⚠️ Kadena suspends operations amid market difficulties

The Kadena project has announced the suspension of its operations due to funding issues and an unfavorable market environment. The KDA token has dropped by over 60% in 24 hours, while the team seeks solutions to preserve existing infrastructure and partnerships.

👉 Read the full article

💳 Wise finally opens up to crypto

Fintech company Wise has added cryptocurrency support to its platform, allowing users to buy, sell, and transfer digital assets. This move marks a major step in Wise’s diversification strategy, as it now targets the Web3 and stablecoin payment markets.

👉 Read the full article

📱 Solana ends support for its Saga smartphone after just two years

The Solana Mobile Foundation has announced the end of technical support for the Saga phone, launched in 2023. Despite a positive reception at launch, limited sales and high maintenance costs led to its discontinuation. Some features will be integrated into the next model, Chapter 2.

👉 Read the full article

🧩 Ethereum enters the final testnet phase before the Fusaka upgrade

The Ethereum network has entered the final testing phase ahead of the Fusaka upgrade, focused on optimizing staking and reducing transaction costs. Developers confirm full compatibility with major clients and expect mainnet deployment by December.

👉 Read the full article

Crypto of the Day: Bittensor (TAO)

Innovation and Value Proposition 🧠

Bittensor is a decentralized artificial intelligence (AI) network aiming to create an open alternative to proprietary models developed by companies like OpenAI or Anthropic. In practice, Bittensor allows any developer, researcher, or enterprise to contribute to a global AI network, host models, and earn TAO tokens based on the quality and usefulness of their outputs.

The protocol operates on a peer-to-peer architecture where each node in the network is an AI model trained to perform specific tasks. These models collaborate and evaluate each other, forming a self-regulated ecosystem of machine learning. Through its Yuma consensus protocol, Bittensor merges blockchain and collaborative learning to create an open, transparent, and incentive-driven “Internet of AI.”

The Token 💰

TAO is the native token of the Bittensor network. It is used to reward “neurons” (AI contributors) who share their models, and to pay query fees for network usage. Holders can also stake their tokens to support subnets and receive a share of the generated rewards.

TAO also functions as a governance token: participants can vote on protocol upgrades and subnet management decisions. With a capped supply of 21 million tokens, just like Bitcoin, TAO combines scarcity, utility, and economic incentives — a key trio for long-term adoption.

Real-Time Performance 📊

💵 Current Price: $366.42

📉 24h Change: −0.78 %

💰 Market Cap: $2.63 B

🏅 CoinMarketCap Rank: #43

🪙 Circulating Supply: 7,172,370 TAO

📊 24h Trading Volume: $22.89 M

Tether surpasses 500 million users

Tether has reached a symbolic milestone with more than 500 million users worldwide — a testament to the meteoric rise of USDT in the stablecoin ecosystem. But what lies behind this massive adoption? Here’s a breakdown of the key factors driving the phenomenon and the challenges that come with it.

Global adoption driven by real-world use cases

The announcement was made on October 21, 2025, by Paolo Ardoino, Tether’s CEO. According to him, this impressive figure reflects genuine adoption rooted in everyday financial use. In many regions where local currencies are volatile, Tether has become a tool of monetary stability.

Three key applications underpin this growth. The first is cross-border remittances, traditionally costly and slow through banking channels. With USDT, millions can send money across countries at minimal cost. The second major use case is everyday payments — in unstable economies, USDT is increasingly viewed as a safer alternative to local currencies. Finally, Tether’s mobile-first strategy allows seamless integration of its stablecoin into digital wallets, often directly accessible via smartphones.

With a market capitalization exceeding $182 billion, USDT remains the clear leader among stablecoins. This figure highlights Tether’s ability to meet the needs of a connected yet largely unbanked global population. For Ardoino, this growth represents a long-term commitment to financial inclusion and resilience in underserved regions.

Regulatory headwinds and transparency concerns

This success does not come without challenges. On the regulatory front, Tether must navigate increasingly strict frameworks. In the U.S., the GENIUS Act could reshape the landscape by imposing new standards on stablecoin issuers. In Europe, the implementation of MiCA has already reduced USDT’s market share from 70 % to 60 % in a year — a clear sign of regulatory pressure and the call for greater compliance.

Financially, Tether’s numbers remain striking. The company reported $4.9 billion in net profit in Q2 2025, surpassing the $4.52 billion of the previous quarter — making it one of the most profitable firms in crypto. Yet this profitability contrasts with one major weakness: the absence of an independent audit by one of the Big Four accounting firms, a persistent source of skepticism about governance and transparency.

To address rising U.S. regulatory requirements, Tether is preparing to launch a new stablecoin called USAT, specifically designed to meet North American compliance standards. This initiative illustrates the company’s intent to adapt its products to evolving global financial rules.

Tether’s worldwide adoption reflects a growing demand for accessible, stable monetary solutions — but also the ongoing tension between rapid innovation and tightening regulation. Its future will depend as much on its capacity to serve users as on its ability to align with global financial standards.